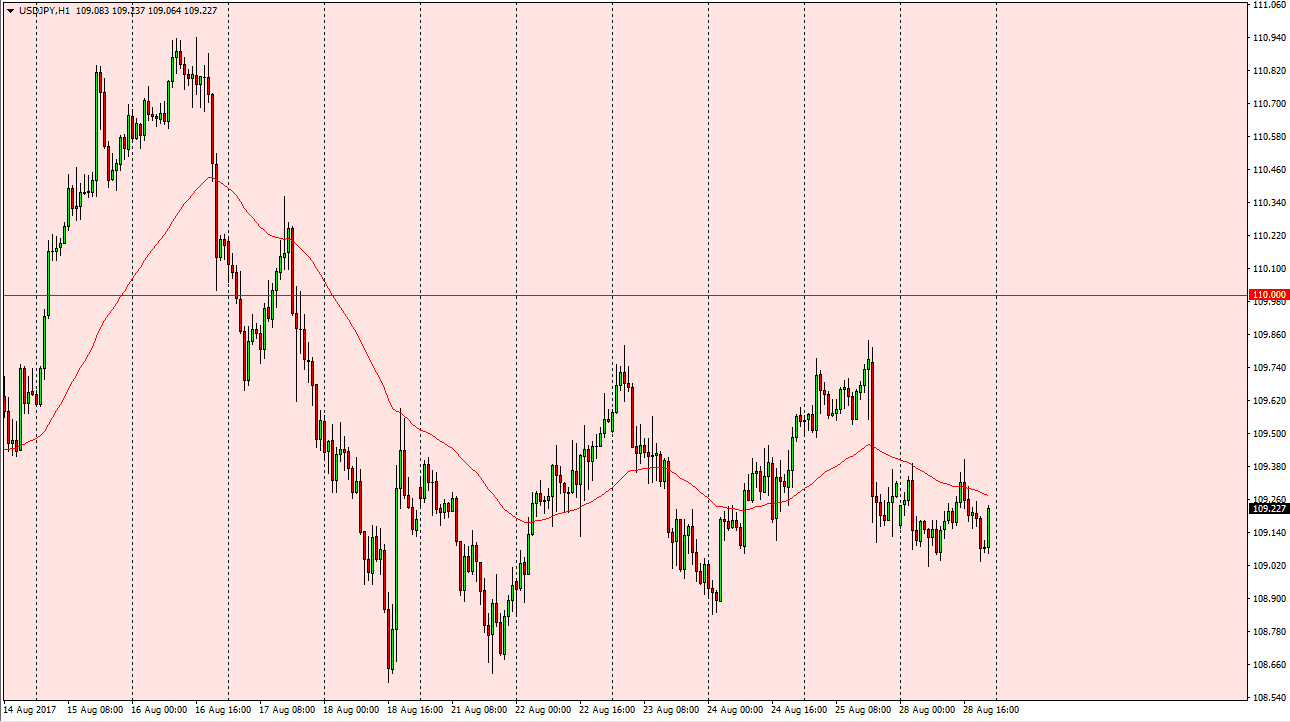

USD/JPY

The US dollar had a lackluster session overall, but did start to see buying towards the end of the day against the Japanese yen. Because of this, I believe that the market is going to continue to be very choppy, and quite frankly that makes a lot of sense as the Nonfarm Payroll announcement comes out on Friday. This pair tends to be very sensitive to that economic announcement, so it would not be overly surprising to see a sideways move over the next several sessions. I also recognize that we are still very much in consolidation, with the 108.50 level underneath being massively supportive. If we break down below there, I think that the markets will probably go looking towards the 105 handle. Otherwise, we should probably head towards the 110 level, and then eventually the 114.50 level. Expect choppiness nonetheless.

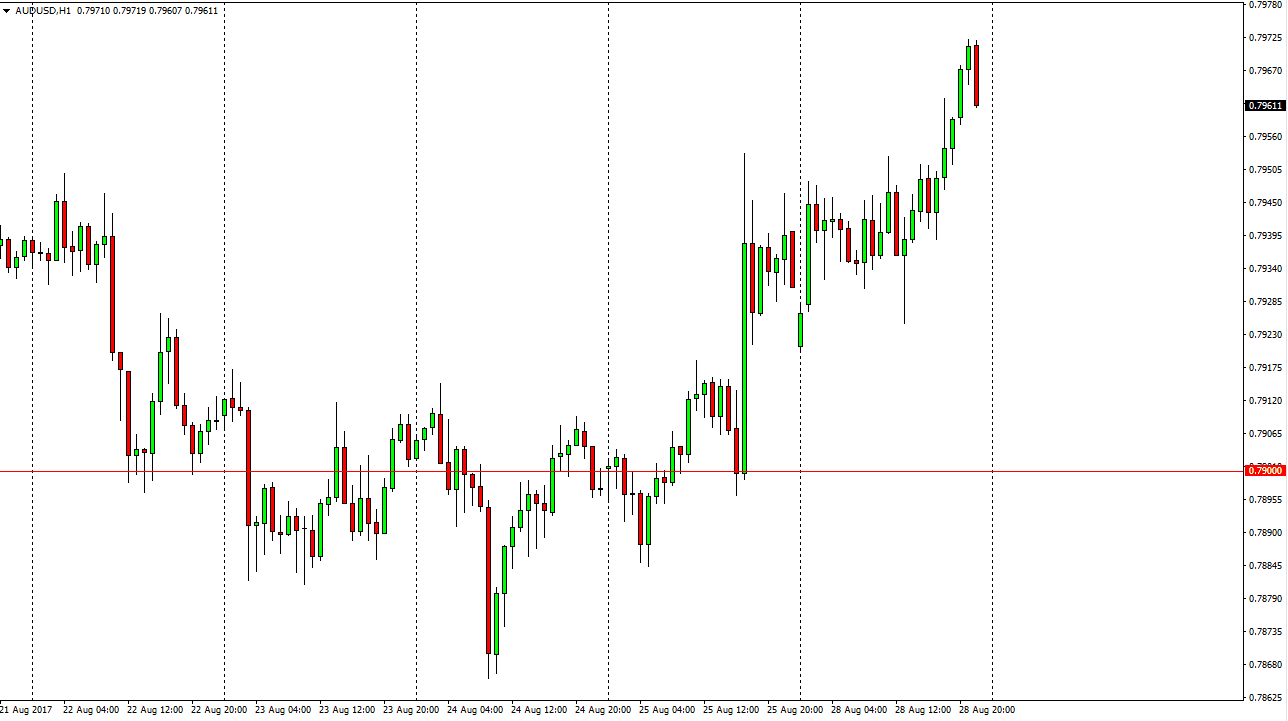

AUD/USD

The Australian dollar got a boost during the day on Monday as gold markets finally broke above the $1300 level. With this in mind, I suspect that the Aussie will continue to track the gold market. However, I see that the 0.80 level above is still in effect, and therefore think we will continue to see a certain amount of resistance in that region. Ultimately, I think we will break above there, but pullbacks will be needed to build up enough momentum to break out to the upside. I recognize the 0.79 level underneath as a massive support level, so pullbacks should attract more volume, as we set up to break out to the upside. If we break down below the 0.79 level, the market could go lower. All things being equal though, with gold breaking out way it has been, I think that eventually we will see the Aussie strengthen.