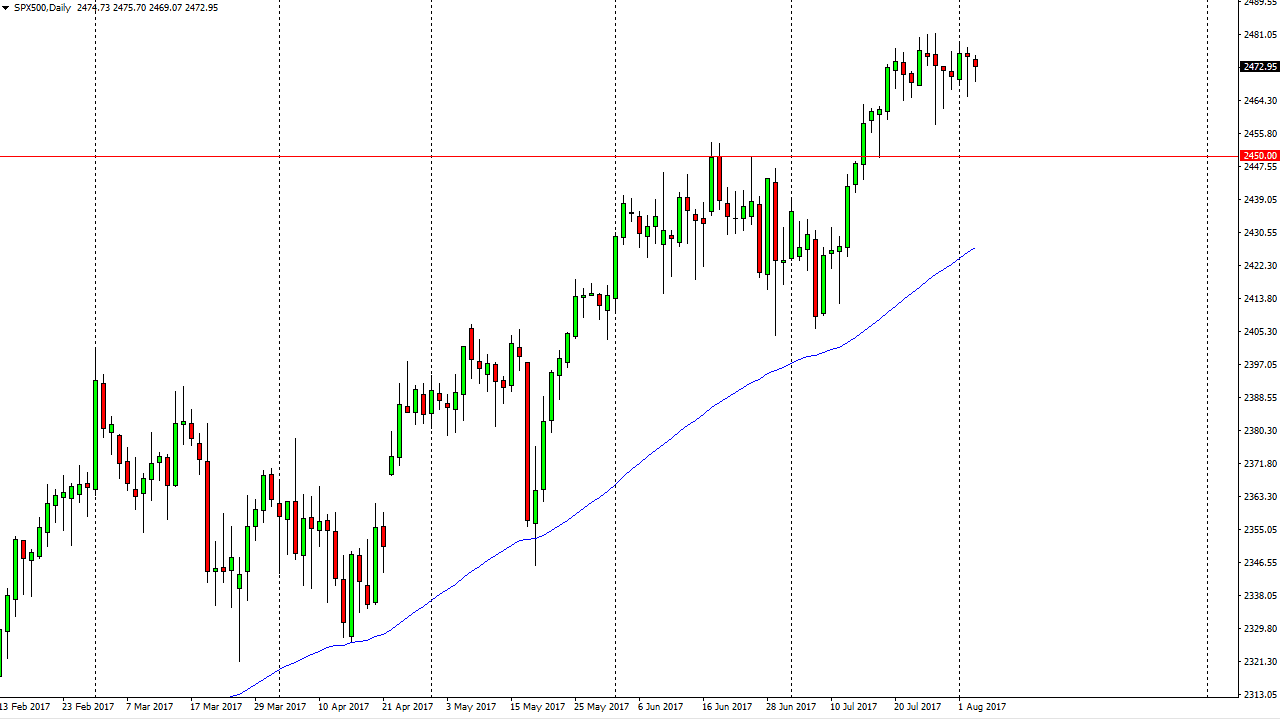

S&P 500

The S&P 500 fell initially during the day on Thursday, but as we have seen all week, the buyers came back to pick up the market. I think that the market continues to go higher, and I think that there is a bit of a “floor” in the market at the 2450 handle. Ultimately, this is a market that remains “buy on the dips”, and with this being the case it’s likely that the jobs number could give us an opportunity to buy at lower levels. That’s what I’m hoping for, and I will be looking to buy the S&P 500 as soon as the market gives away. If we do go higher, I suspect that the 2500 level will be resistive, but a break above there and more importantly, a close above there, would be a very bullish sign. I don’t have any interest in shorting.

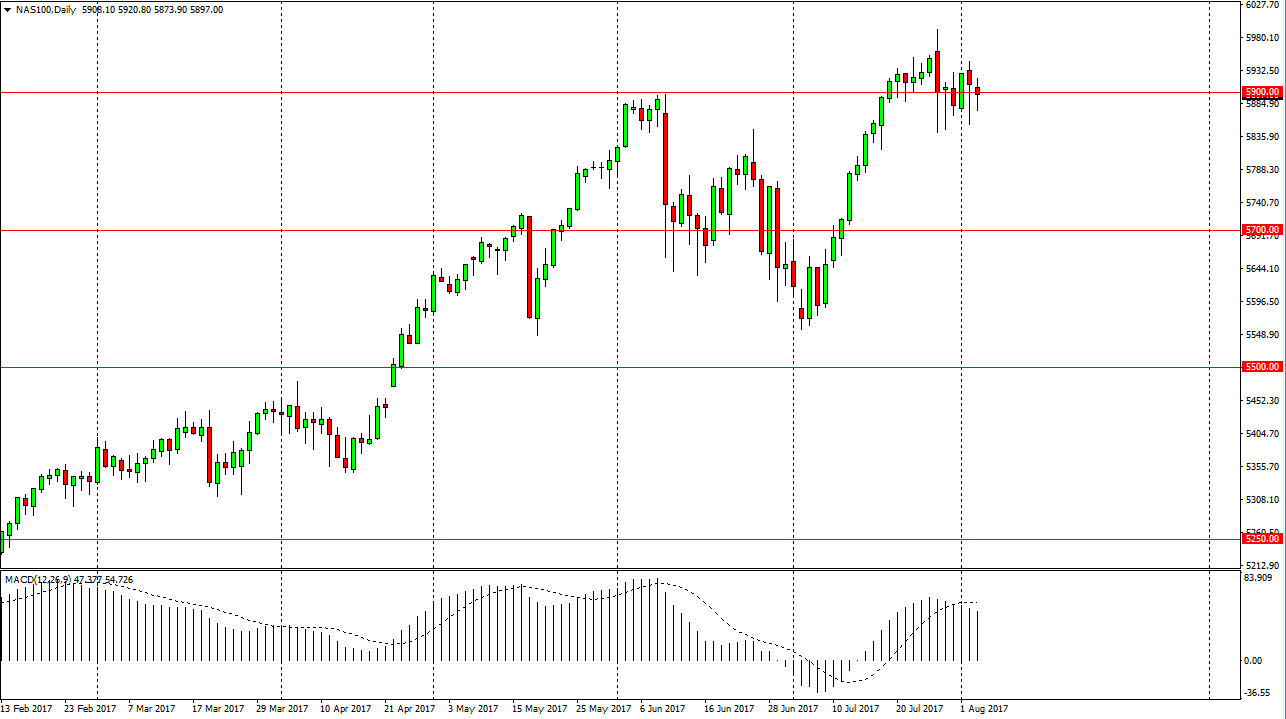

NASDAQ 100

The NASDAQ 100 initially fell during the day on Thursday, but found support underneath the 5900 level yet again. I believe that the market will continue to find buyers underneath, and eventually reach towards the 6000 handle. I think that a pullback from here should find support all the way down to at least the 5750 level, so I am bullish. A jobs number Ms. or something that is a bit disconcerting to the market could offer value, and that’s value that I’m more than willing to take advantage of. I believe that the NASDAQ 100 will reach the 6000 handle above, which given enough time I think gives way. I like this market, and I believe that the buyers will continue to push to the upside as there is more than enough in the way of earnings to continue to rise.