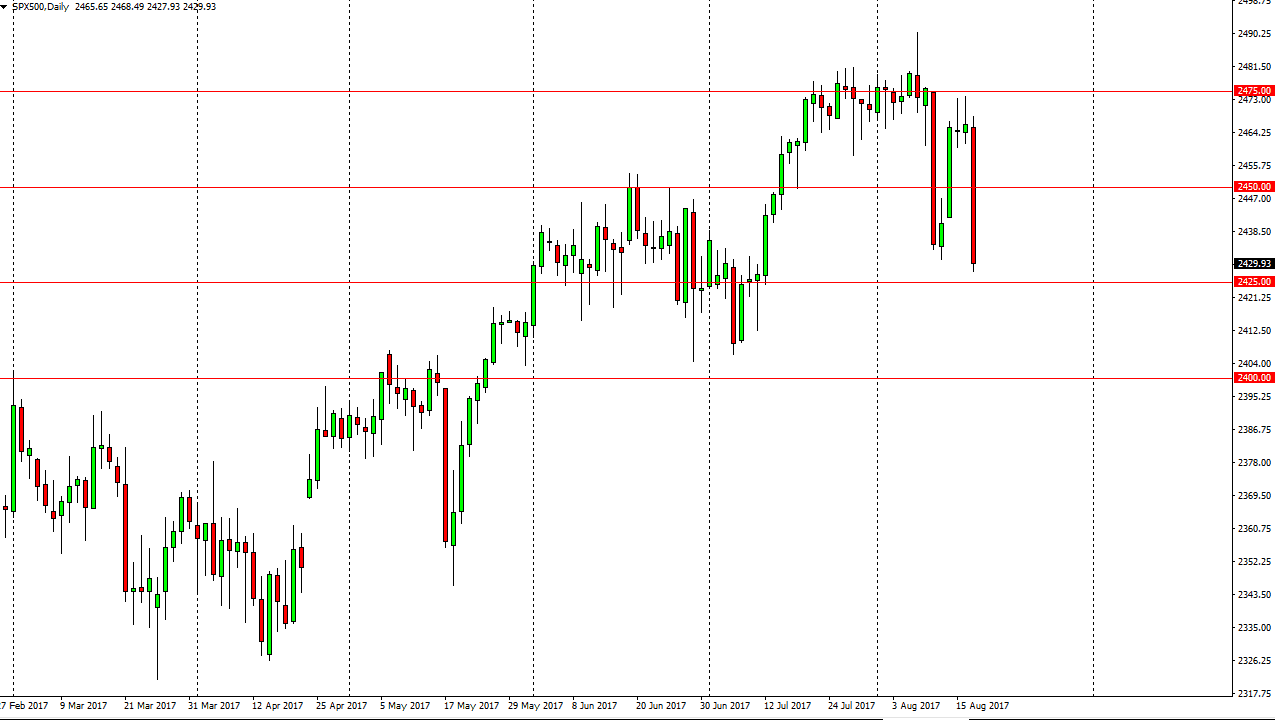

S&P 500

The S&P 500 had a very bad day on Thursday, reaching towards the 2430 handle. The market has support at the 2425 level, and quite frankly if you can weather the storm in that area, we could get a bit of a bounce. Most of the volatility has been political noise, and although this is a very bad looking candle, you can see how quickly we turned around the last time this happened. Because of this, it comes down to whether the market is ready to give up. I don’t think it is because the earnings have been decent. With this being the case, I think it’s only a matter of time before the buyers return but obviously you need to see some stability before putting money to work. I’d probably wait until the end of the day to see if we get a supportive or an impulsive candle to the upside before putting your trade on.

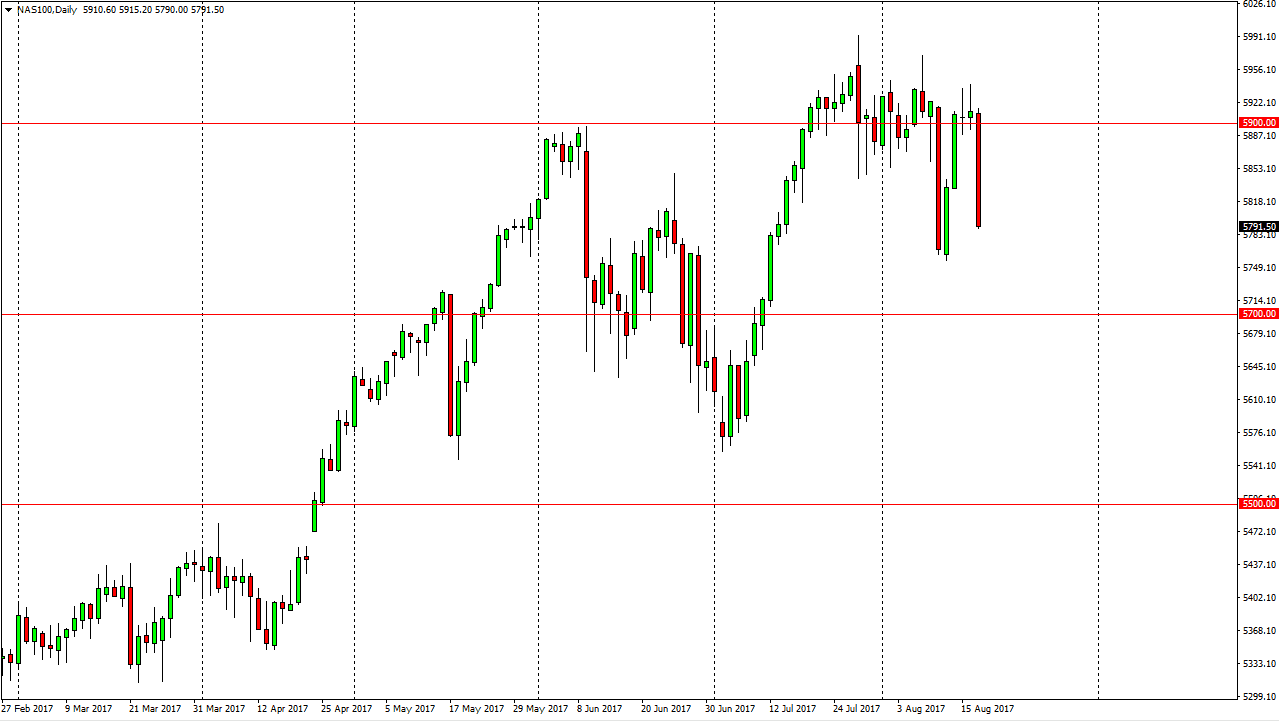

NASDAQ 100

The NASDAQ 100 broke down significantly during the day on Thursday, reaching down to the 5791 handle. This is a market that has a significant amount of support below, but I think you may wish to stand on the sidelines to let the market prove itself. After an impulsive candle like this, quite often you will see a bit of grinding and therefore accumulation. I don’t know that the markets ready to fall apart, a lot of this was conjecture on the Presidents Business Counsel, which at the end of the day is a sentiment thing, not necessarily in earnings thing. It’s only a matter of time before the buyers get involved, I have no doubts about that. The 5700 level should be supported underneath, so pay special attention to that area for perceived value to appear.