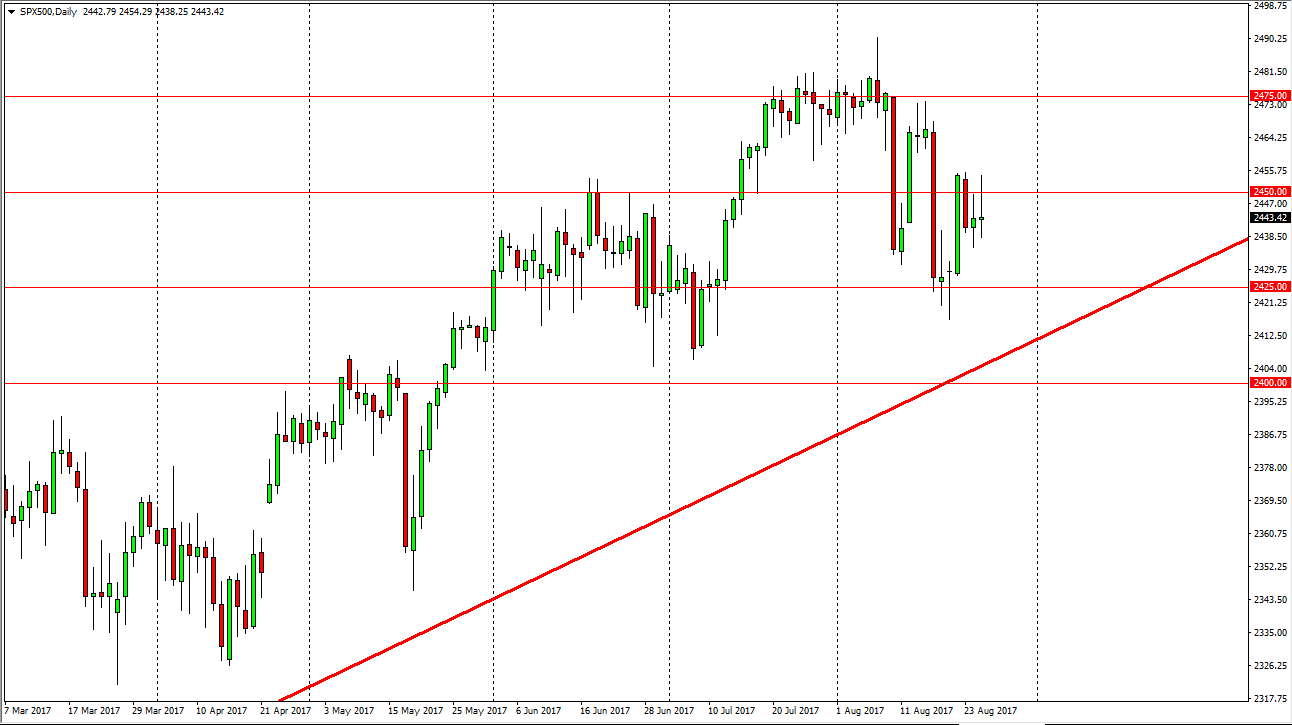

S&P 500

The S&P 500 initially tried to rally but turned around to form a shooting star. The 2450 handle is massively resistive and the shooting star is very likely to signify that we could roll over yet again. I think a breakdown below the bottom of the candle is a move to the 2425 handle just waiting to happen. Ultimately, there is an uptrend still going on, but we may need to continue to pull back and find support going forward. The market is a little over heated currently, so I think that the market could need to look at lower levels for buying pressure. The 2475 level above would be a target, then perhaps the 2500 level. I have no issues in shorting until we get below the 2400 level.

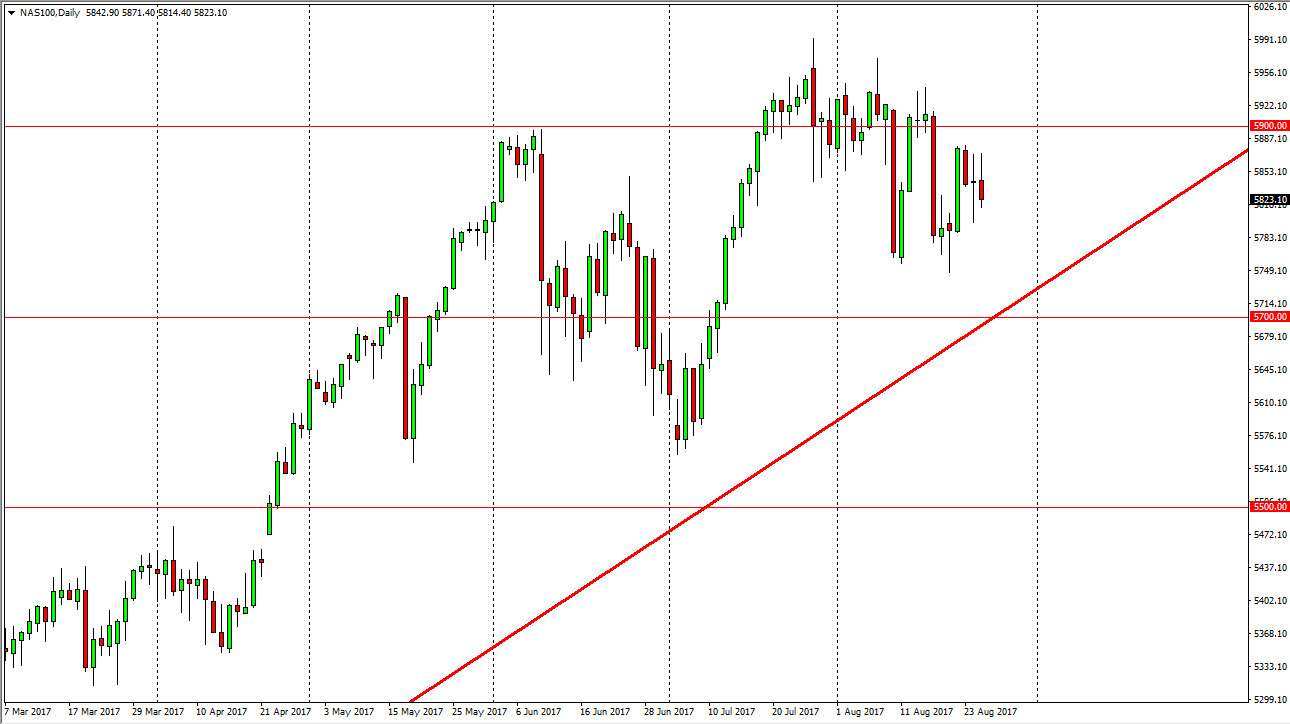

NASDAQ 100

The NASDAQ 100 initially tried to rally during the day but turned around to form a shooting star. The 5750-level underneath will be supportive, just as the uptrend line will as well. If we break down below the 5700 level, the market should continue to go much lower. Ultimately, some type of supportive candle would be a nice buying opportunity as the NASDAQ 100 does tend to lead the rest of the US stock markets. The 5900 level above should be a bit resistive, and I think we may need to cool offer a few sessions. This being the case, I think that looking for value underneath is probably the best way to go. If we can find that support, then I look at the market should go to the 6000 handle. Markets will continue to be volatile, but quite frankly I think given enough time the buyers will return. Either way, keep your position size small to protect your trading capital.