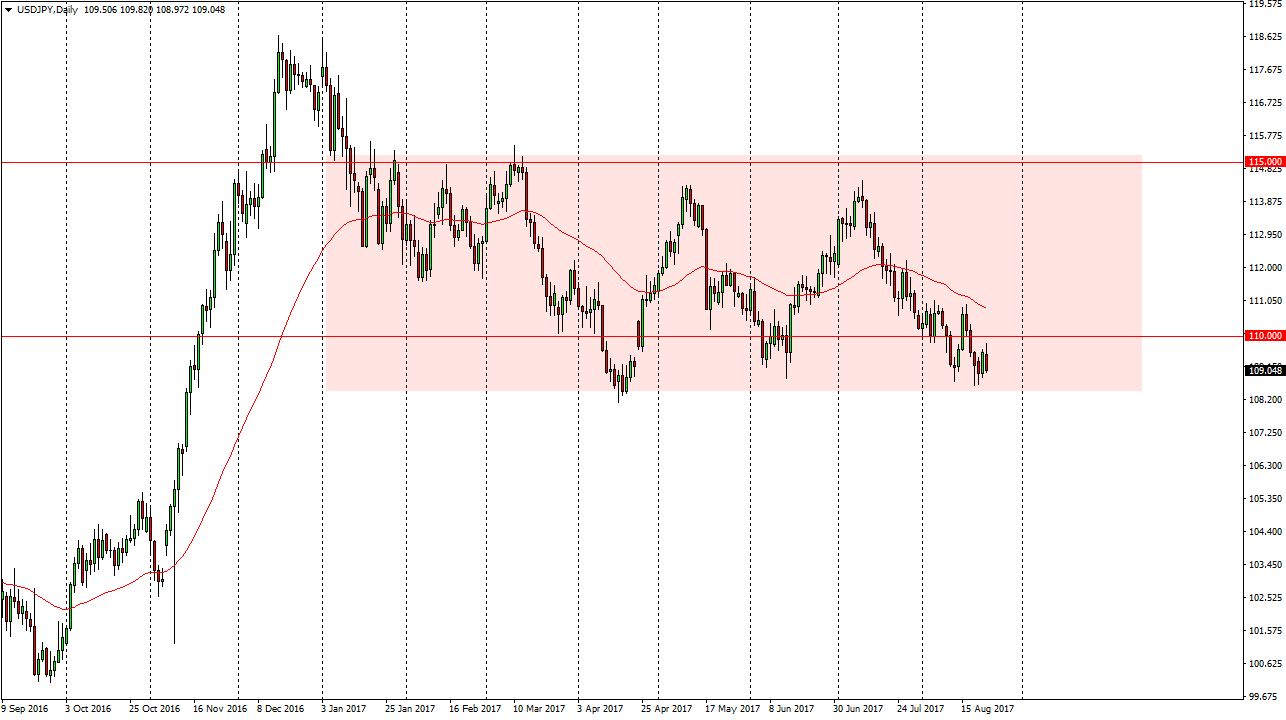

USD/JPY

The US dollar had a slightly negative session on Wednesday, as we initially tried to rally but found the 110 level to be a bit too resistive. Falling back towards the bottom of the large consolidation area, I believe that the market will probably find buyers underneath. I also recognize that the speech by Janet Yellen on Friday will of course be a massive influence on this market. I believe that the market should continue to find buyers in that general vicinity, unless she suddenly sounds very dovish. If she does, the market should go looking towards the 105-level next. Alternately, if we can break above the 110 level, then I feel that the market probably goes back towards the top of the consolidation box you see on the chart right now.

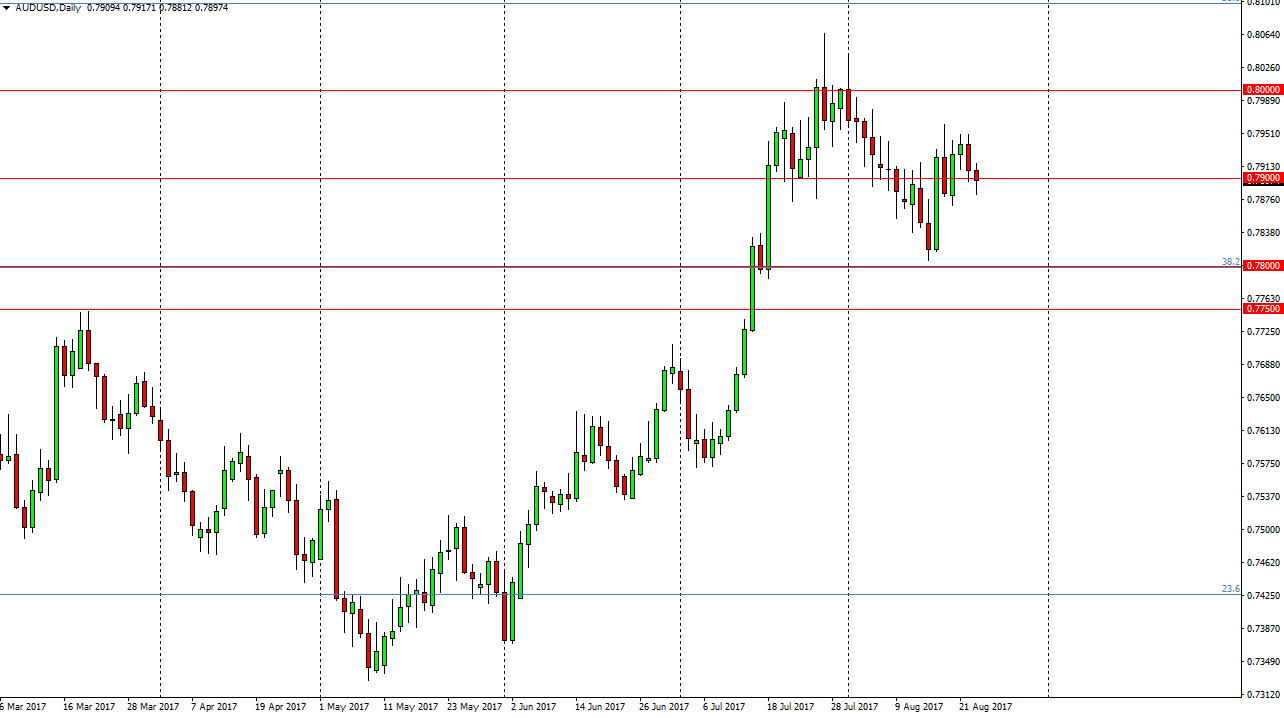

AUD/USD

The Australian dollar initially fell during the day on Wednesday, dipping below the 0.79 handle. We continue to see a lot of volatility, and it’s likely that the market will pay attention to what the US dollar does more than anything else. The gold markets continue to try to break above the $1300 level. However, it’s not until we get the Janet Yellen speech that the market will more than likely be able to break above there. I think that today will probably be more sideways than anything else. If we can break above the top of the hammer though, that is a bullish sign and could have the market looking for the 0.80 level above. If we can break above there, then it becomes more of a “buy-and-hold” situation. Until then, expect a lot of volatility. If we break down below the bottom of the candle for the session on Wednesday, we will more than likely go looking towards the 0.78 level underneath which had been supportive in the past.