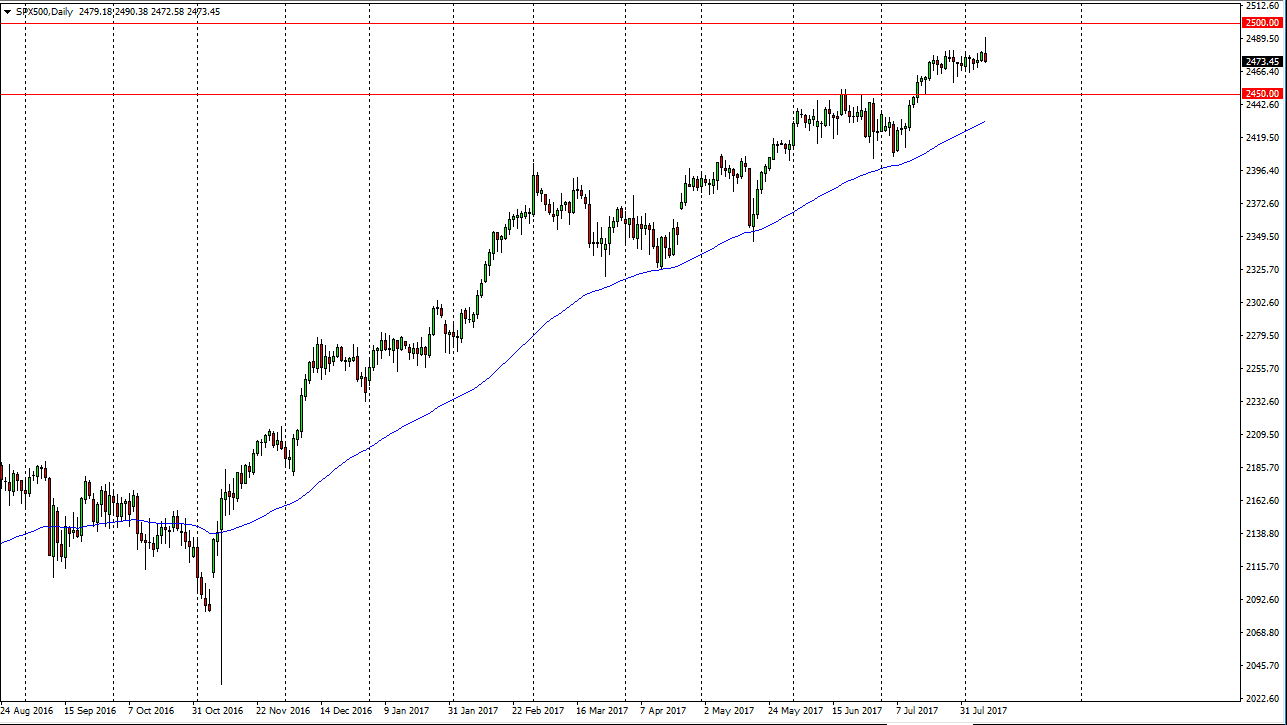

S&P 500

The S&P 500 initially tried to rally but turned around to form a massive shooting star. Even with the largest JOLTS announcement to ever come out of the United States, we could not hang on to the gains. While I am not looking for some type of melt down, I believe that the S&P 500 is getting very exhausted, and at this point needs to pull back. I would look for support near the 2450 handle, and then below there at the 2400 level. I think that eventually we will break above the 2500 handle above, but quite frankly we don’t have the momentum or energy to do so. With this, I am fairly ambivalent when it comes to the S&P 500 and will be looking for short-term displacement a price to trade against anything beyond standard deviation.

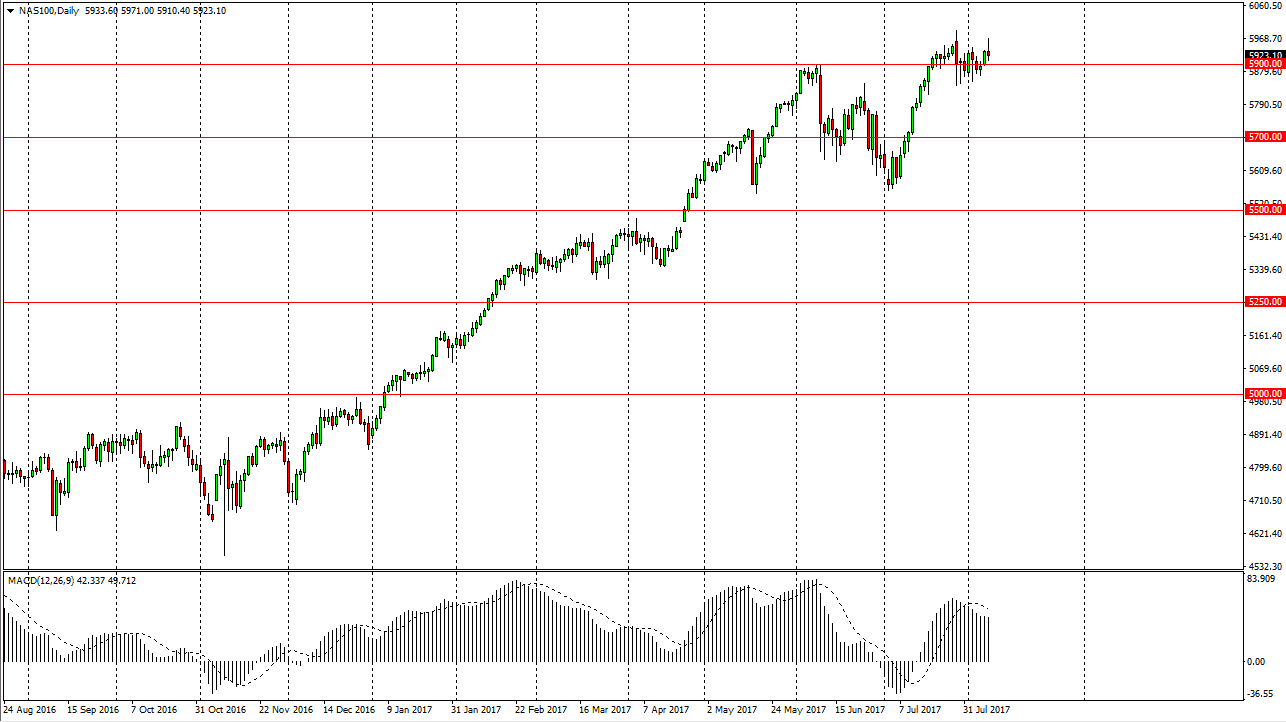

NASDAQ 100

The NASDAQ 100 tried to rally during the day but gave back the gains to form a shooting star. The MACD is starting to show a little bit of weakness, and I believe that we need to pull back. I think this is true with stock markets in general, and a correction seems to be on the way. That does not mean that I’m willing to short this market, it means I am on the sidelines waiting for value. I would look at the daily chart for signs of life, and then take advantage of them. I think that eventually we will go looking for the 6000 handle, but it’s not going to be today. The turnaround laid during the trading session on Tuesday was a very negative sign after we had initially rallied so hard when the Americans got on board. I think we will have volatility, but you would not be blamed for sitting on the sidelines.