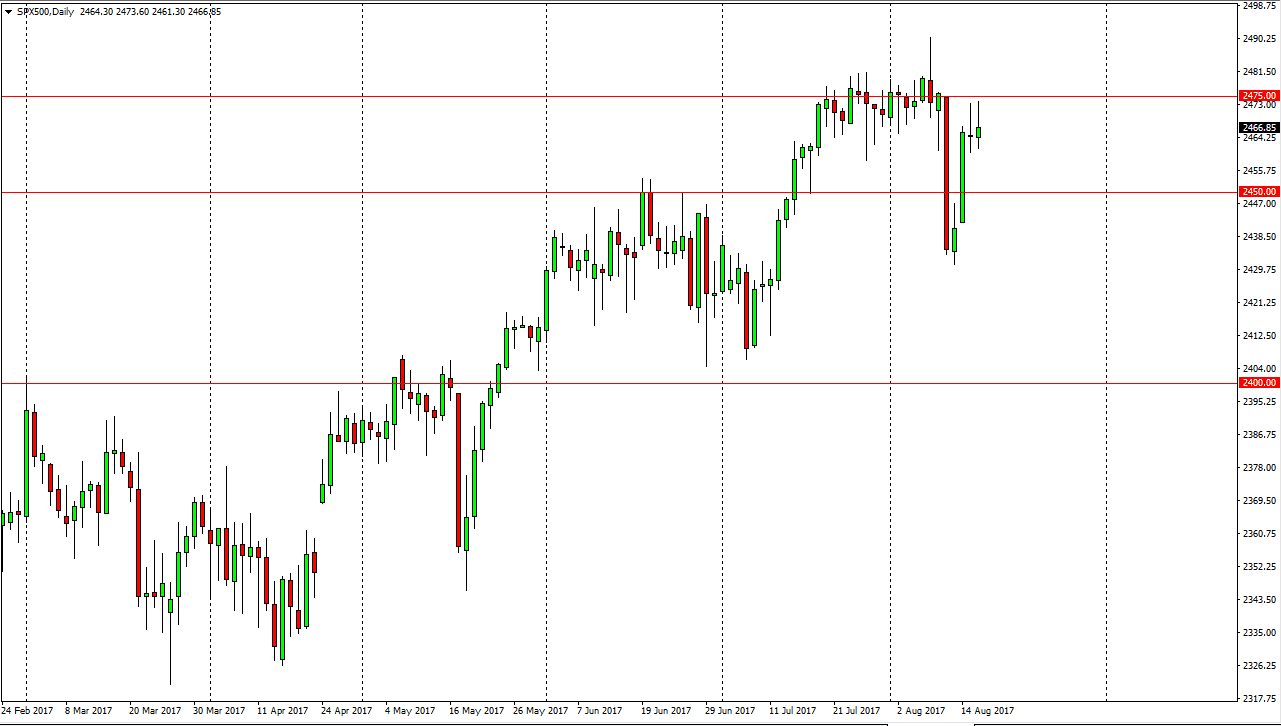

S&P 500

The S&P 500 initially shot towards the 2475 handle, but after the dissolution of the Presidents Business Counsel, the market sold off a bit. Also, the FOMC Meeting Minutes were a bit more dovish than anticipated, so that was bullish for the market. I think we continue to see a significant amount of volatility, but if we can break above the 2475 handle, the market should continue to go higher. Alternately, if we break down below the bottom of the candle from both the Wednesday and Tuesday sessions, we could find ourselves reaching towards the 2450 level underneath. Either way, I expect a lot of volatility, and the market is starting to look a little bit exhausted, so it may be more of a stock pickers type of market.

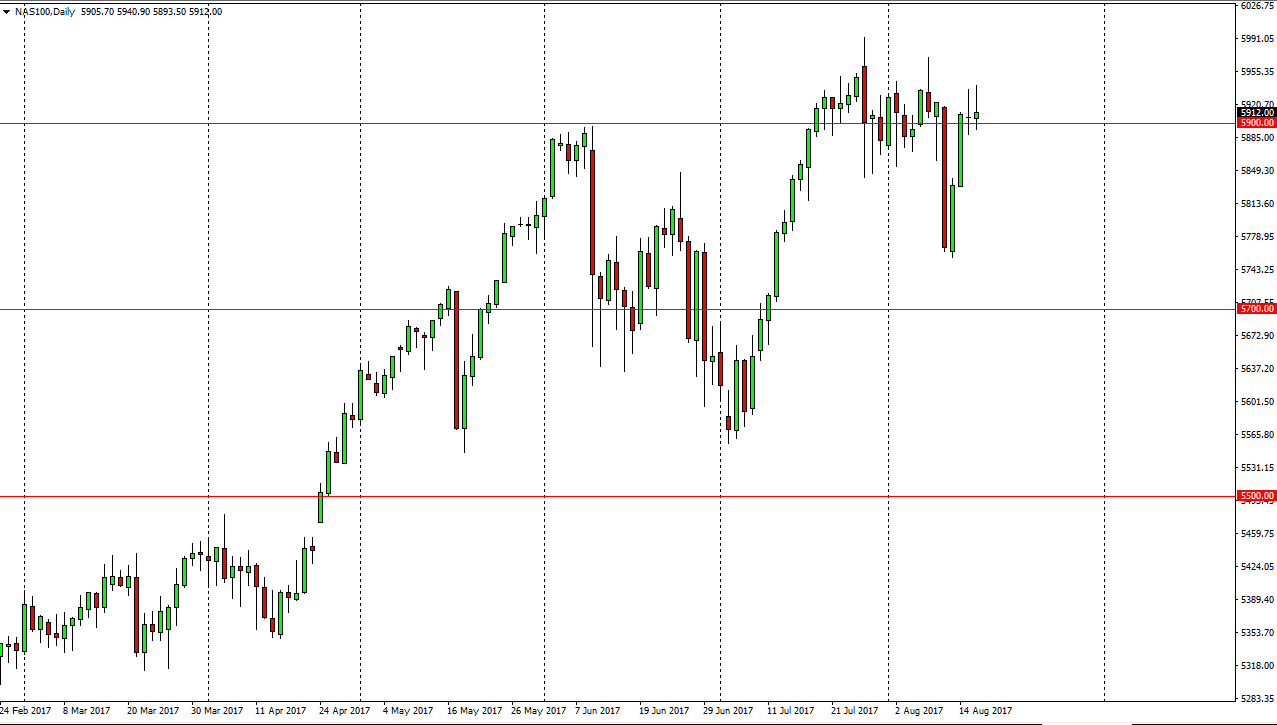

NASDAQ 100

The NASDAQ 100 has formed a shooting star of sorts, and it seems like it is currently stock around the 5900 level. A break above the top of the shooting star for the day on both Wednesday and Tuesday sends the market looking towards the 5990 level. The 6000 level above is a massive barrier, and if we break above there, the market should continue to go much higher. Alternately, if we break down below the bottom of the 2 candles, then we could drop towards the 5775 handle. However, right now it looks as if the market is content to sit around. Because of this, I think the given enough time we may have the buyers return but this will be due to the dovish tone of the FOMC more than anything else. The earnings have been decent, but quite frankly we are bit ahead of ourselves. Nonetheless, if we break out to the upside you must follow.