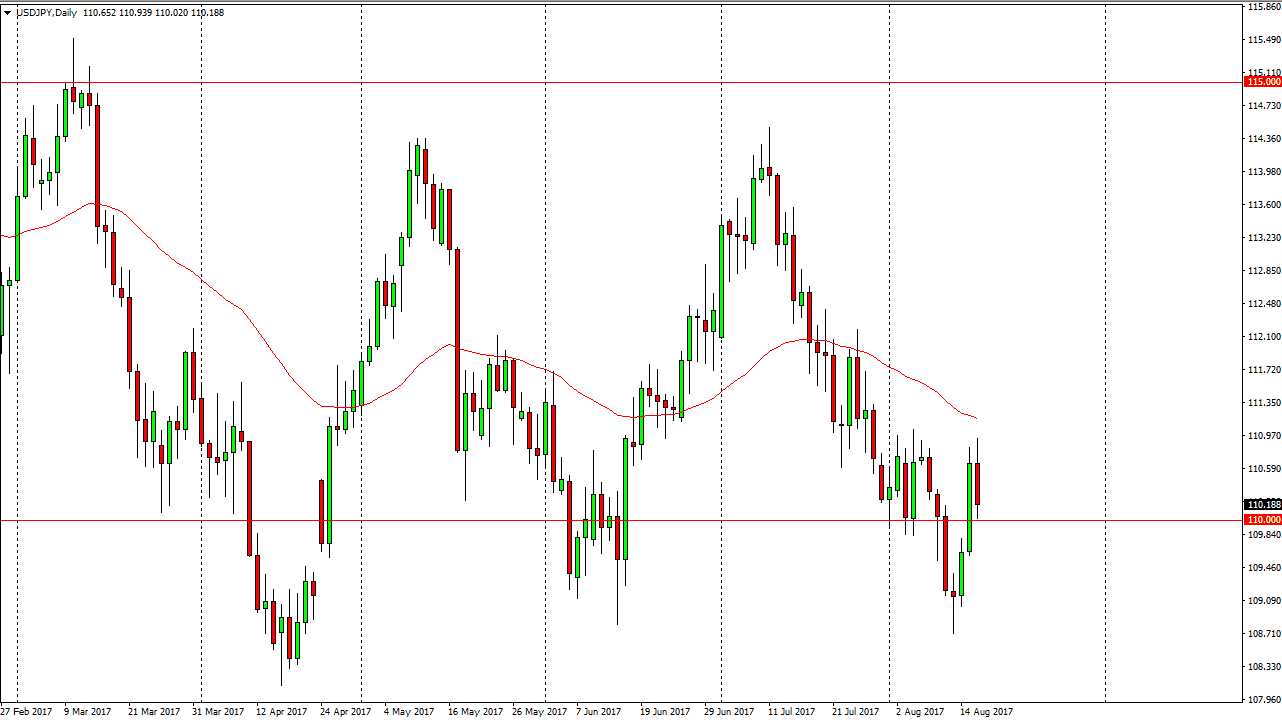

USD/JPY

The US dollar initially tried to rally during the day on Wednesday, but turned around at the 111 level as the FOMC meeting minutes came out much more dovish than anticipated. Because of this, we crashed into the 110 level, and now I think that we are starting to see a real inflection point. After all, the default position was that the Federal Reserve was willing to raise interest rates a couple of times between now and the end of the year. The dovish minutes suggests that it may not be as foregone of a conclusion as once thought. Because of this, we will continue to see volatility in this market, and I think we are going to bounce around the 110 handle overall. Ultimately, this is a market that should continue to see extreme amounts of volatility and you would be forgiven for stepping away.

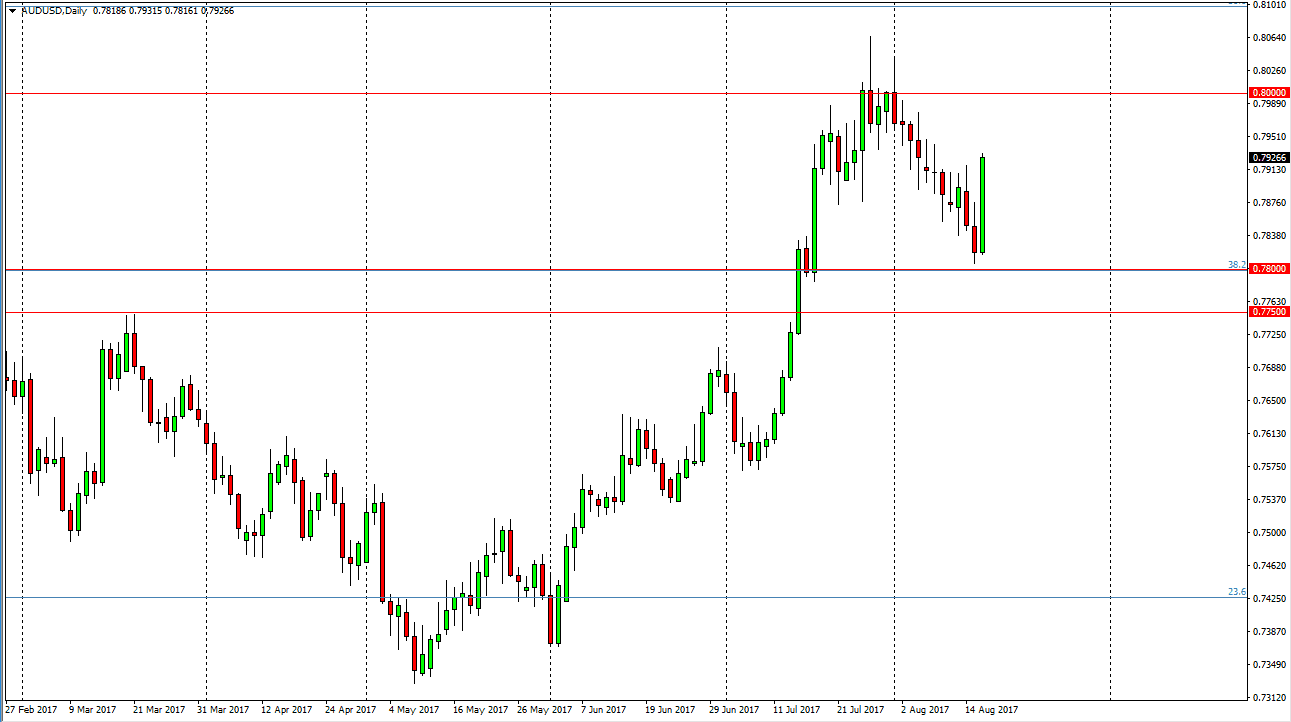

AUD/USD

The Australian dollar exploded to the upside during the day on Wednesday, breaking above the 0.79 handle. By doing so, the market looks as if it is ready to go to the 0.80 level above there. That is an area that will have a significant amount of resistance, as it is important on the longer-term charts. If we can reach that area again, I do not expect it to break out right away. After all, it’s such an important level that it will probably take several different attempts to get above there. However, if we were to fall from here, I think we will see support again at the 0.78 level, extending down to the 0.7750 level. That is an area that was previously resistive, and the fact that we have broken above there was of course important. Ultimately, I think that this market will continue to favor the Aussie dollar, but we may need to build up enough momentum to go higher.