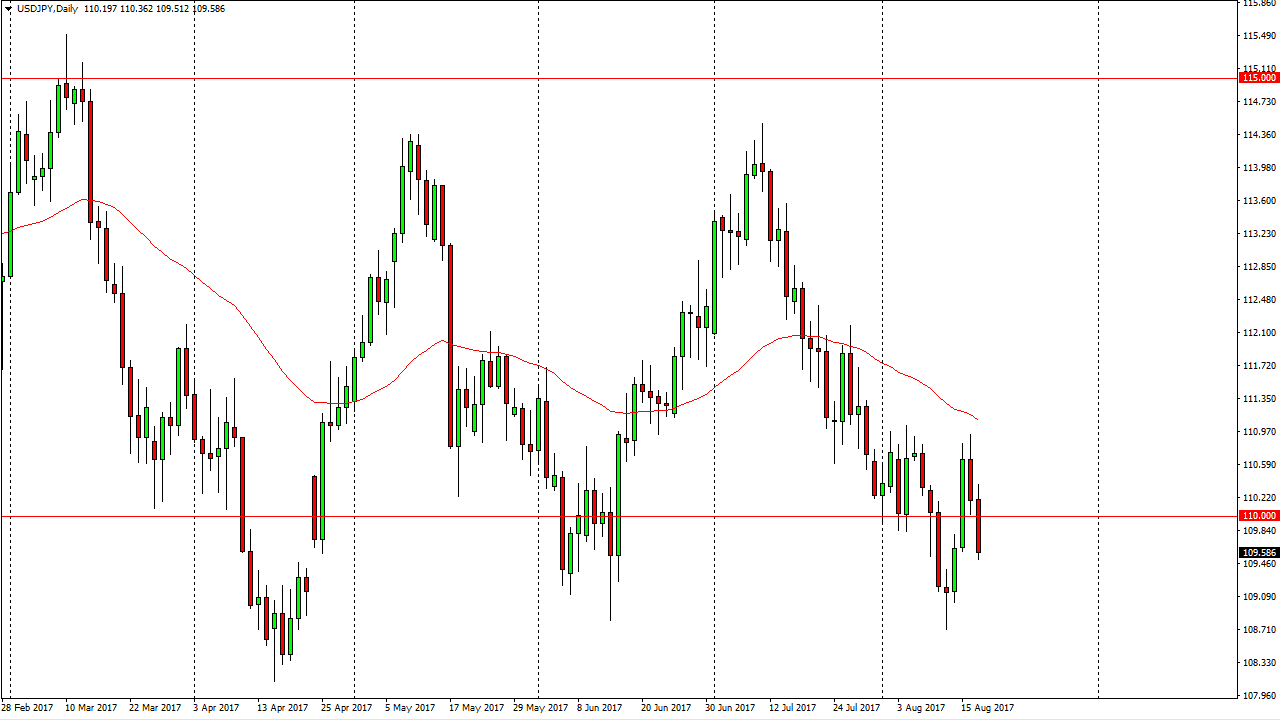

USD/JPY

The USD/JPY pair fell significantly during the session on Thursday, as a bit of a “risk off” trade has been the case. We felt to the 108.50 level, and then bounced again. However, later in the day we rolled over as well as it looks like we are trying to consolidate in this general vicinity. I think that longer-term, we are going to go higher, because we are close to the bottom of a large consolidation area. With this being the case, it’s likely that we could go as high as the 114 handle, but you’re going to have to be able to deal with a significant amount of volatility in the meantime. If we did break below the 108 handle, this market will probably fall apart and go looking towards the 105-level next. Ultimately, I think the one thing you can probably count on is volatility.

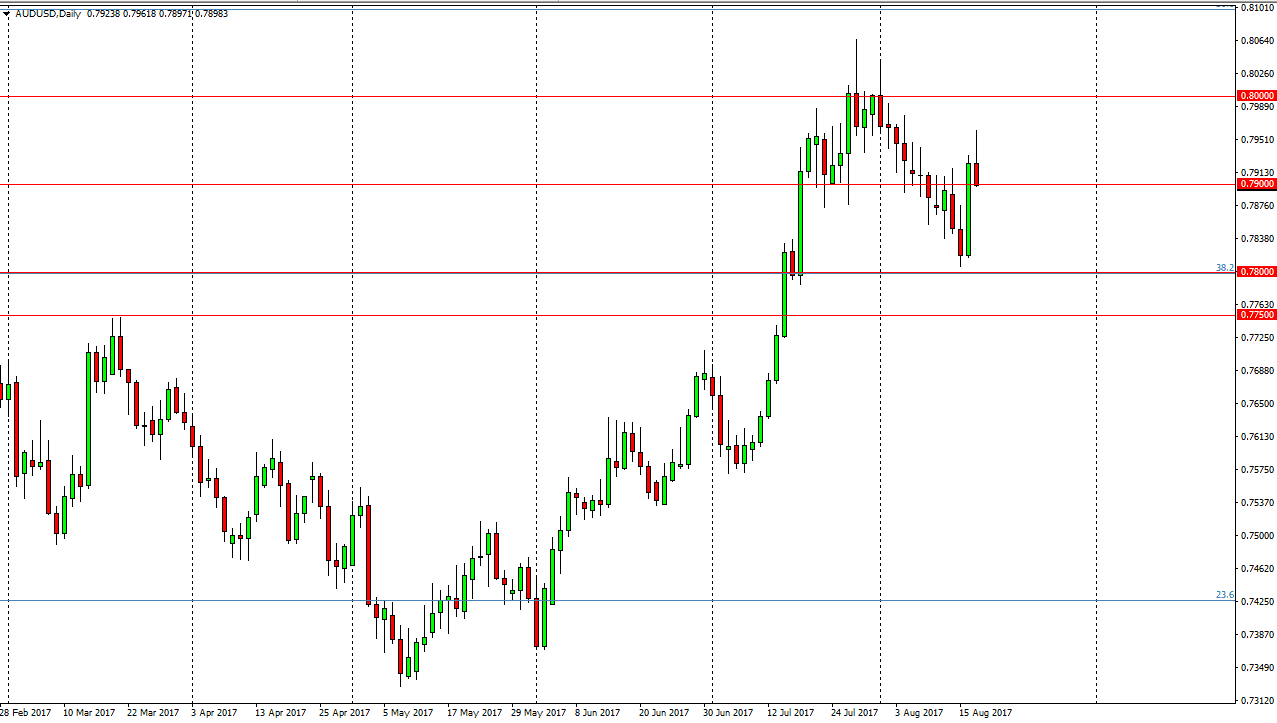

AUD/USD

The Australian dollar initially tried to rally during the day on Thursday but got turned around at the 0.7950 region to turn around and form a massive shooting star. If we can break down below the bottom of the candle, we should then go towards the 0.78 handle. Pay attention to the gold markets, there is a positive correlation between the 2 markets and that could give you a bit of a “heads up” on what will happen next. Ultimately, this is a market that I believe does go higher, but we may need to pull back to build up momentum. The massive candle during the session on Wednesday is a very bullish sign, but may need the market to pull back to pick up enough momentum to keep going higher. I also recognize that the 0.80 level above is massively resistive, as it is a large number going back decades.