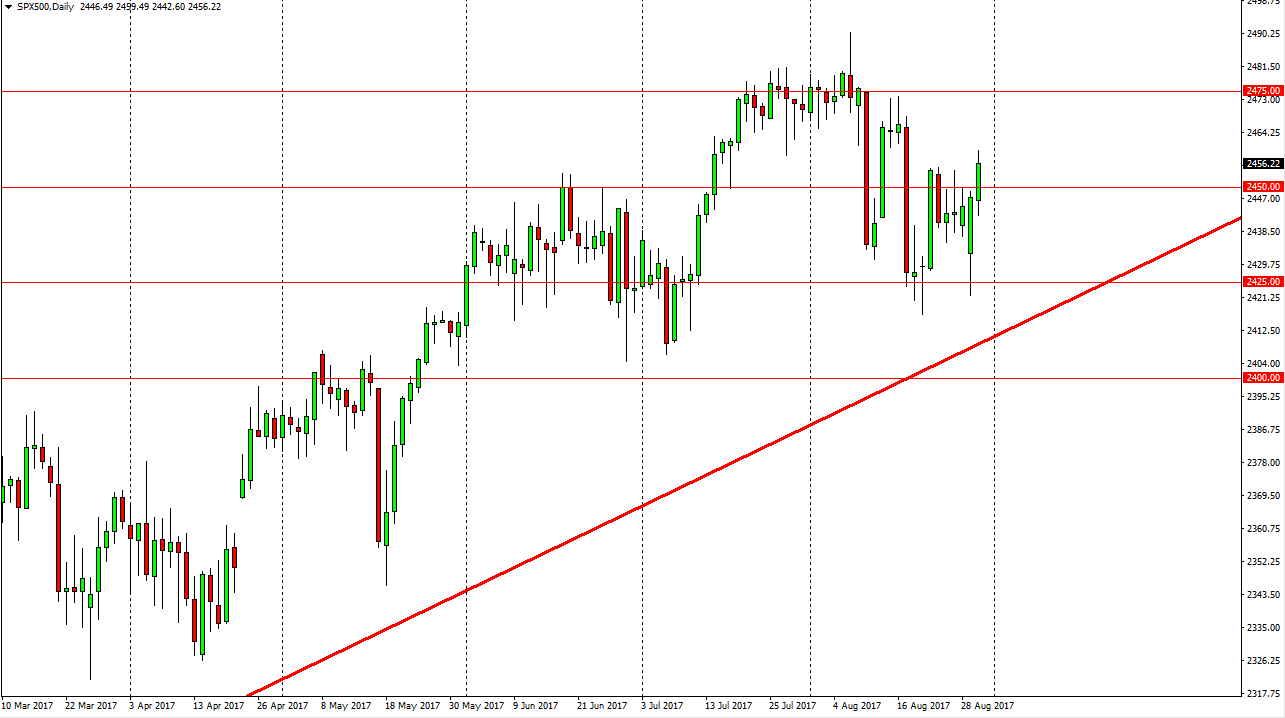

S&P 500

The S&P 500 initially fell during the day on Wednesday, but then shot above the 2450 handle. In fact, we closed at a higher level than we have in the last week or so, so I think we are going to go higher. Eventually, we should go looking towards the 2475 handle. If we do pull back, there should be plenty of support underneath, especially near the 2425 handle. We have the jobs number coming on Friday, so that of course could cause a bit of volatility in the meantime, but I think the buyers are most certainly in charge of this market, after we have seen a complete turnaround more than once. The uptrend lives, and there’s not much that I’m willing to do about it. Buying is about the only thing that this market allows.

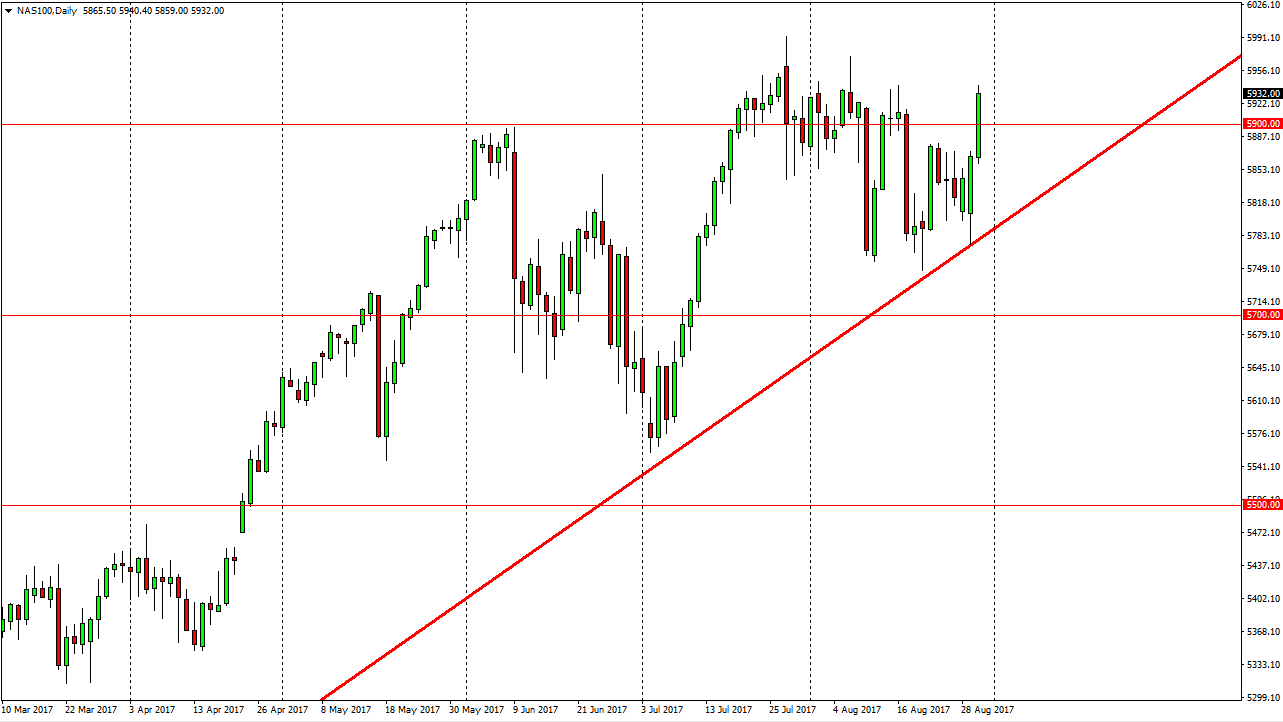

NASDAQ 100

If the S&P 500 looks bullish, the NASDAQ 100 looks like it’s absolutely on fire. We have broken above the 5900 level with a huge green candle for the session, and it now looks as if we are approaching the significant resistance. However, any pullback at this point should be looked at as value, and I’m sure the marketplace will look at it as such. The uptrend line continues to be very supportive, and a pullback should be reason enough to go long. I believe that given enough time we should go to the 6000 level but we will course have the volatility over the next couple of days keeping us from doing that as the jobs number will be important on Friday. Liquidity is a bit thin, but I think it’s only a matter of time before the market rallies on any pullback. The buy on the dips mentality is strong in America.