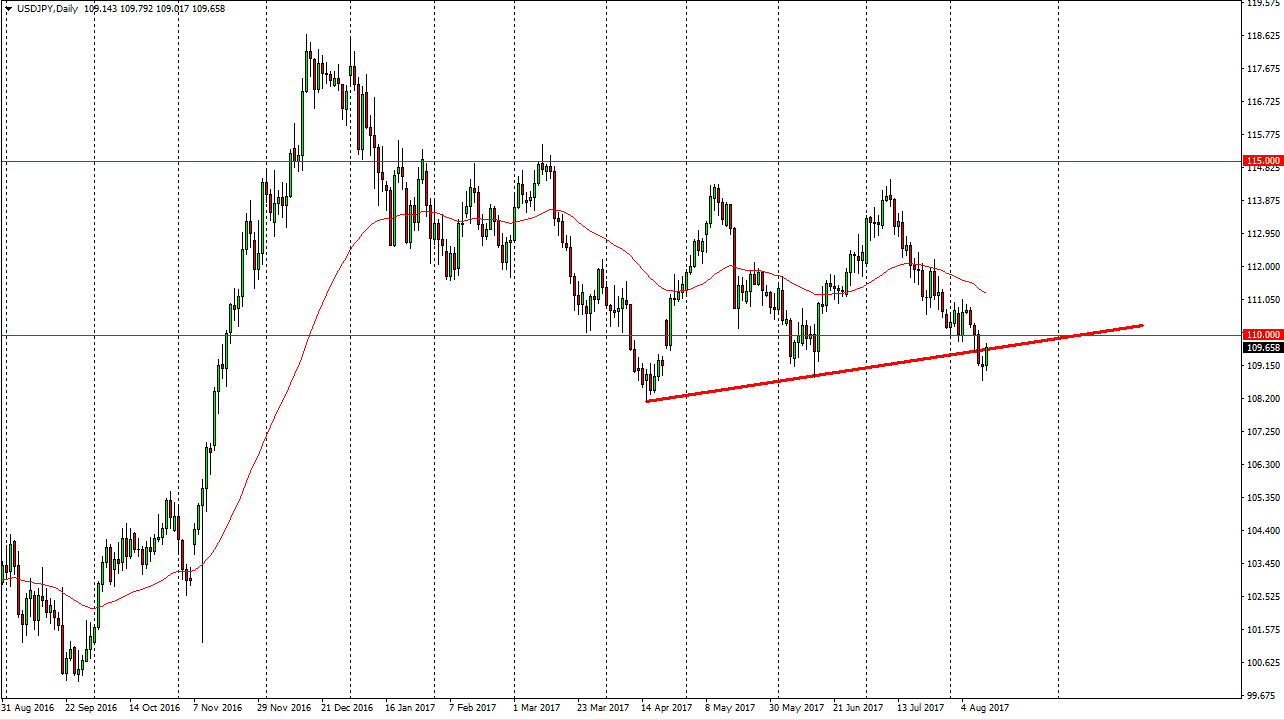

USD/JPY

The US dollar shot higher during the session on Monday, testing the uptrend line that had recently given way. The question now will be whether we can break above the 110 level to confirm a nullification of this trendline. Alternately, if we get some type of exhaustion in this area, that could be the beginning of something rather negative. I believe that most of the selling recently has been due to noise coming out of North Korea, and of course Washington DC. That seems to be stopping, and if that’s the case I think we will start to look at the interest rate expectations a bull central banks, which does actually in fact favor the Americans. Because of this, a move above 110 has me buying but I do recognize that if we start to show signs of exhaustion, we may roll right back over.

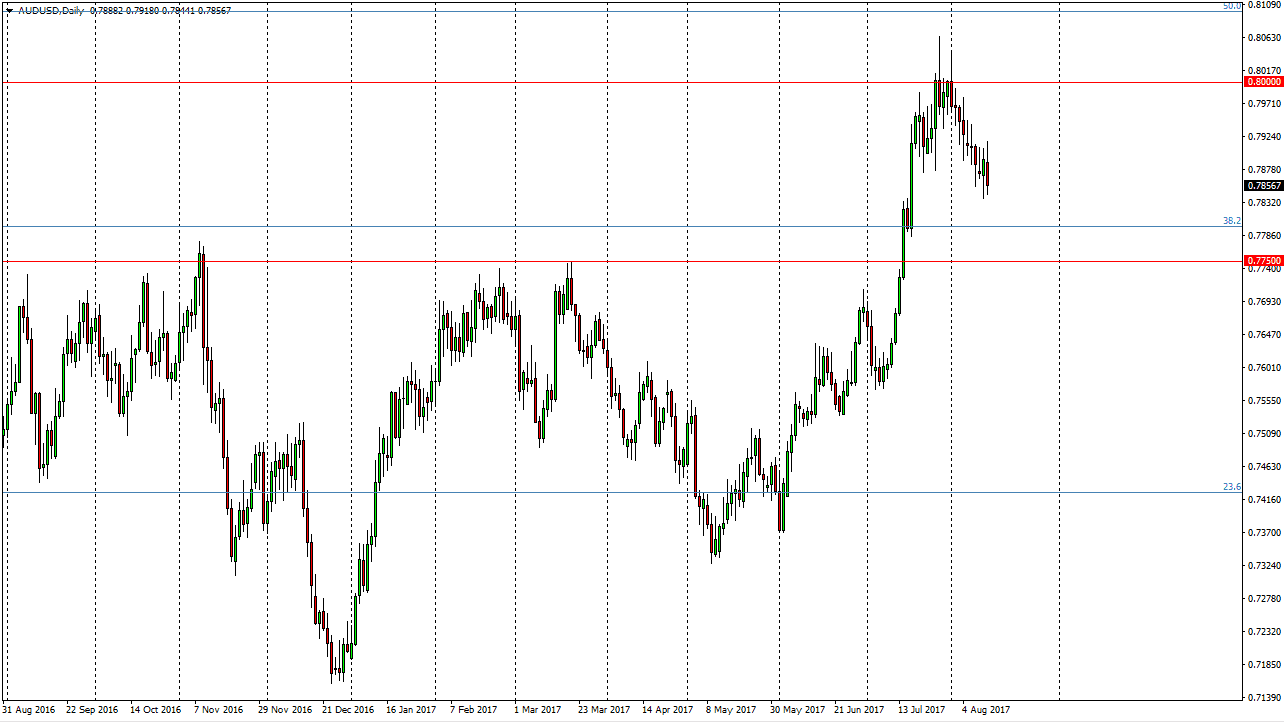

AUD/USD

The Australian dollar initially tried to rally during the Monday session, but fell lower during the day. It now looks as if we will probably try to drop towards the 0.7750 level, and that’s an area where I would expect to see a significant amount of support, because it was so resistive in the past. We have not retested that area, so this may be more of a technical move than anything else. Ultimately, I believe that this market may drop and the short-term, but I suspect that there will be a nice buying opportunity closer to the 0.7750 level. If we break down below there, the market will break down significantly. I don’t have any interest in buying currently, looks like we are bit overextended, and I think that this pullback might be healthy for the Australian dollar going forward anyway. Gold markets are rolling over a little bit, and that should facilitate the pullback.