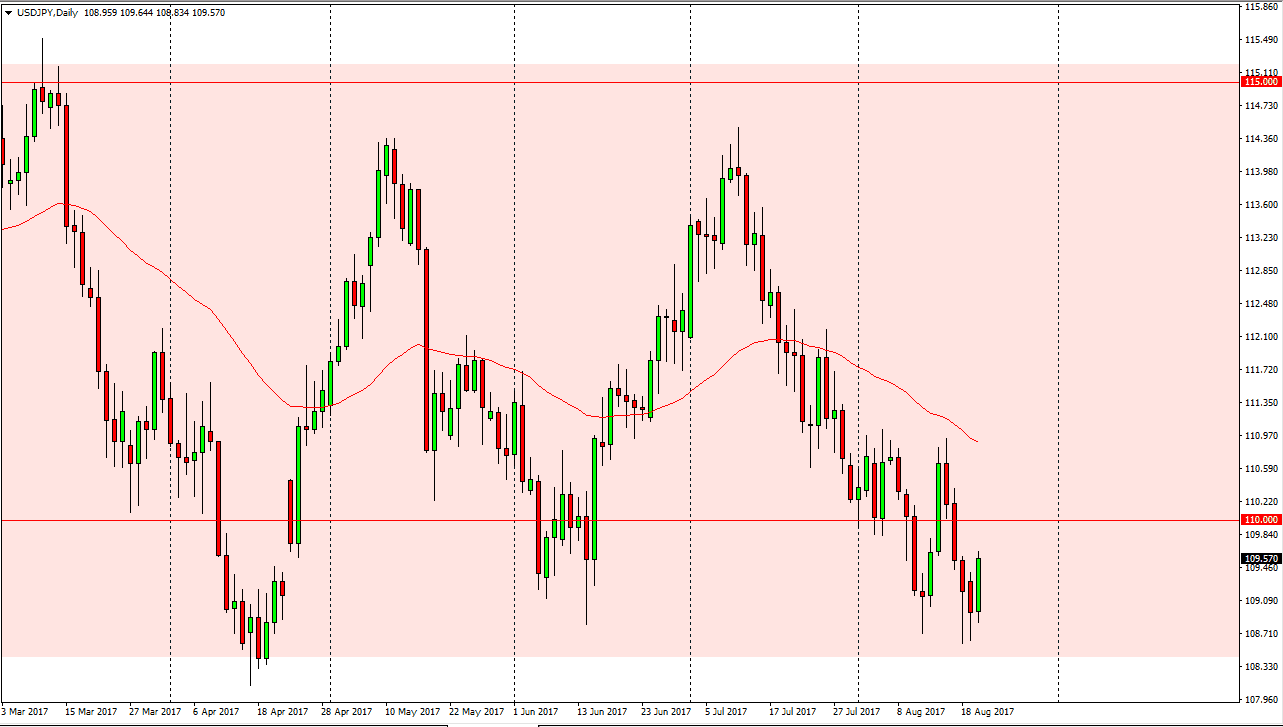

USD/JPY

The US dollar rallied during the Tuesday session, breaking the top of the hammer from both Monday and Friday. The market is at the bottom of a major consolidation area, so it would not surprise me at all to see the market going higher. A break above the 110 level has the 111 level in focus, and a move above there has the market been looking at the 112.50 level, and then the 114 level. The top of the consolidation is at the 115 handle, and that could be a longer-term target. However, if we were to break down below the 108 level, that would be disastrous. With the Jackson Hole Symposium going on this week, we will get some volatility. Because of this, be careful but follow whichever direction the market moves that I laid out above.

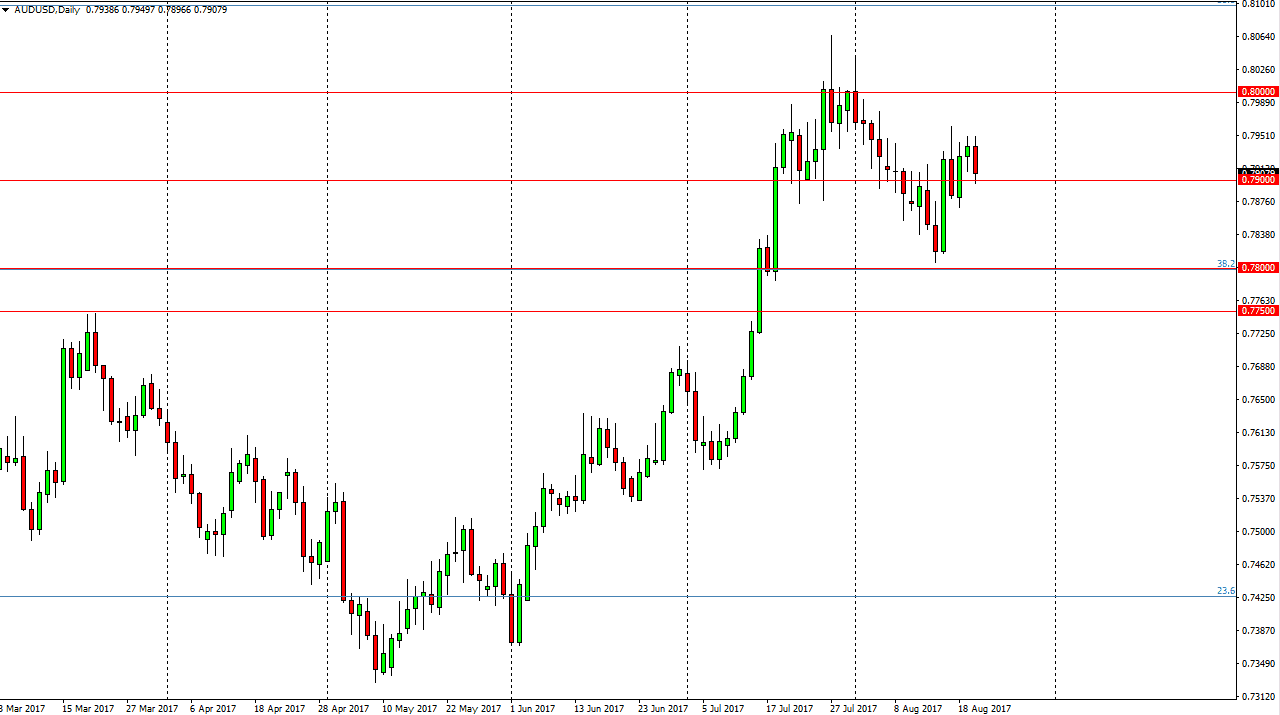

AUD/USD

The Australian dollar fell during the day on Tuesday, testing the 0.79 level. That level is support, and I think that there is a lot of bullish pressure under this pair. However, the 0.80 level above is a massive barrier to overcome, and it will probably need some type of dovish statement coming out of Janet Yellen to push the markets higher. Because of this, it’s likely that we may just meander for the next day or so, but once we break above the 0.80 level on a daily close, that could be a very important move, as it opens more of a “buy-and-hold” field to the market.

I believe that there is plenty of support below at the 0.7750 level as well, so I don’t have any interest in shorting. At this point, I am simply looking for value and the Australian dollar to take advantage of, placing trades when it presents itself.