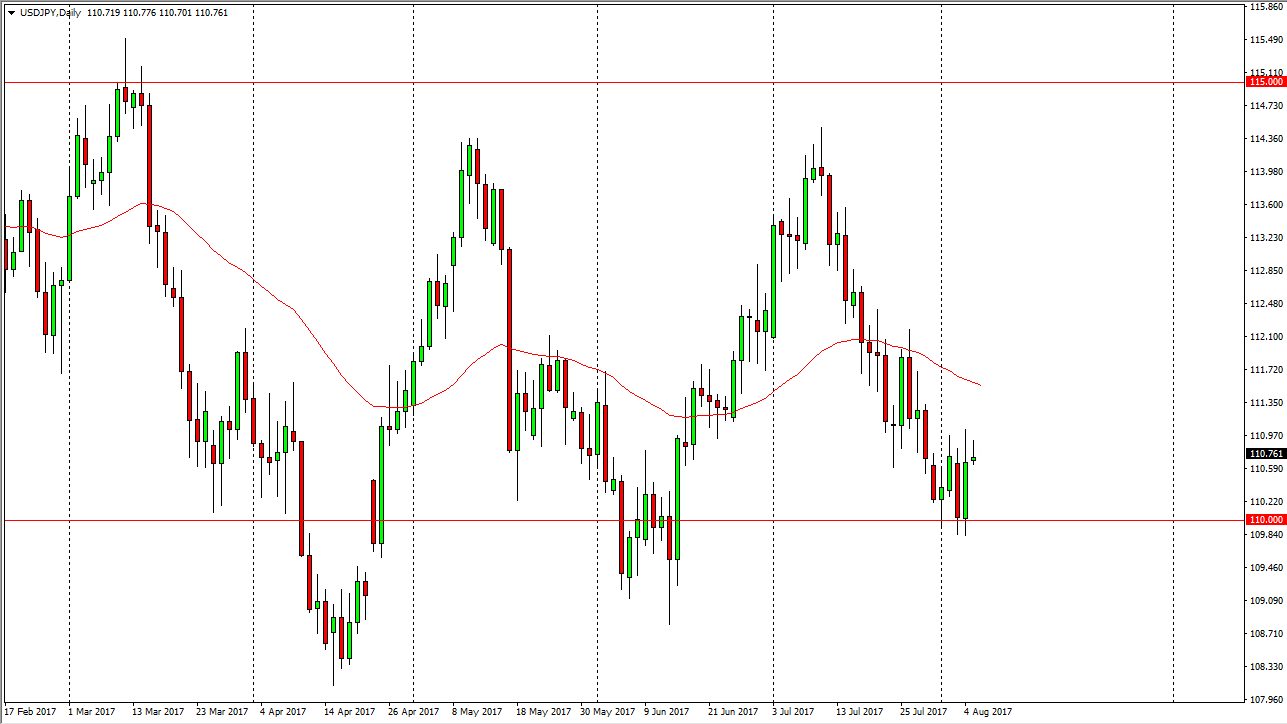

USD/JPY

The US dollar did almost nothing against the Japanese yen during the day on Monday, testing the 111 level, but struggled a bit to overcome that barrier. Ultimately though, I think that we are looking at consolidation between the 111 level and the 110 level underneath that. If we do break above the 111 level significantly, then I suspect that the market is to go looking towards the 112.50 handle. I believe that will eventually happen, but right now the market doesn’t look like it’s in a hurry to go anywhere, so we could see a bit of grinding in the meantime. That grinding could be a potential opportunity for those of you who choose to trade short-term charts. A range bound market could be very good for those of you who trade like this, and I believe that the 110 level will offer a bit of a “floor” in the short term.

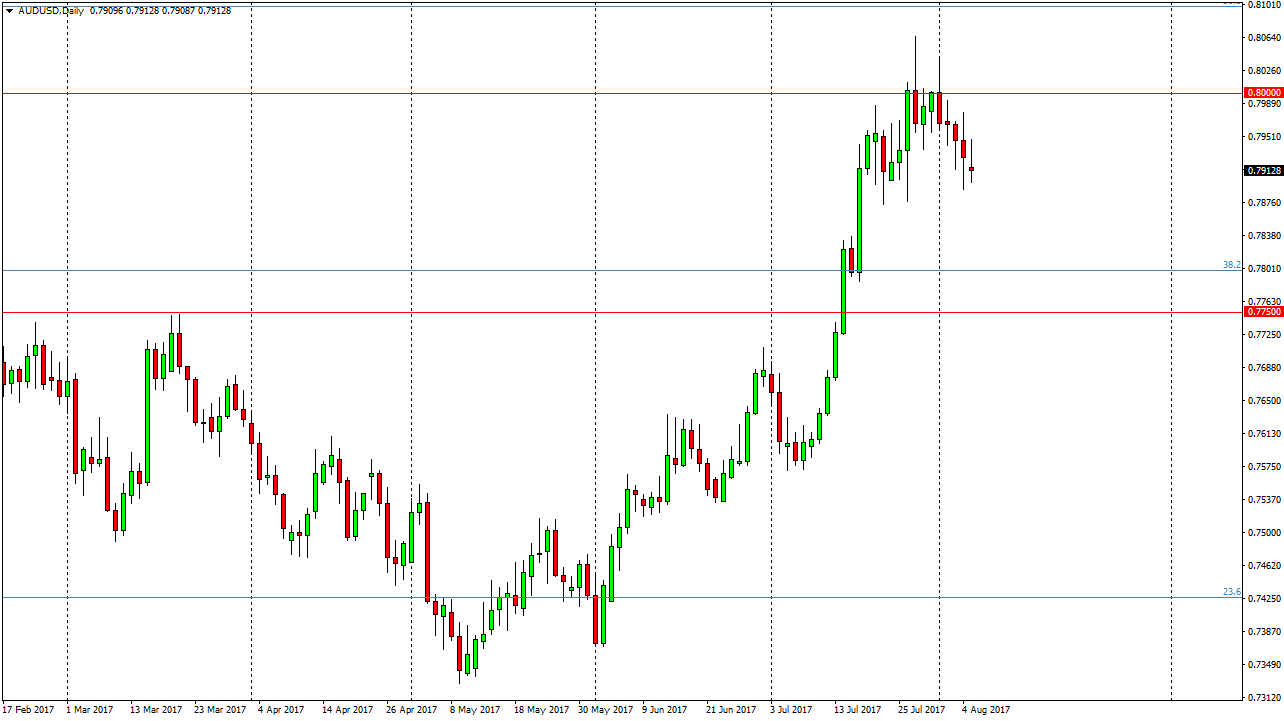

AUD/USD

The Australian dollar had a slightly negative session after volatile trading on Monday. Ultimately, I think that this market is trying to roll over and a breakdown below the 0.79 level is likely. The 0.7750 level under that should be supportive though, so I’m not looking for anything major. I think that this pullback is indicative of what we are seeing in the gold markets, and quite frankly they are not supporting the Aussie at the moment. I don’t think were in a breakdown drastically, I just believe that this pullback is necessary as we have not retested the previous resistance barrier found at the 0.7750 level for support. That’s classic technical analysis, so a little bit of a drift lower could be expected over the next several sessions. The 0.80 level is a major barrier that goes back decades, so it will take a significant amount of momentum to break through.