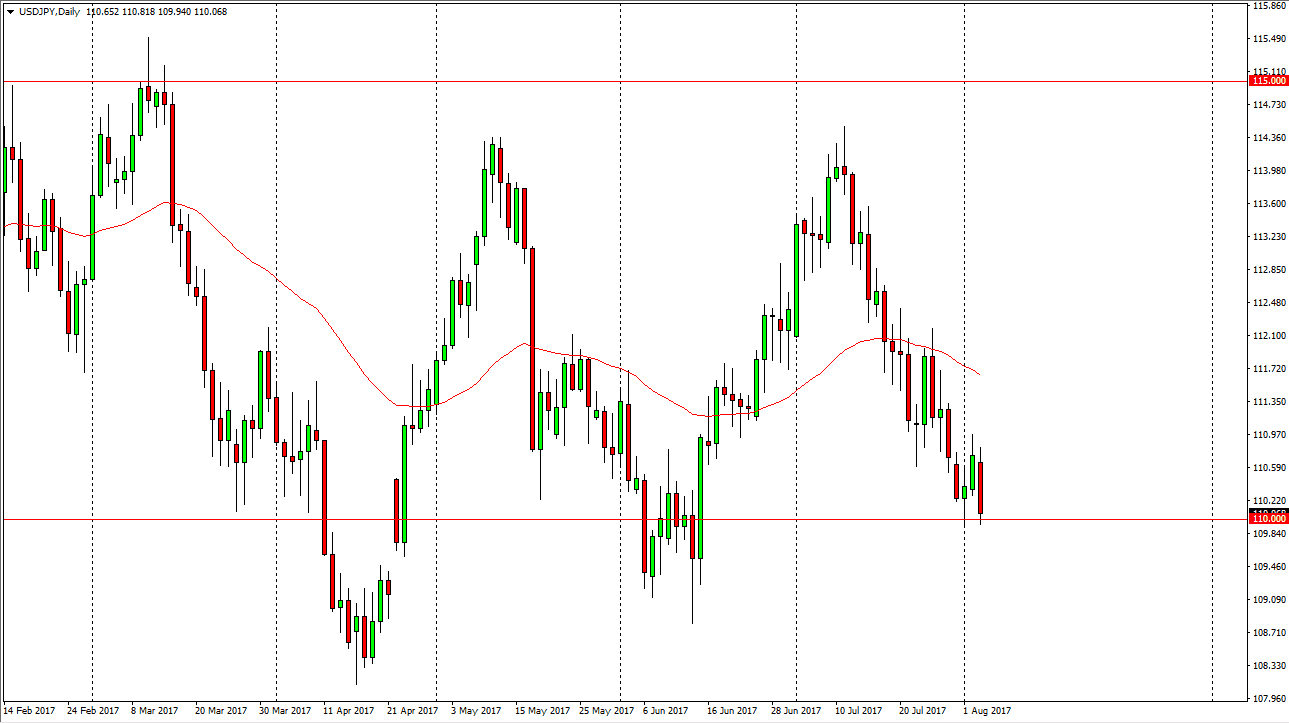

USD/JPY

The US dollar fell during the day on Thursday, testing the 110 handle. The level looks to be very supportive, and I think that the market is simply taking a break in the short term as we are awaiting the jobs number. The jobs number comes out at 8:30 AM New York time, and that should continue to offer a relatively quiet trading environment until we get that announcement. I believe that the market will probably have a bit more downside ahead of it, especially the jobs number misses. Alternately, if we come in with a number above 200,000 at the time of announcement, I think we could turn around almost immediately.

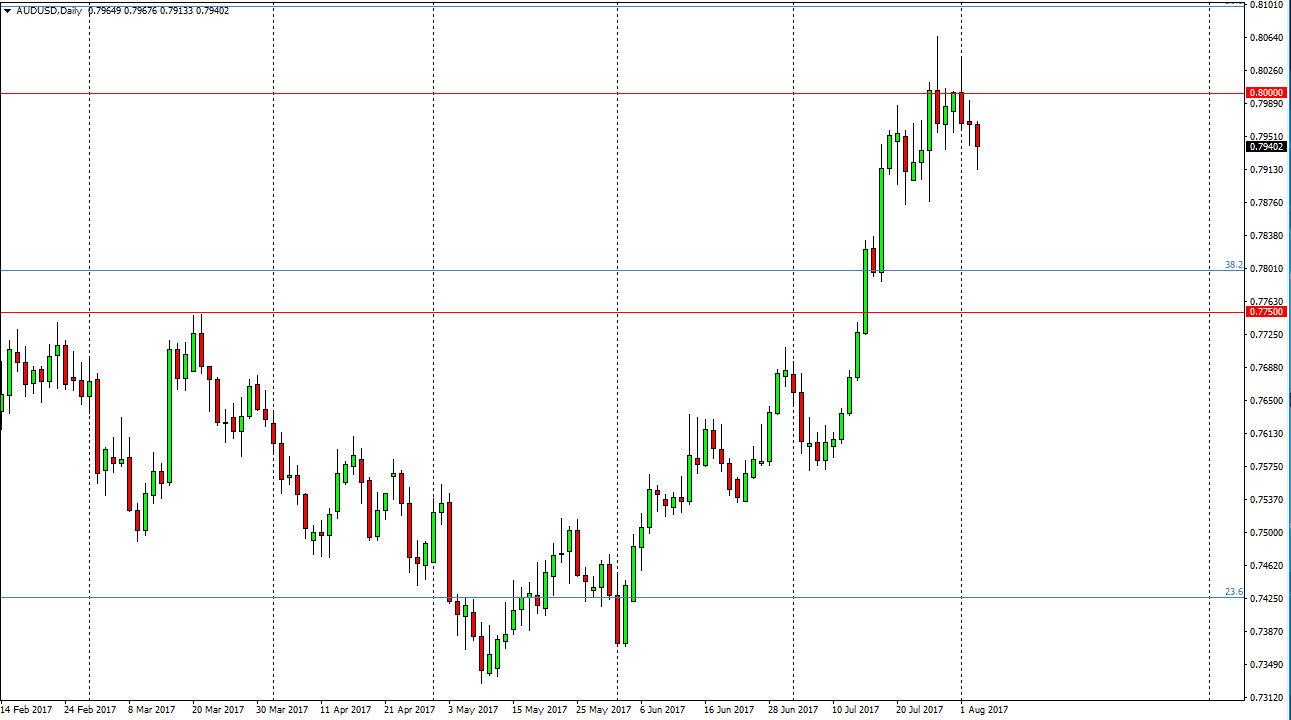

AUD/USD

The Australian dollar as you can see fell initially during the day but turned around to form a bit of a hammer. The 0.80 level above should be a magnet for price either way, because quite frankly I believe that looking at the chart’s going back decades, it has been an area that has attract a lot of attention. If we can break above the 0.80 level on a daily close, then I believe that the Australian dollar is ready to go much higher. At that point, I anticipate that it becomes more of a “buy-and-hold” situation. Alternately, if we do pull back from here, I think that the market probably goes down to the 0.79 handle underneath, and then perhaps even the 0.7750 level after that. Either way, I don’t have any interest in shorting and I believe that a pullback simply offers a nice buying opportunity based upon value, especially if gold stays within a range as it has over the last several months. Longer-term, I do think that we are going to go higher, but it’s probably going to be difficult to build up the necessary momentum.