By: DailyForex

Gold prices are modestly lower in afternoon U.S. trading Monday as surging U.S. stock markets and a rebound in the dollar took some momentum away from the precious metal. Last week the bulls took advantage of weakness in global equities and pushed prices to their highest level since July 7.

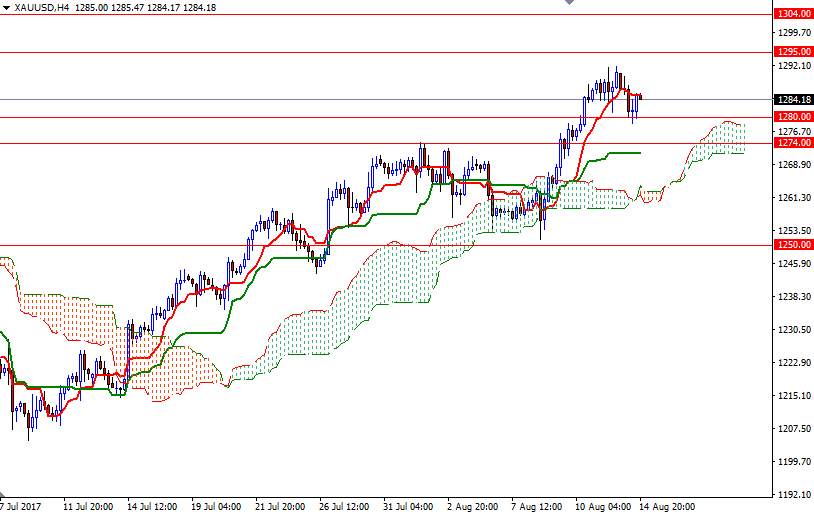

The support around the 1280 level has held the market so far but beware that the short-term charts are slightly bearish at the moment. XAU/USD is trading below the Ichimoku clouds on the M30 chart and we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) on both H1 and M30 time frames.

The bottom of the hourly cloud currently sits at 1278.50 so the market has to get down below there to make a move towards the 1274/1. To the upside, the initial resistance stands in the 1288-1286.46 (the top of the hourly cloud). If the bulls can capture this strategic point, the 1292 level will be the next target.