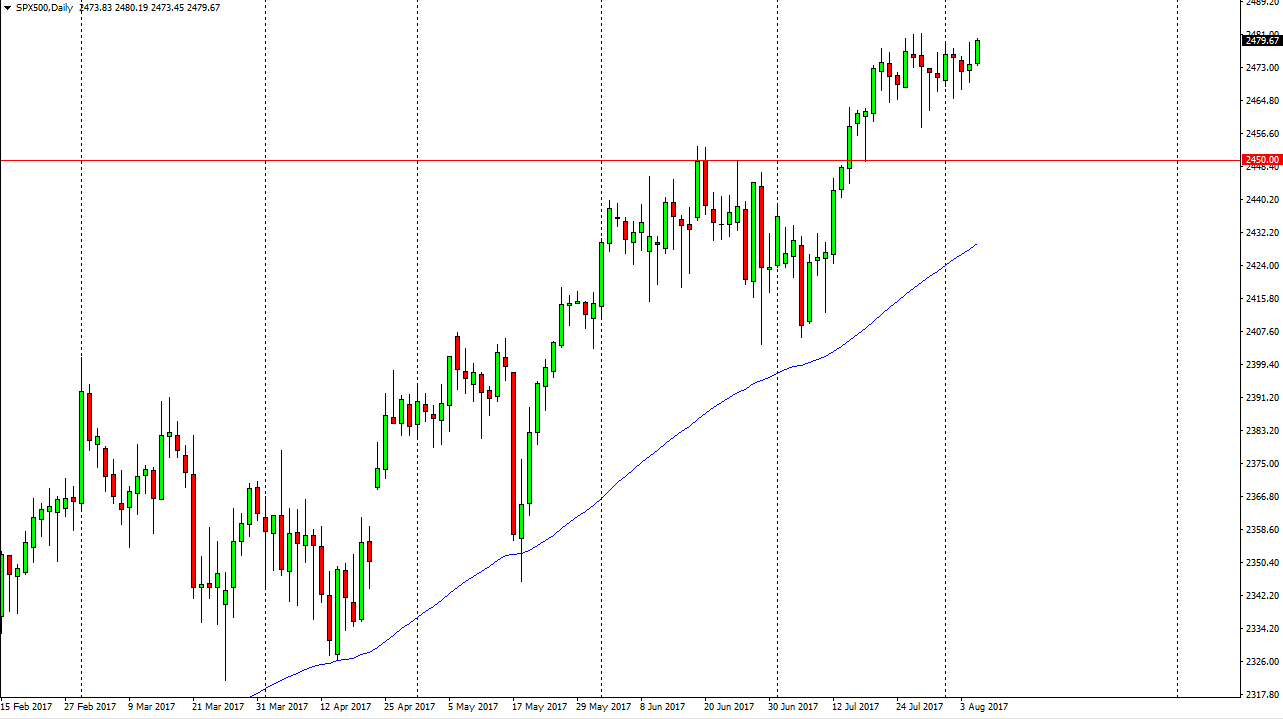

S&P 500

The S&P 500 rallied during the day on Monday, breaking above the top of the shooting star like candle from Friday. This is a very bullish sign, but I recognize that there is still a lot of noise above, and extending to the 2500 level at the very least. I believe the pullbacks are buying opportunities, and that there is a significant amount of support near the 2465 handle. There’s even more support below at the 2450 handle, and I believe that the uptrend is essentially enjoying a “floor” at the 2400 level. I have no interest in shorting this market and believe that eventually we will manage to build up the momentum necessary to break above the 2500 handle. Once we do, becomes more of a “buy-and-hold” market.

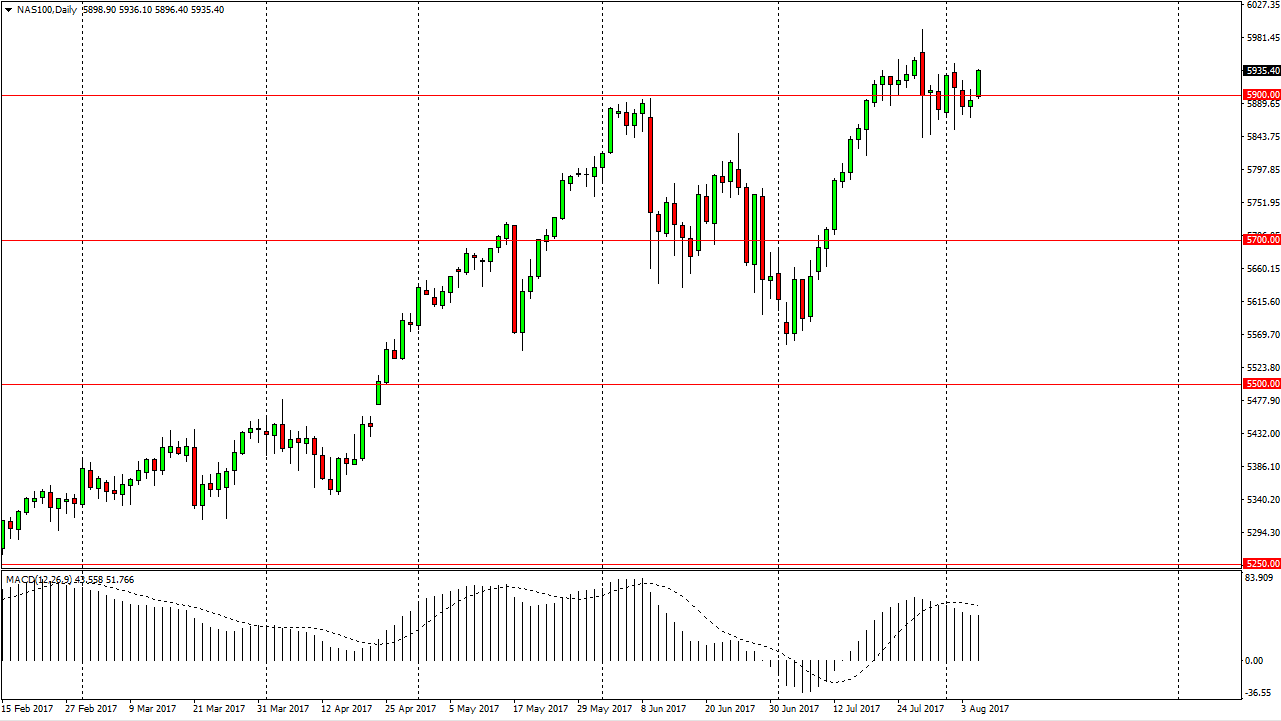

NASDAQ 100

The NASDAQ 100 rallied as well, and more importantly, closed near the highs of the day. This is a market that has been leading the rest of the indices higher in the United States, and it looks set on reaching towards the 6000 handle again. If we can get there, I think that eventually we will break above that level, and continue much higher. Technology companies continue to lead the way, specifically the largest ones, but it seems as if that is the catalyst for indices traders out there to continue to buy in the United States. I believe there is a significant amount of support at the 5850 handle, so as long as we can stay above there, I am a buyer. We could get a bit of a pullback today, but I look at any fall from here the states above the 5850 level as a buying opportunity as it should offer a significant amount of value in what has been one of the strongest markets.