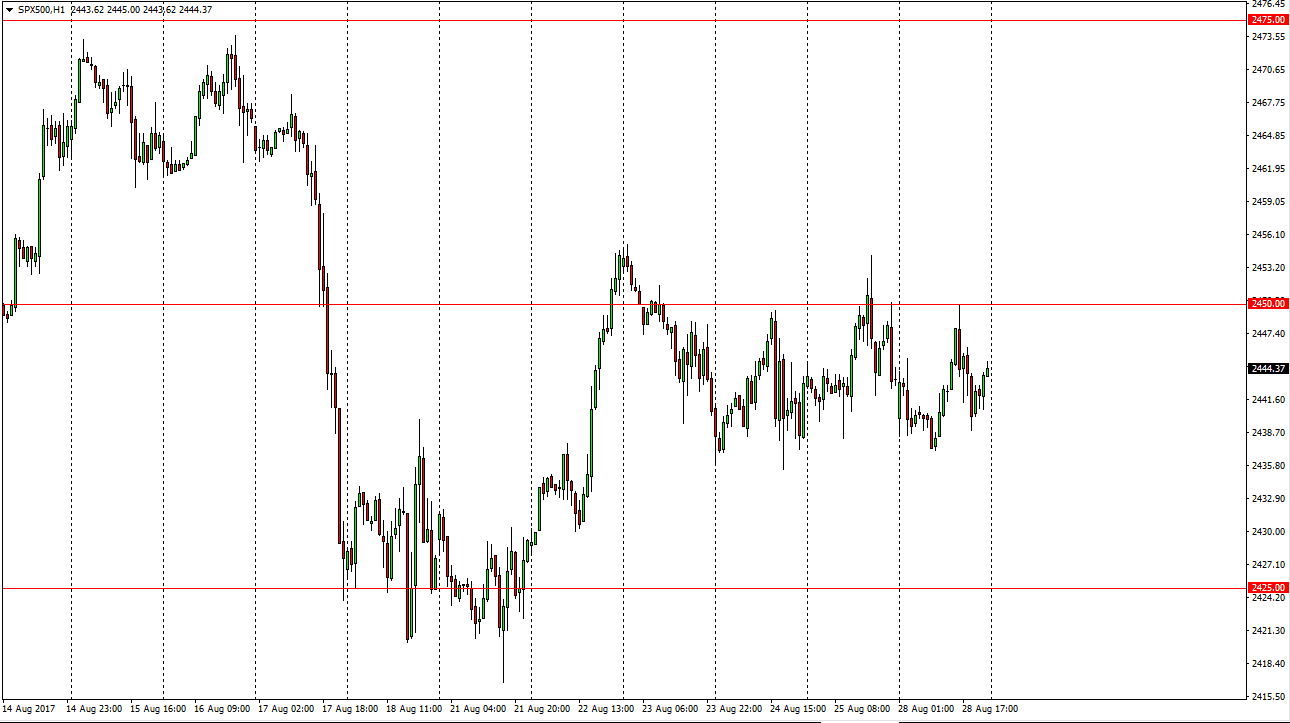

S&P 500

The S&P 500 went back and forth during the session on Monday, as we continue to bounce between the 2435 handle on the bottom, and the 2450 level on the top. I think eventually we will make some type of decision, and if we can break above the 2455 handle, I think the market is free to go much higher. The next obvious target would be the 2475 handle, and then eventually the 2500 level. I think pullbacks offer value that people will be willing to take advantage of, especially near the 2425 handle. Keep in mind that this is one of the least liquid times of year, so big moves are not going to be very likely. This is compounded by the jobs number coming out on Friday, which will more than likely influence where this market goes, or in this case doesn’t go, in the meantime.

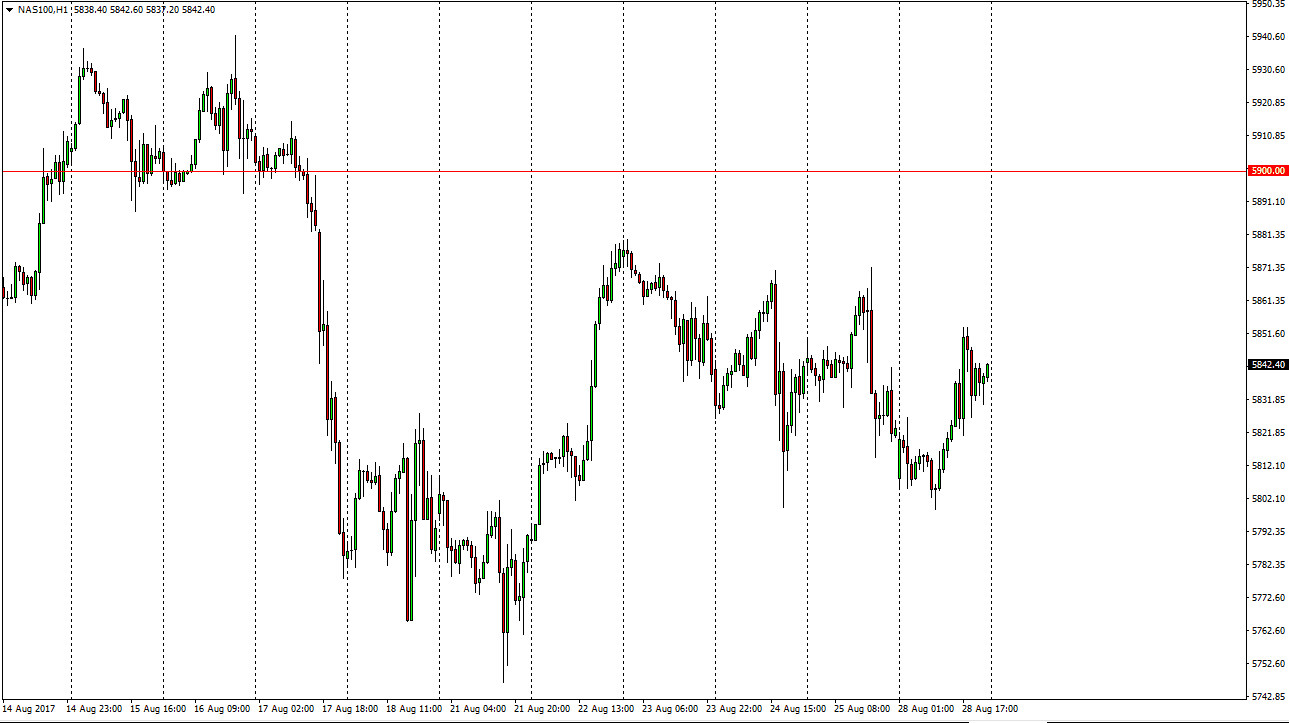

NASDAQ 100

The NASDAQ 100 initially dipped during the day, but then bounced significantly from the 5800 level. This is a very bullish sign, and I think that we will eventually grind towards the 900 level, but as you to take time to get there. The jobs number coming out on Friday of course will have an influence as well, but currently it looks as if the NASDAQ 100 is trying to lead the way going forward. If we can finally break above the 5900 level, then that would be a very bullish sign. In the meantime, it looks like a little bit of a sideways malaise is probably what we’re going to get over the next several sessions. With this being the case, buying on dips might work, but they will be short-term moves at best, especially before Friday.