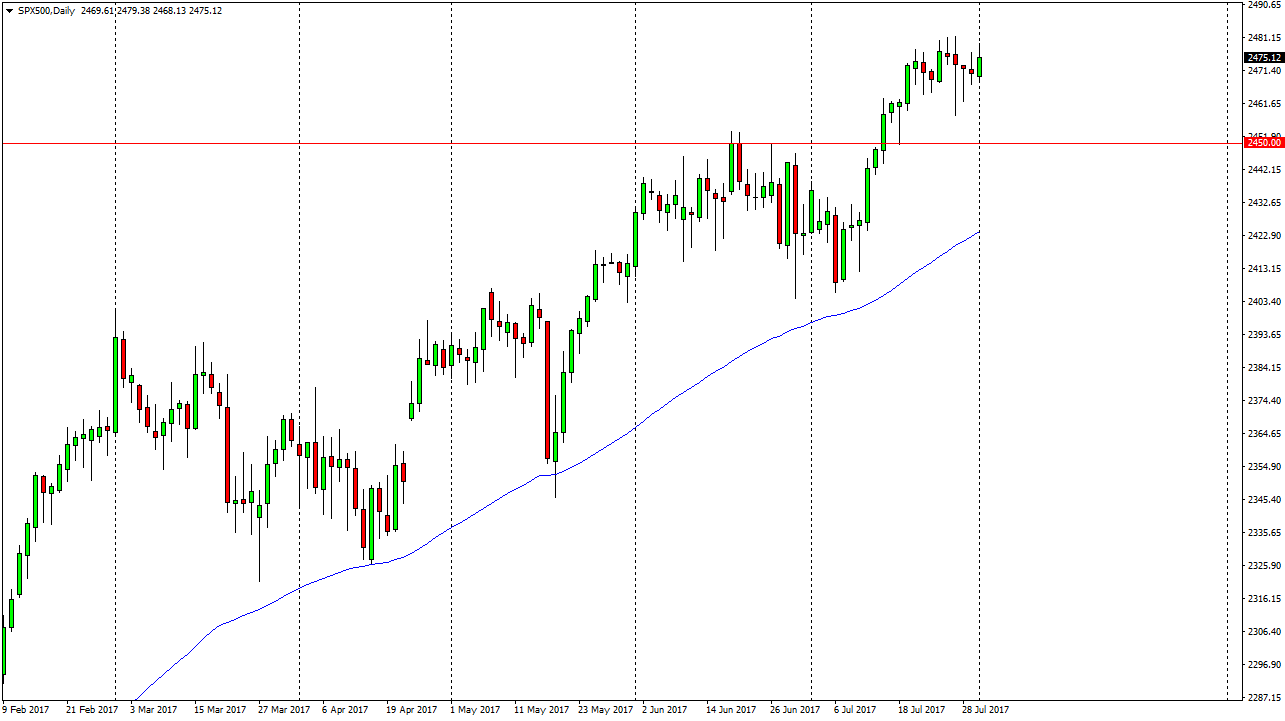

S&P 500

The S&P 500 rallied during the day on Tuesday, touching as high as 2480, but did pull back later in the day. The market looks as if it is supported just below, and I think it’s only a matter of time before the buyers return. I also believe that the 2450 handle underneath continues to be very supportive, so therefore I think it’s only a matter of time before the support takes over. I think that the ADP number coming out during the day today will probably be a main driver, and I believe that the uptrend is still very much intact. The 2500 level above and should continue to be resistive, but also a target that most people are looking for.

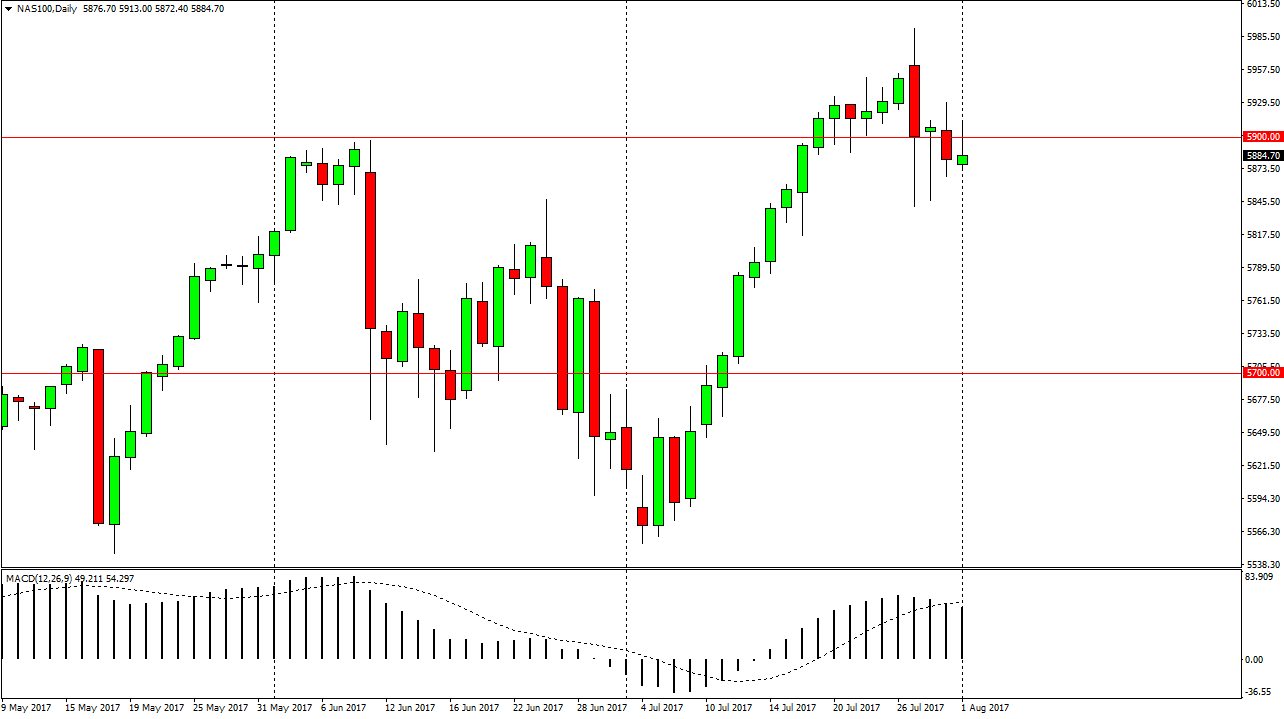

NASDAQ 100

The NASDAQ 100 tried to rally initially during the day on Tuesday, but found the resistance above the 5900 level to be far too strong to continue going higher. The shooting star that we formed suggests that we are going to continue to look for support below, and that we may not have found enough. Ultimately, I think that the market will continue to be very volatile but the jobs number coming out this Friday will take center stage. The ADP number today will be a harbinger of what could be coming, so the better that number, the more likely we are to see the NASDAQ 100 rally. A break above the top of the range for the day would be very bullish, and have the market looking for the 6000 level in the short term. If we do breakout from here, I expect to see a significant amount of support near the 5800-level underneath, and that of course the 5700 level after that. I am still bullish, but I recognize that we are struggling a bit.