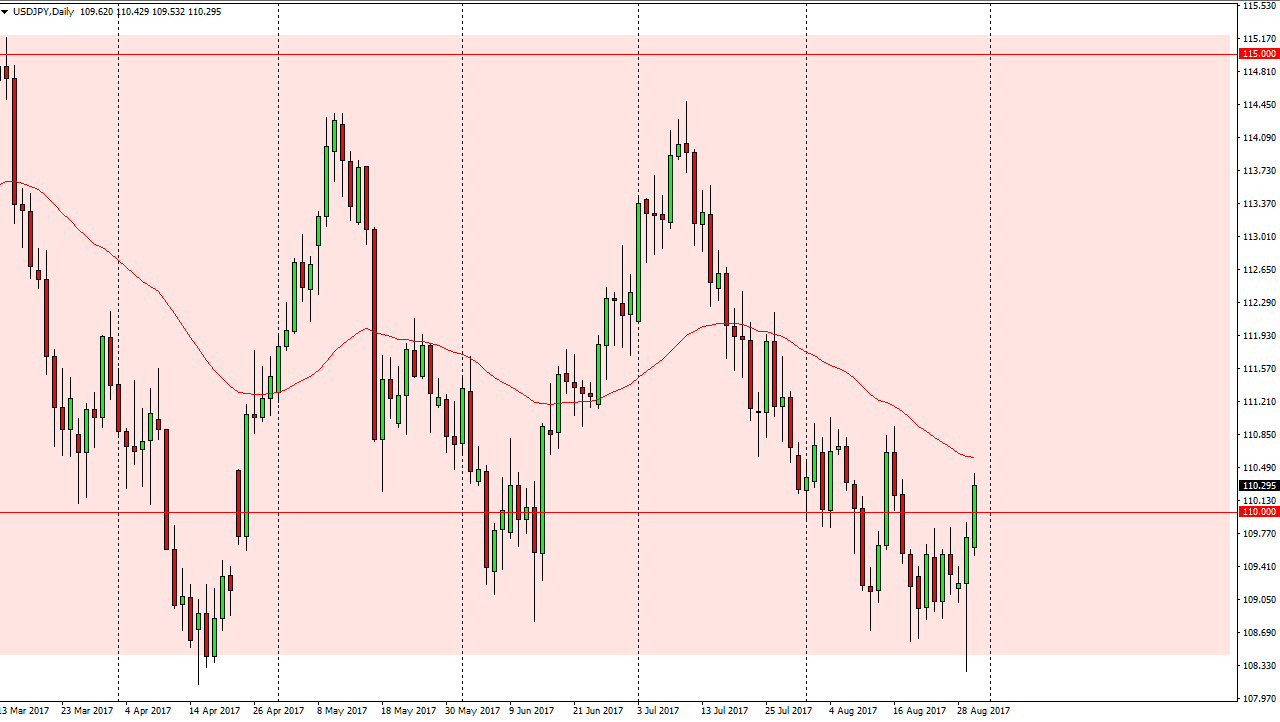

USD/JPY

The US dollar broke higher during the session on Wednesday as we continue to see resiliency in the stock markets worldwide. After the selloff due to the North Korean missile launch, we have seen a massive amount of support hold at the 108.50 level, an area that has been supportive for several months. We have been consolidating in this pair, and everything I see in this chart suggests that we will continue to do so. If we break above the 111 level, the market should then go to the 114 handle later. Alternately, if we break down below here, the market will probably offer buying opportunities at lower levels as well. If we were to break down to a fresh, new low, and then I feel that the pair will probably go down to the 105 handle.

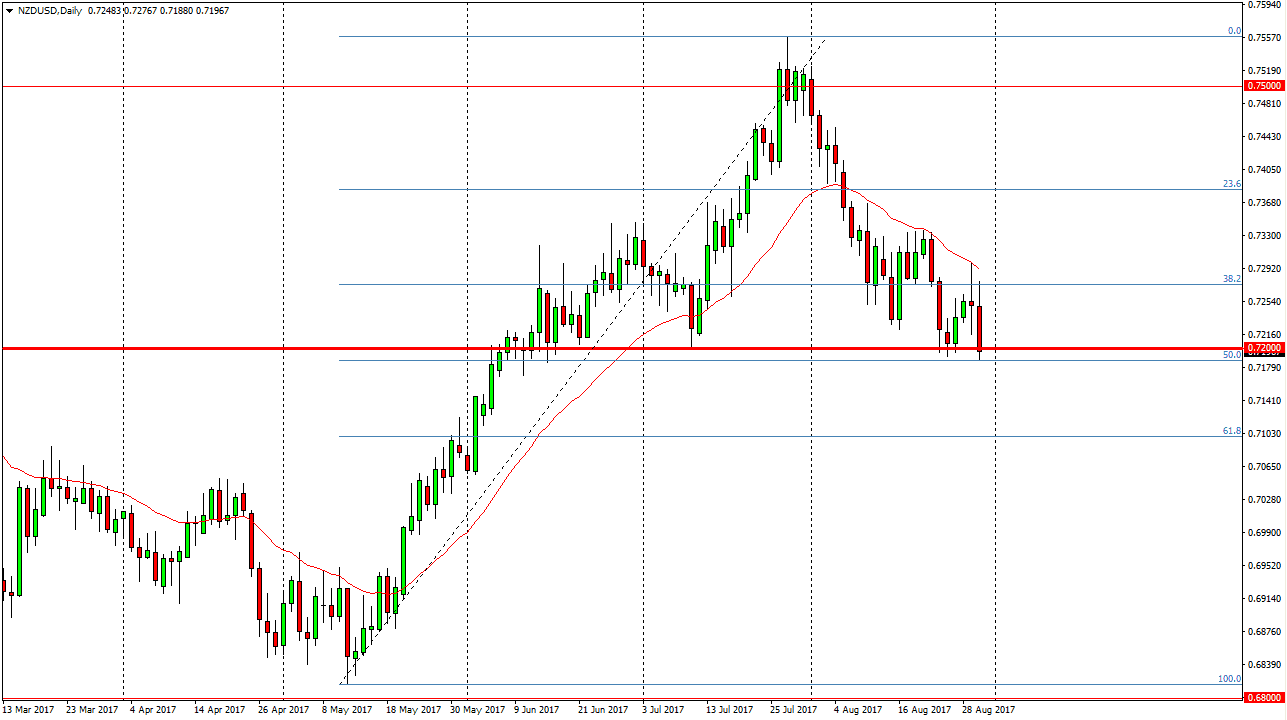

NZD/USD

The New Zealand dollar initially tried to rally during the day but fell significantly, breaking down to the 50% Fibonacci retracement level. This is just below the 0.72 handle, and if we can break down below the bottom of the daily candle, I think the market will drop down to the 0.71 level, which consequently is also the 61.8% Fibonacci retracement level. We could see a bounce from here, but it’s very unlikely that we will see a massive bounce right away, but we could see a return to the 0.7260 handle.

When I look at this chart, I see the potential for a bit of a head and shoulders, but it would be complex at the best. Given enough time, I think that the usual correlations between commodities and the New Zealand dollar will return, so pay attention to those as well. Ultimately, this market will remain volatile because the volume is then this time of year.