By: DailyForex

Gold prices rose in afternoon U.S. trading, recouping earlier losses, as soft U.S. economic data raised doubts about the path for higher interest rates. The Commerce Department’s report showed that consumer prices were flat in June from the prior month and the Institute for Supply Management said its manufacturing activity index fell to 56.3 from 57.8 the prior month. The market is pricing in a very low probability of a September hike.

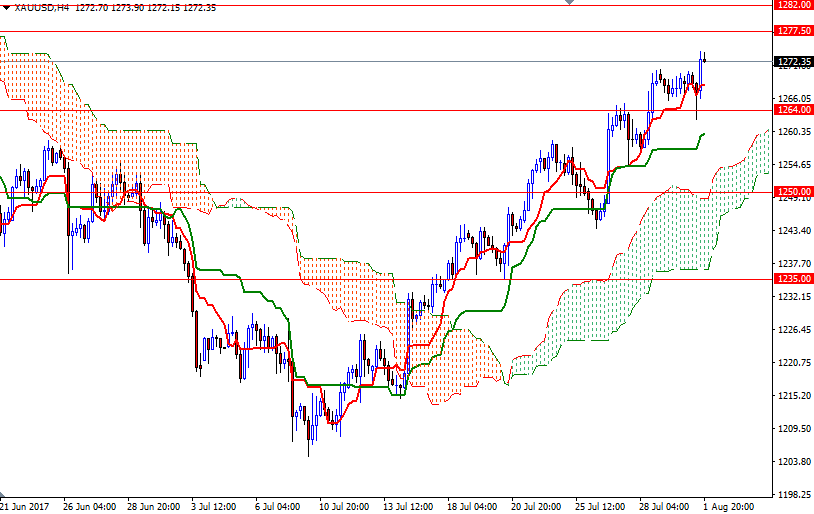

The medium-term charts are bullish at the moment, but the short-term charts show signs of exhaustion. Investors may reluctant to take sizable positions ahead of closely watched U.S. employment figures. With these in mind, I think gold prices will tend toward consolidation for the next few days.

If the bulls can hold prices above the hourly cloud, prices will probably continue to approach the 1277.50 level. Closing beyond 1277.50 would make me think that the market is getting ready to test 1282. If XAU/USD falls through 1264-1262.70 (the bottom of the hourly cloud), the market will be aiming for 1257.50-1255. The bears will have to overcome this support so that they can set sail for the 1250 level.