By: DailyForex

Gold prices were higher U.S. trading Monday as stocks deepened their losses. Last week, the Dow Jones Industrial Average had posted its biggest decline in three months. The U.S. dollar index is lower in afternoon trading.

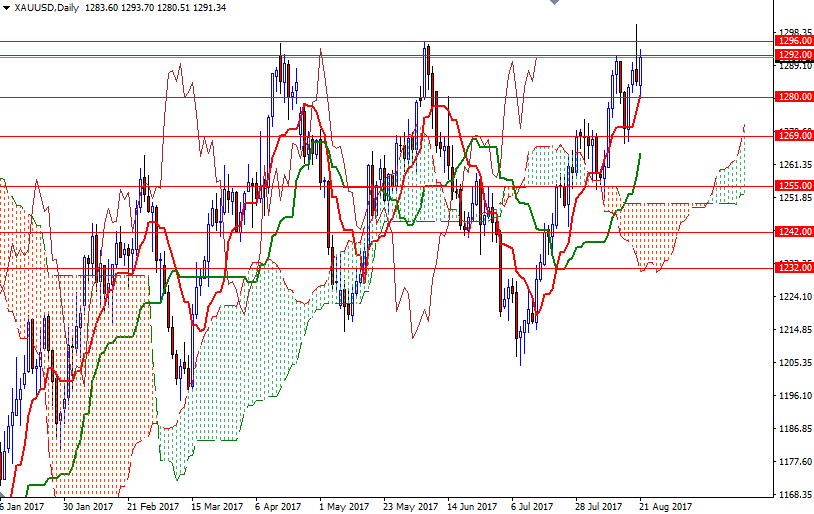

XAU/USD initially tested the support around the 1280 level before heading higher. The bulls still have the overall technical advantage, with the market trading above the Ichimoku clouds on all time frames (except the monthly chart). However, on top of us there is an anticipated resistance zone that stretches from 1292 to 1296 and the market is currently stalling in this area.

The bulls have to lift prices above there to gather momentum for 1308/4, the next key resistance on the charts. The bottom of the hourly Ichimoku cloud sits at 1284 so the bears will need to capture this camp in order to make a move for 1280. If the market falls through 1280, the 1277-1275.50 area may be the next stop.