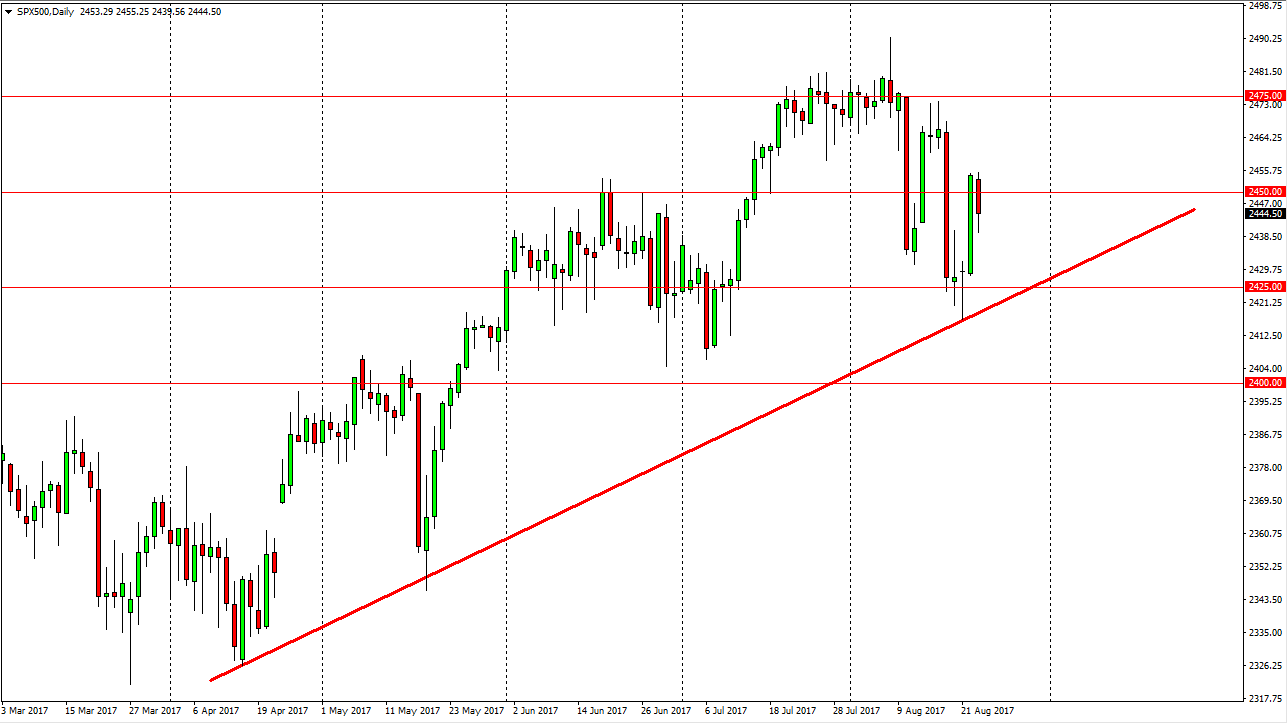

S&P 500

The S&P 500 has fallen a bit during the day on Wednesday, but found enough support towards the end of the day to show signs of life again. There is a massive uptrend line just below, so I think that the buyers will return to the market given enough time. There is a lot of noise out there, but I think eventually the buyers will come looking for value. If we can break above the highs from the session on the day, that would be a very bullish sign and should send this market looking towards the 2475 handle. It is not until we break down below the 2400 level that I think the uptrend is over, although we are certainly seen quite a bit of volatility and perhaps a bit of exhaustion as well. Don’t expect an easy trade, but I still think that the buyers are in control.

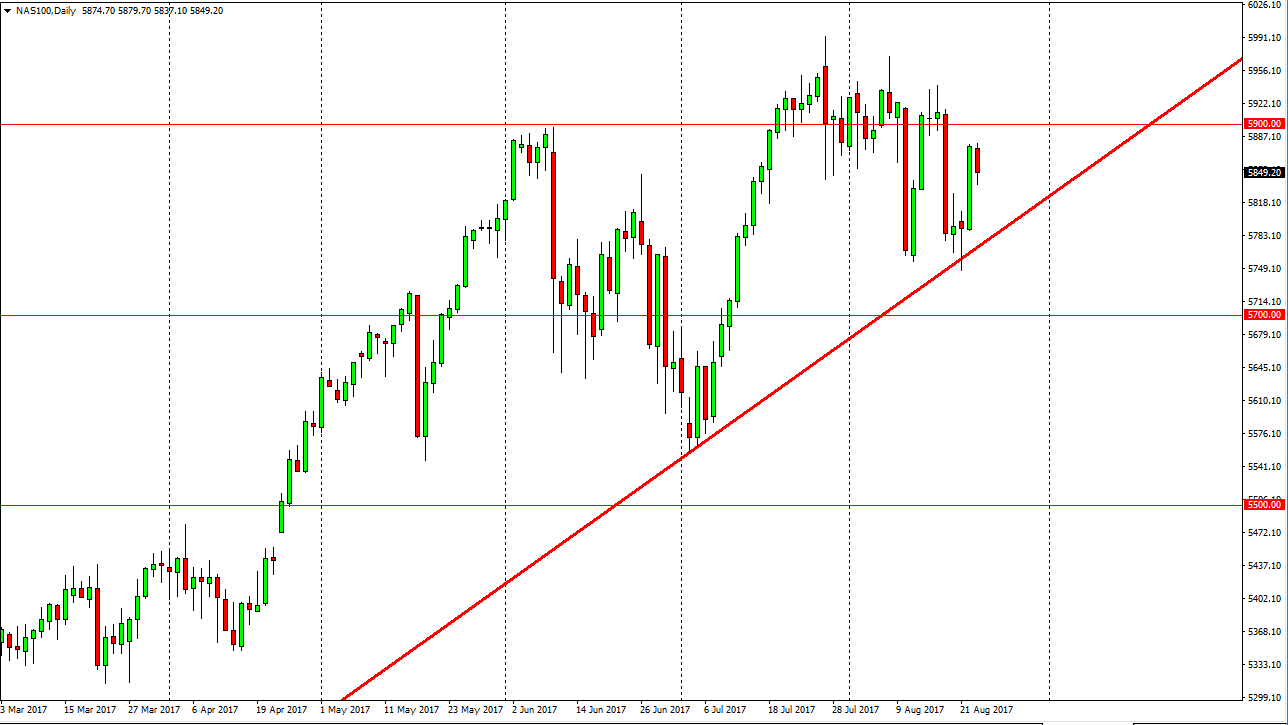

NASDAQ 100

The NASDAQ 100 fell slightly during the day on Wednesday, showing signs of exhaustion. I believe that although we did have a negative session, when you look at the massive green candle from the Tuesday session, it’s obvious that there was quite a bit more influence during that day. If we can break above the 5900 level, the market should continue to go to the 6000 level. The uptrend line underneath is massively supportive, and I think that if we can stay above there, the buyers will continue to return to this market. The NASDAQ 100 has been a leader for the other indices around the United States, and I think that continues to be the case here. If we were to break down below the uptrend line, that would be negative, not only for this index, but other ones as well.