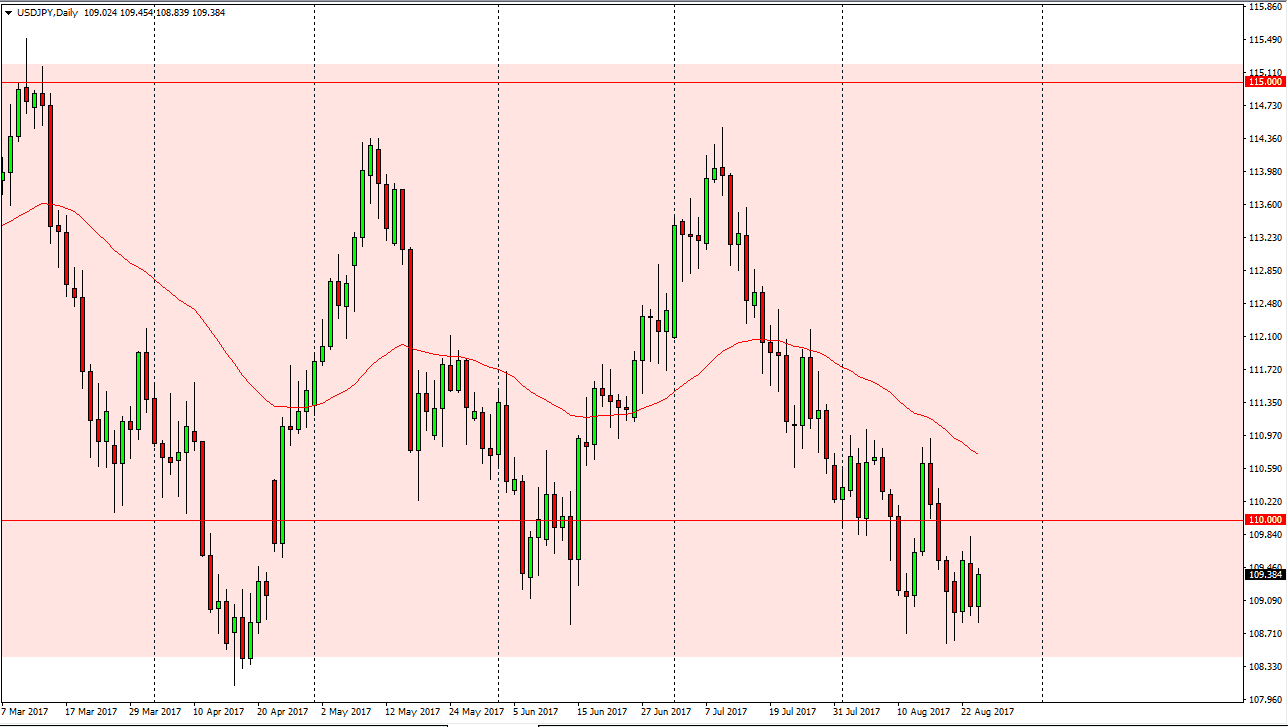

USD/JPY

The US dollar rallied during the day on Thursday, showing signs of support yet again. The 110 level above being broken to the upside should be a buying opportunity, and I think that it’s only a matter of time before the market reaches even higher. However, this is a situation where we are waiting on Janet Yellen to give a speech at Jackson Hole today, and that could move the US dollar overall. Ultimately, I think that if we break above the 110 level, it’s going to continue the overall consolidation, meaning that we could go to the 114.50 level. Alternately, if we break down below the 108.50 level, it is probably a market that should continue to fall, perhaps reaching down to the 105 level. Today is vital for this currency pair.

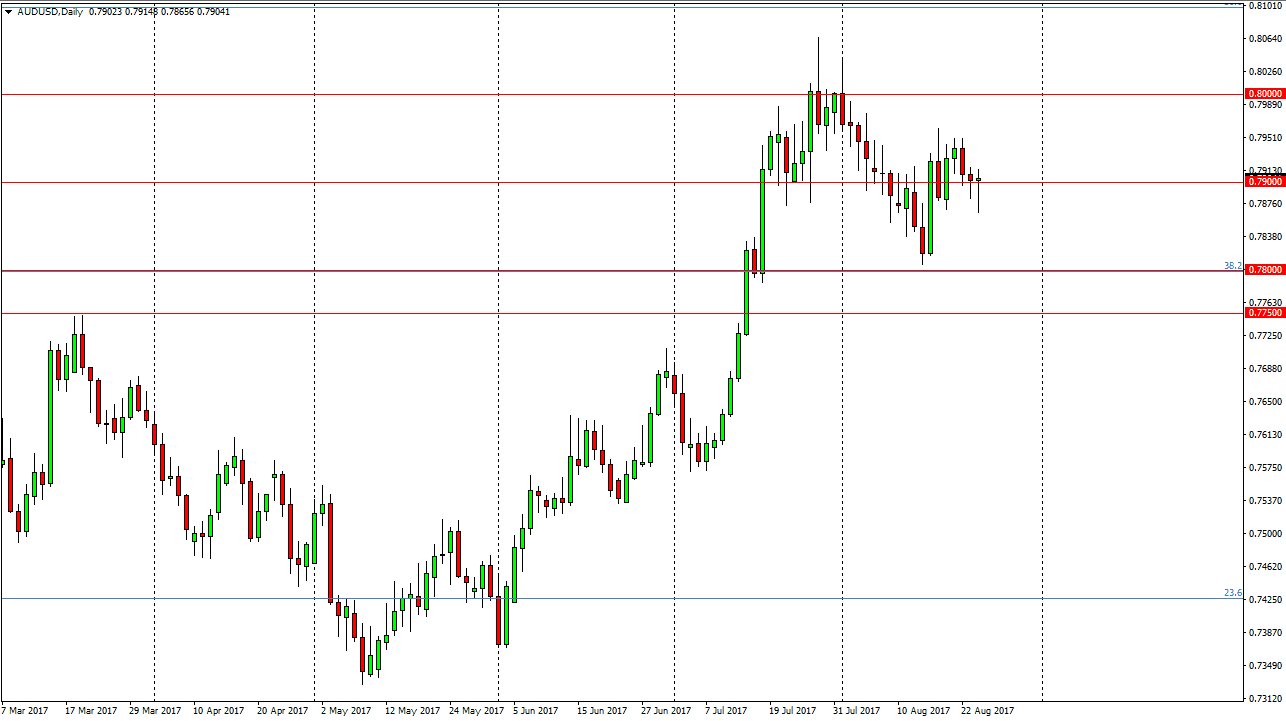

AUD/USD

The Australian dollar initially fell on Thursday, turning around to form a hammer. The hammer is a very bullish sign, and it’s likely that if we break above the top of the range, the market should then go to the 0.80 level. This is a market that will also be waiting for the Janet Yellen speech, so I think until she gives that, there probably won’t be much in the way of movement. If we break down below the bottom of the range, I think that the market should then go to the 0.78 handle next. If we break above the top of the candle, then we should try that vital 0.80 handle above, which appears on charts going back decades as for support and resistance. A break above there has this market more of a “buy-and-hold” type of situation. Ultimately, this is a market that seems to want to go higher, the question now is whether Janet Yellen will cause it to happen.