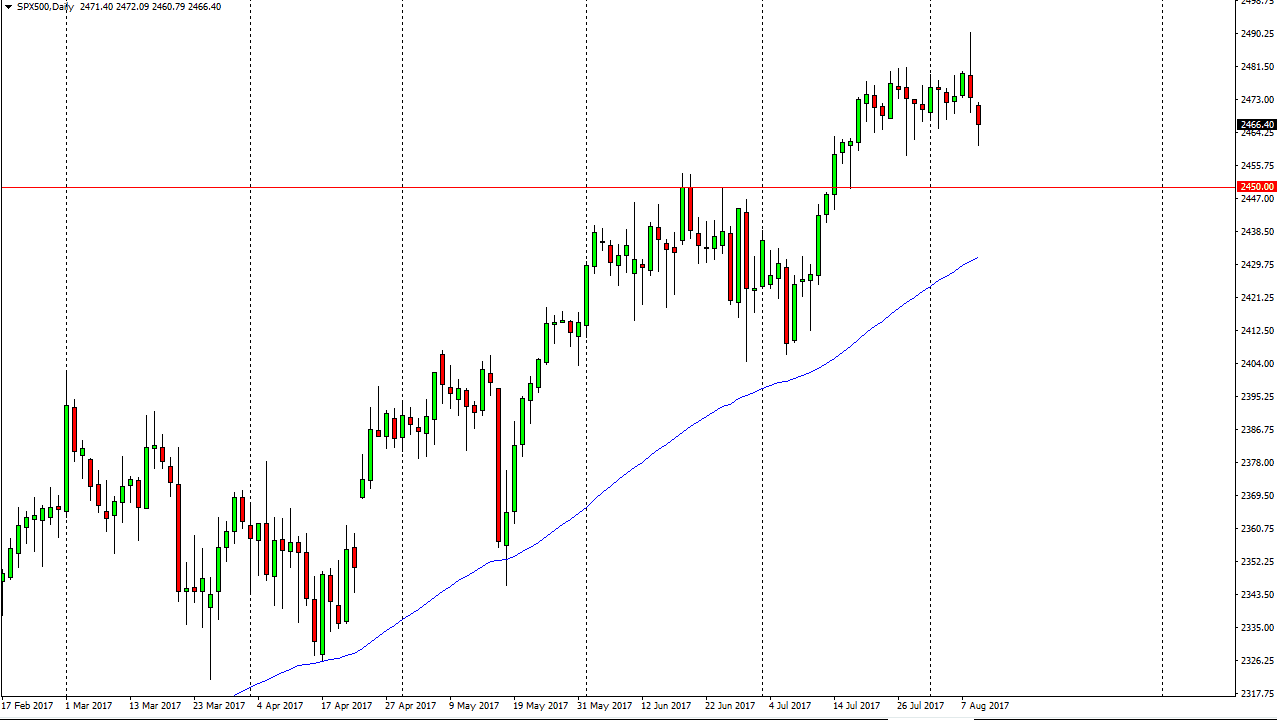

S&P 500

The S&P 500 gapped lower at the open on Wednesday, but found enough support underneath to turn around and form a hammer. This is important, because it completely contradicts the previous shooting star. I think that the market is showing resiliency, but quite frankly I think a lot of it comes down to algorithmic trading bots picking up the pieces of the market. I think that the 2450 level below will be massively supportive, and it appears that most of these high-frequency traders are jumping back into the market at 2460. Because of this, I am a “buy on the dips” type of traitor but I am not expecting anything other than a quick scalp or 2 along the way. Longer-term trades are probably going to need some type of catalyst to occur, and quite frankly we just don’t have that right now.

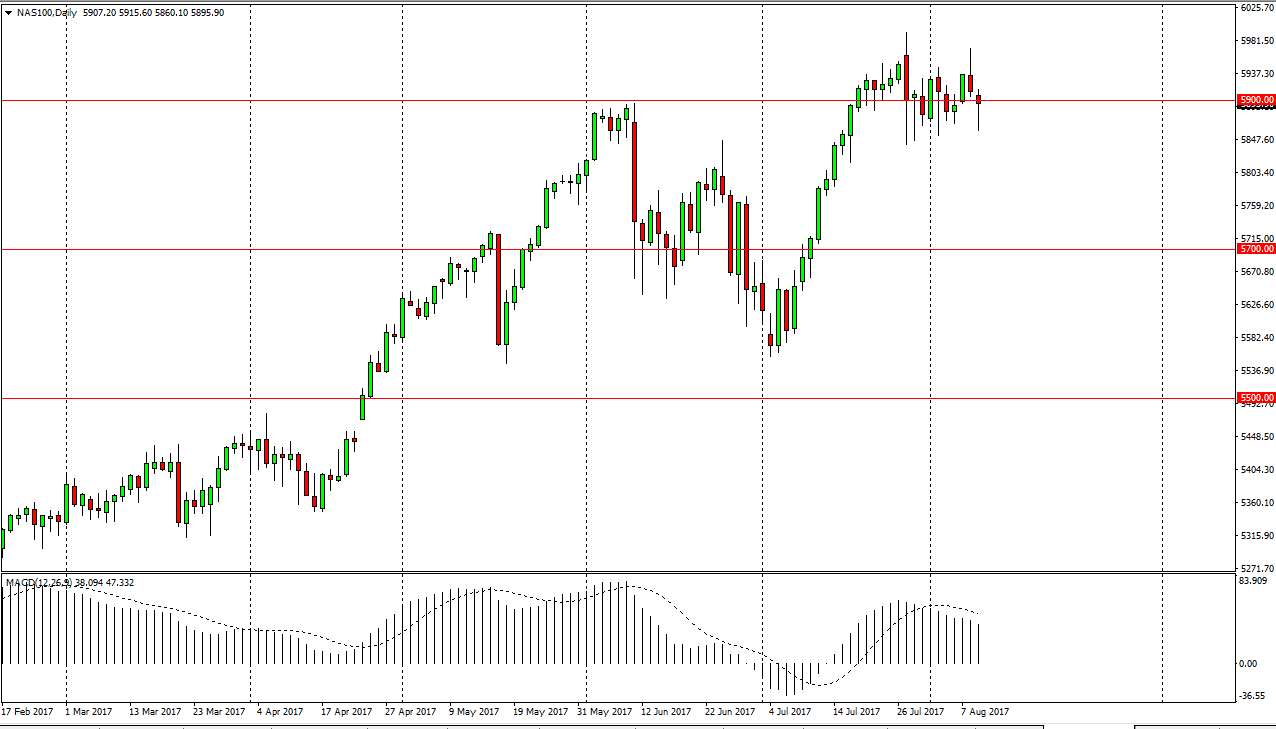

NASDAQ 100

The NASDAQ 100 also fell, reaching down towards the 5850 handle. We found enough support to turn around and form a nice-looking hammer, which of course is situated right along the bottle 5900 level. I think that longer-term will probably go looking for the 6000 level, but it’s probably best to buy pullbacks more than anything else and trying to collect profit rather quickly. I think this is a high-frequency trader type of market, and as a result you have to think like that. You’re not looking for major gains, you’re looking to pick up the market when it drifts a little bit too far below. A break above the 6000 level is more of a “buy-and-hold” situation, but I don’t think we’re going to see that happen in the short term. Expect quite a bit of noise, and keep your positions short-term, in order to protect your trading account.