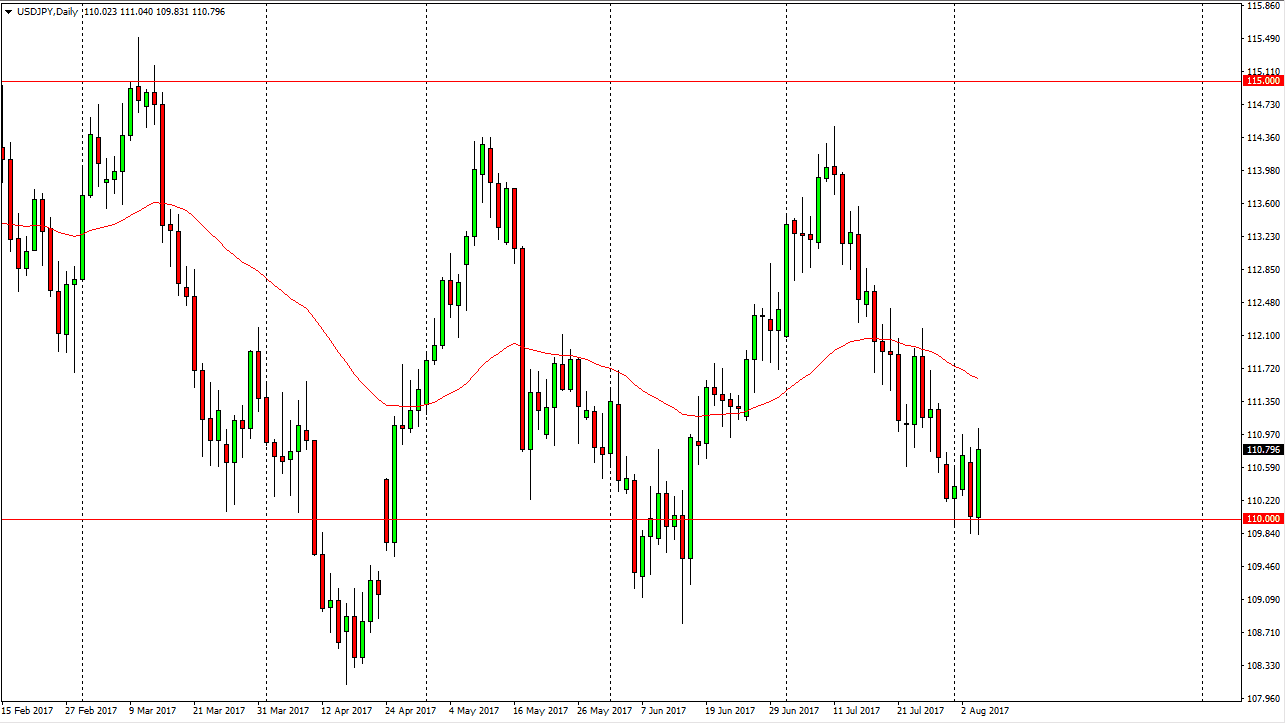

USD/JPY

The US dollar exploded to the upside during the session on Friday as the jobs number came out much longer than anticipated. We were sitting at the 110 level, which has a certain amount of psychological importance, and of course has been supportive structurally as well. This being the case, and we ended up forming a nice bullish candle and I think that a break above the top of the candle for the session on Friday census market much higher. I believe that the 112.50 level will be the next target, and then eventually the 114.50 level. The market continues to consolidate longer-term, and this simply continues that pattern. However, I would be the first to point out that the lows are getting higher, and that means that we are starting to see buyers become a bit more aggressive.

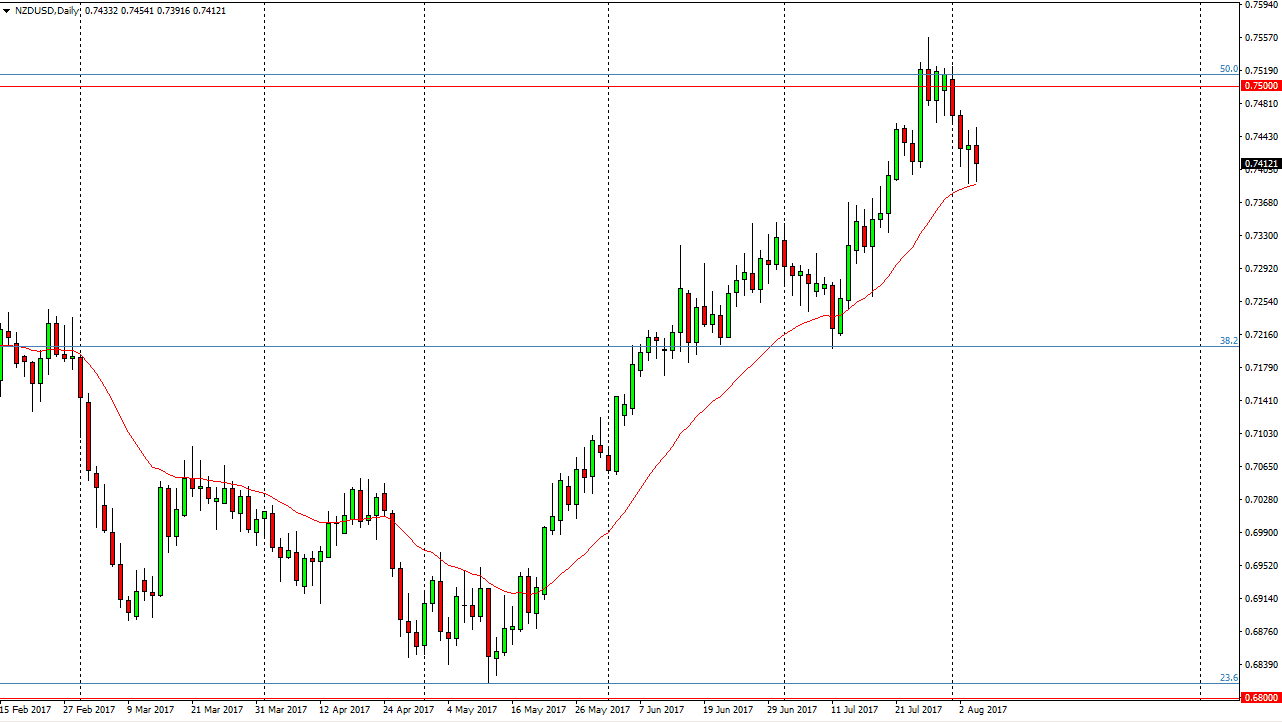

NZD/USD

The New Zealand dollar fell slightly during the day as we continue to see negative pressure. However, the market looks like we are going to pull back, reaching towards the 0.73 handle. I think it’s only a matter of time before we bounce and start going towards the 0.75 handle. The market should continue to see quite a bit of noise, and keep in mind that the New Zealand dollar is highly sensitive to the commodity markets in general. If we do break below the 0.73 handle, I think the next target is the 0.72 level. Overall, the US dollar should continue to strengthen, and that will put a bit of a muting effect on any type of rally in this market. I think that we will see a general consolidation, and therefore a lot of back and forth short-term trading is probably what we’re looking at and the kiwi dollar of the next several sessions.