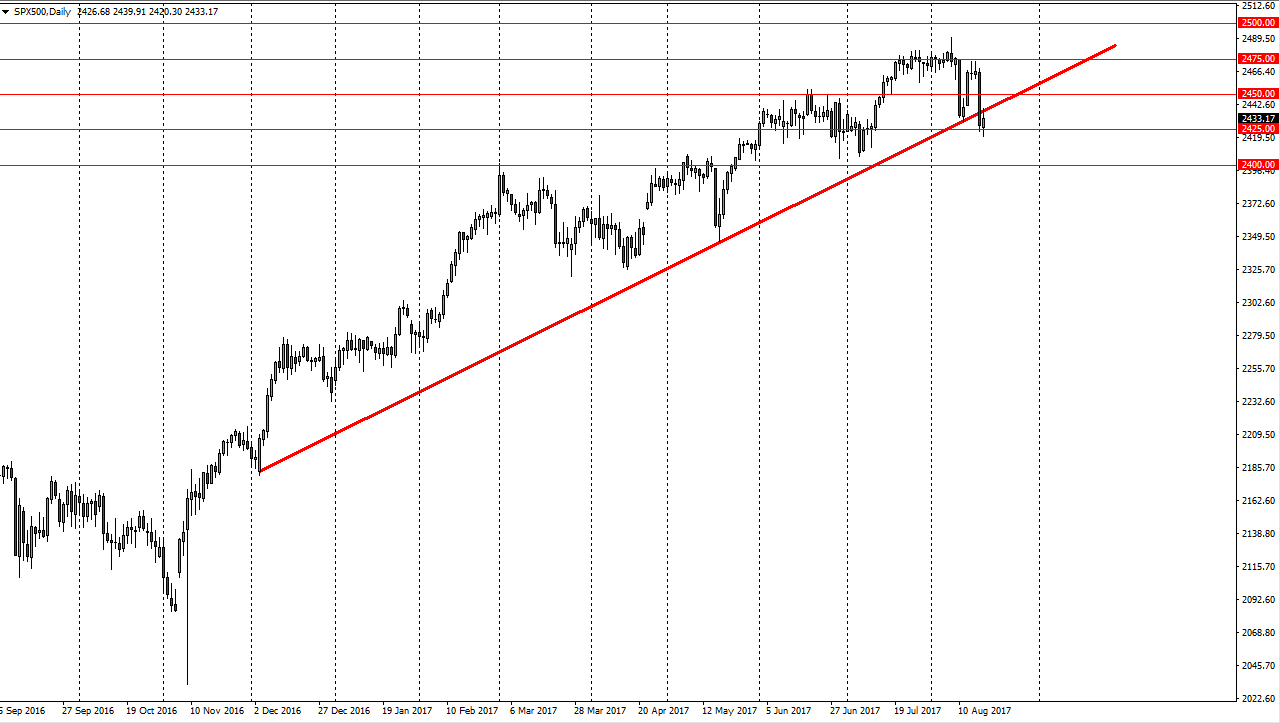

S&P 500

The S&P 500 had a positive session on Friday, using the 2425 level as support. However, we are below the uptrend line that has been so important and it offered a bit of resistance. Because of this, I think the next couple of sessions are going to be vital, and quite frankly I would stay away from this market. If we broke above the 2450 handle, then it’s an obvious bullish sign, just as a breakdown below the 2400 level would be obviously bearish. In the meantime, I expect to see a massive amount of volatility over the next couple of sessions, and that the S&P 500 might be a market to avoid as we have potential for significant moves.

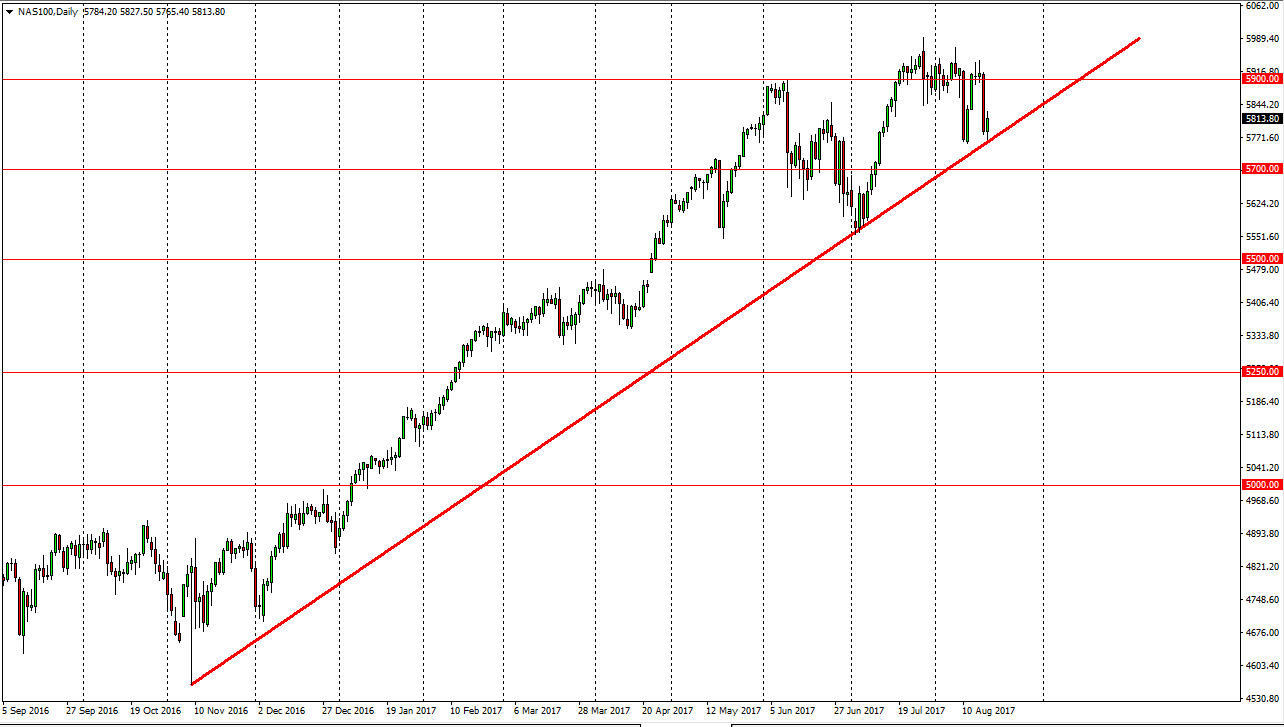

NASDAQ 100

The NASDAQ 100 rallied during the day, bouncing from a trend line that has been in effect from November of last year. If we can rally here, the market will probably go looking towards the 5900 level. If that happens, then the other stock indices will probably rally. In the meantime, expect a lot of volatility but if we go below the 5770 handle, I would be very leery of this market as it will probably begin the selloff of several indices in the United States. I think the one thing you can count on is a lot of noise, but the NASDAQ 100 has lead the way for other indices recently, and that of course should continue to be the way you monitor the markets. Ultimately, the technology stocks have been the biggest boon for the US indices, and should continue to be the way forward. Because of this, it’s likely that the market will be one of the most followed charts over the next several sessions.