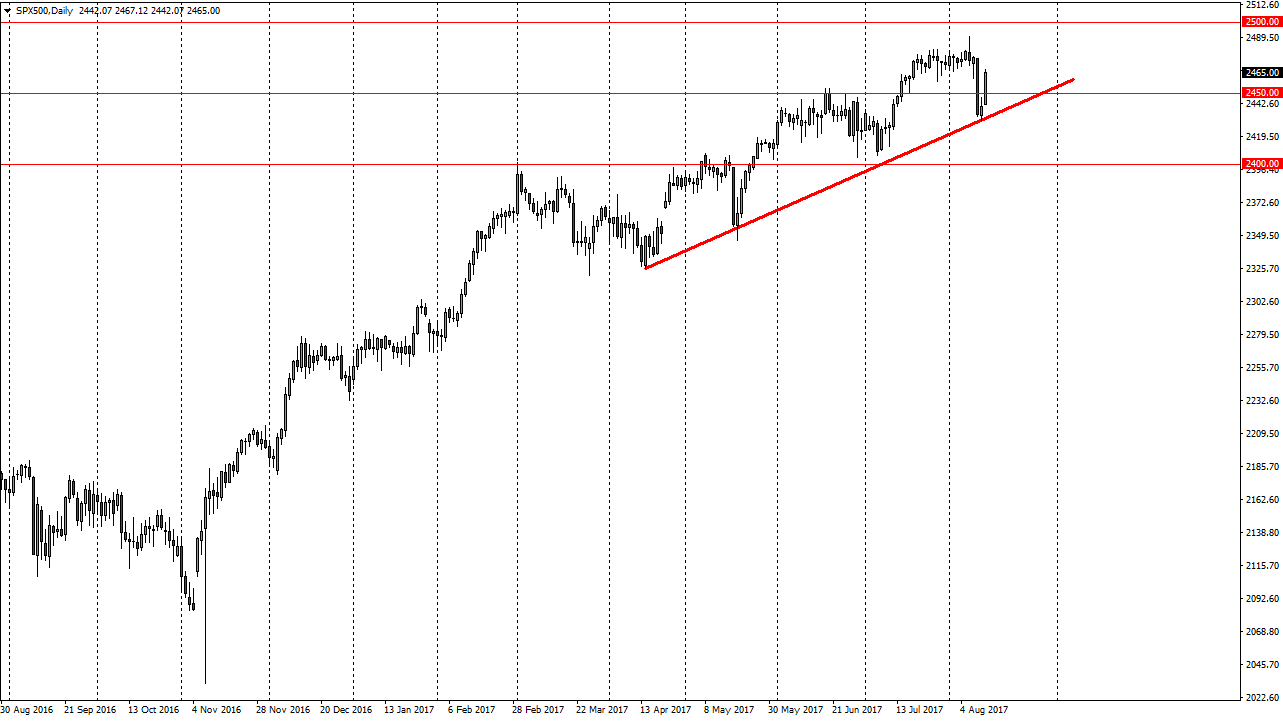

S&P 500

The S&P 500 exploded to the upside on Monday, breaking above the 2450 handle. Ultimately, this is a market that is still very much in an uptrend, and I think there’s no reason to think anything has changed. The pullback came in one session, and it was essentially about North Korea. This pullback is necessary, as we have seen far too much in the way of complacency. Now that we have had this massive move lower and an almost complete repudiation, I believe that the market is ready to start moving towards the 2500 level again. While we may get a short-term pullback, I believe that the uptrend line should still hold true, as it has for quite some time. I am a buyer of dips, just as we had seen during the Monday session.

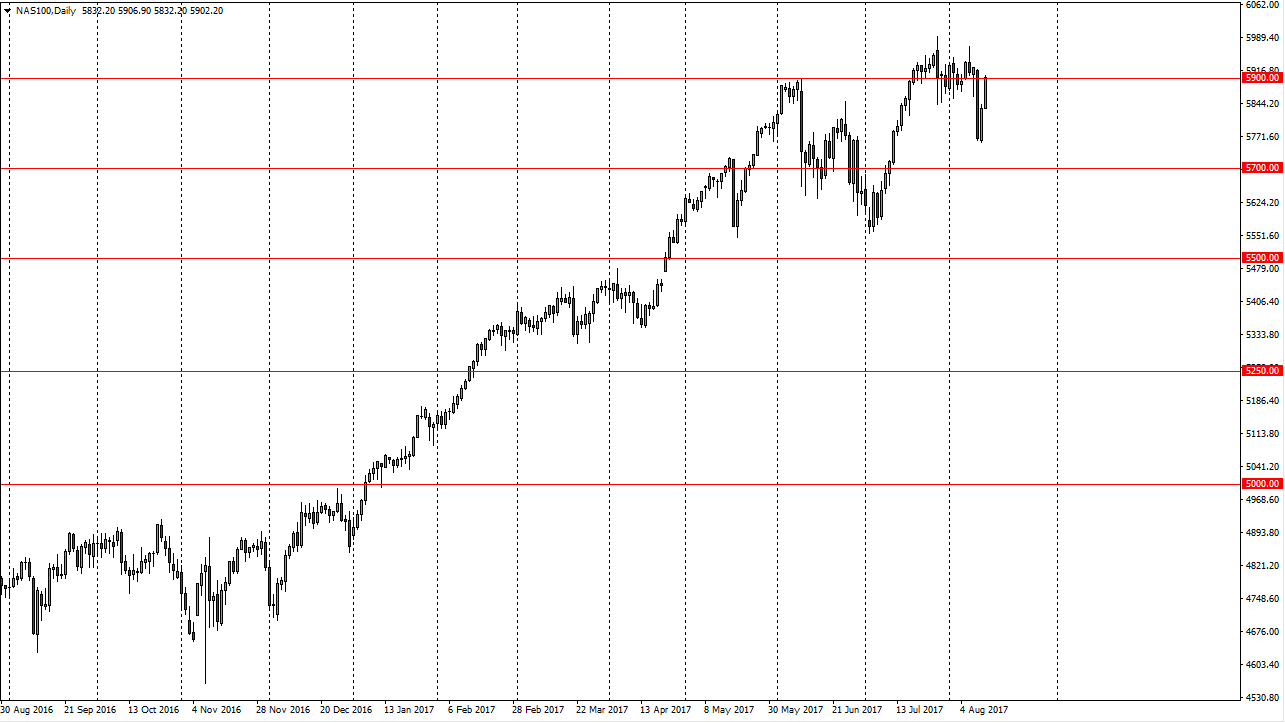

NASDAQ 100

The NASDAQ 100 also bounced during the day, continuing the move that started on Friday. The market closed in on the 5900 level, and I think it is going to make a fresh, new high. Once it does, I suspect that we will be heading towards the 6000-handle next. That has been my longer-term target, and obviously we have not made it yet. However, I think that we will and it’s only a matter of time before the market participants try to test that level. I believe in buying dips, and I also believe that the NASDAQ 100 could be a bit of a leader for the rest of the US indices, as it had been in the past. Technology continues to drive a lot of the gains in the stock markets, with companies such as Facebook, Google, Amazon, and the like powering the NASDAQ 100 much higher. I have no interest in shorting.