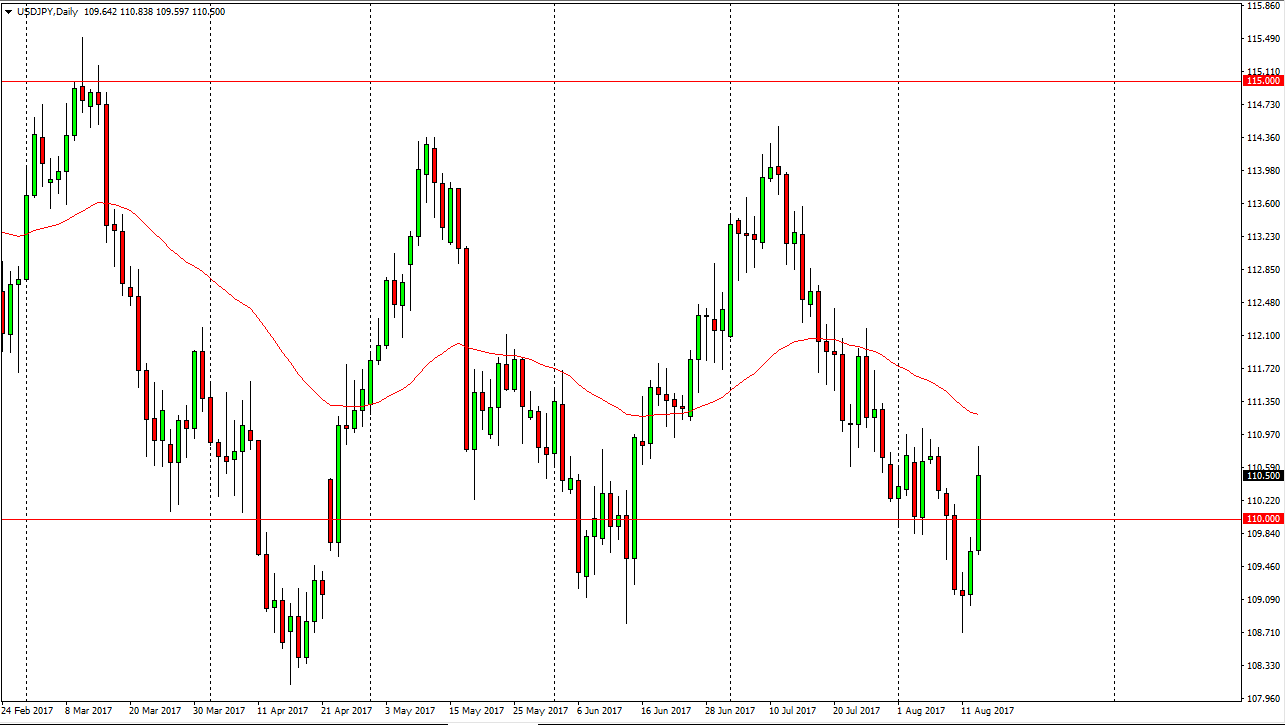

USD/JPY

The USD/JPY pair broke higher on Tuesday, slicing through the 110 level. At this point, I believe that if we can break above the top of the range for the day, the market should continue to go much higher. The retail sales figures coming out of the United States were much stronger than anticipated, so this at money flowing into the US dollar. Also, keep in mind that the North Korean situation had been driving yen buying, and therefore the situation abating a bit certainly helps the markets move against the Japanese yen. If we break above the top of the candle for the session on Tuesday, I believe that the market then goes to the 112.50 level. If we managed to break down below the bottom of the Friday candle, I believe at that point the market goes to the 108 handle.

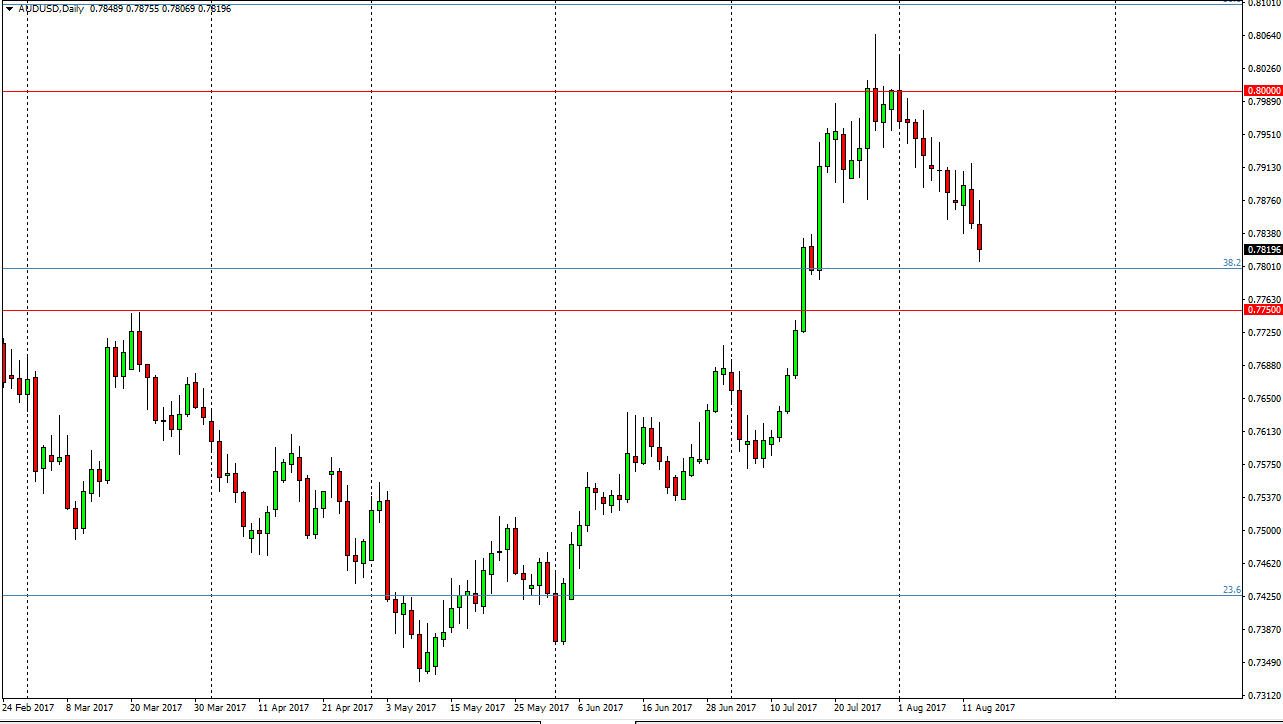

AUD/USD

The Australian dollar initially tried to rally on Tuesday, but found enough resistance at the 0.7875 level to turn around and drop significantly. The market still has support below that it can probably find though, especially near the 0.7750 level. That was an area that was previously massive resistance, so now that we have broken above there, it makes sense that the market will probably go back to test that level for support. Also, you should pay attention to the gold markets rolling over as the North Korean tension is starting to leave the market. That works against gold, and that by extension works against the value of the Aussie dollar. I don’t necessarily think we are going to go much lower, just that the market is almost certainly going to test the 0.7750 level before making the next move. If we bounce from there, it’s a buying opportunity. However, if we break down below the 0.77 level, the market should continue to go lower.