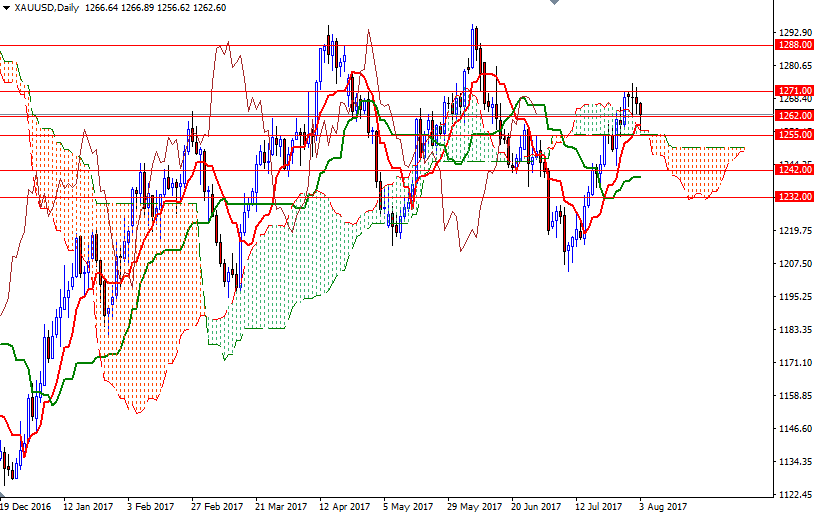

Gold prices fell $2.33 an ounce on Wednesday, moving away from a six-week high struck the previous day. On the economic data front, the ADP reported the private sector added 178000 jobs in July, slightly below expectations of 187000. The greenback weakened significantly since July and it appears that some investors have begun buying back the currency ahead of Friday's non-farm payrolls report. XAU/USD is currently trading at $1262.07, lower than the opening price of $1266.64.

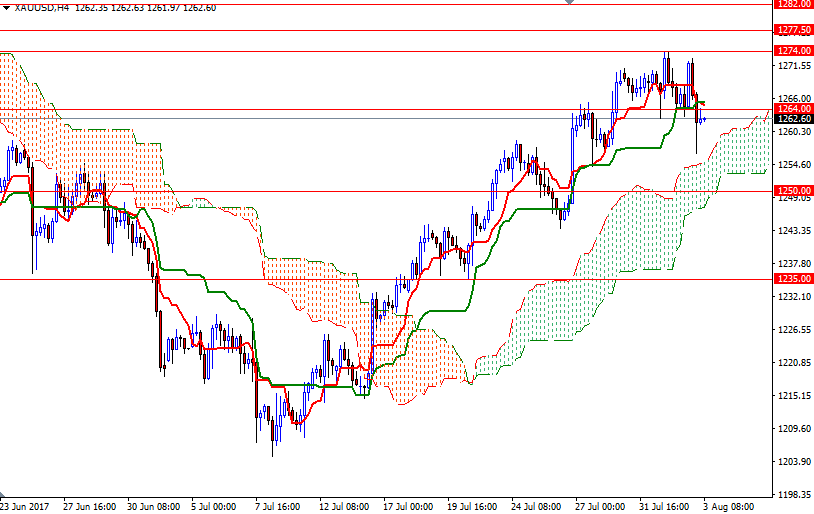

Short-term charts are slightly bearish at the moment, with the market trading below the Ichimoku clouds on the H1 and the M30 time frames. In addition to that, we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) on the 4-hourly chart. Keep an eye on the 1264/2 area. A break down below there could weigh on the market and pull prices back to the 1257.50-1255 zone, where the daily and the 4-hourly clouds overlap. If XAU/USD falls through the cloud on the 4-hour chart, then the 1250 level may be the next stop.

If the bulls take the reins and push prices above 1264, it is likely that we will visit the 1268.24-1267 area occupied by the hourly cloud. Above there, the 1274/1 zone stands out as a key resistance, and the bulls have to overcome this barrier to set sail for 1277.50.