The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 6th August 2017

Last week, I saw the best possible trades for the coming week as long DJX, GBP/USD, and AUD/USD, and short USD/CAD. The results were mixed: DJX rose by 0.96%, GBP/USD fell by 0.74%, AUD/USD fell by 0.72%, and USD/CAD rose by 1.72%. All the Forex components lost, only the Dow Jones moved in line with its long-term trend over the week. The averaged result was a loss of 0.56%.

The Forex market mover broadly in line with a bearish U.S. Dollar trend most of the week until Friday’s Non-Farm Payrolls result came in at an unexpectedly strong level, boosting the U.S. Dollar and producing a strong pull-back against the prevailing trend. A more bullish U.S. Dollar sentiment is likely to prevail over the coming week, or at least until the release of further major U.S. economic data releases beginning on Thursday, as last week’s data suggests the Federal Reserve should now be poised to begin seriously shrinking its balance sheet and generally tightening monetary policy further.

This week I forecast that the highest probability trade will be long of the Dow Jones 30 Index, as the U.S. Dollar is likely to continue to retrace against the long-term bearish trend for most of this week, making Forex trend trades dangerous plays at least until the release of new key U.S. Data.

Fundamental Analysis & Market Sentiment

The major elements affecting market sentiment at present are a more bullish view on the U.S. Dollar and a more bearish view on the British Pound following the Bank of England’s cut in its growth forecast.

As we are now well into the traditionally quiet month of August, we may see a general decrease in volatility and a flattening out of the market over the coming two or three weeks.

Technical Analysis

U.S. Dollar Index

This pair printed a bullish candlestick, with its low signaling a possible double bottom formation beginning at about 11853. However, there is a clear long-term bearish trend and the price has carved out new resistance above, while closely following a dominant bearish trend line. Furthermore, the former key support level at 12012 has been decisively broken. The bullish weekly candlestick is also of an average or perhaps relatively small size, so it is probably too early to call the start of a major trend change.

Dow Jones 30 Index

This pair printed another strongly bullish candlestick, closing near its high and making another new all-time high price. There is a clear long-term bullish trend and the price is trading in “blue sky”. There are no obvious obstacles ahead to a further advance whatsoever.

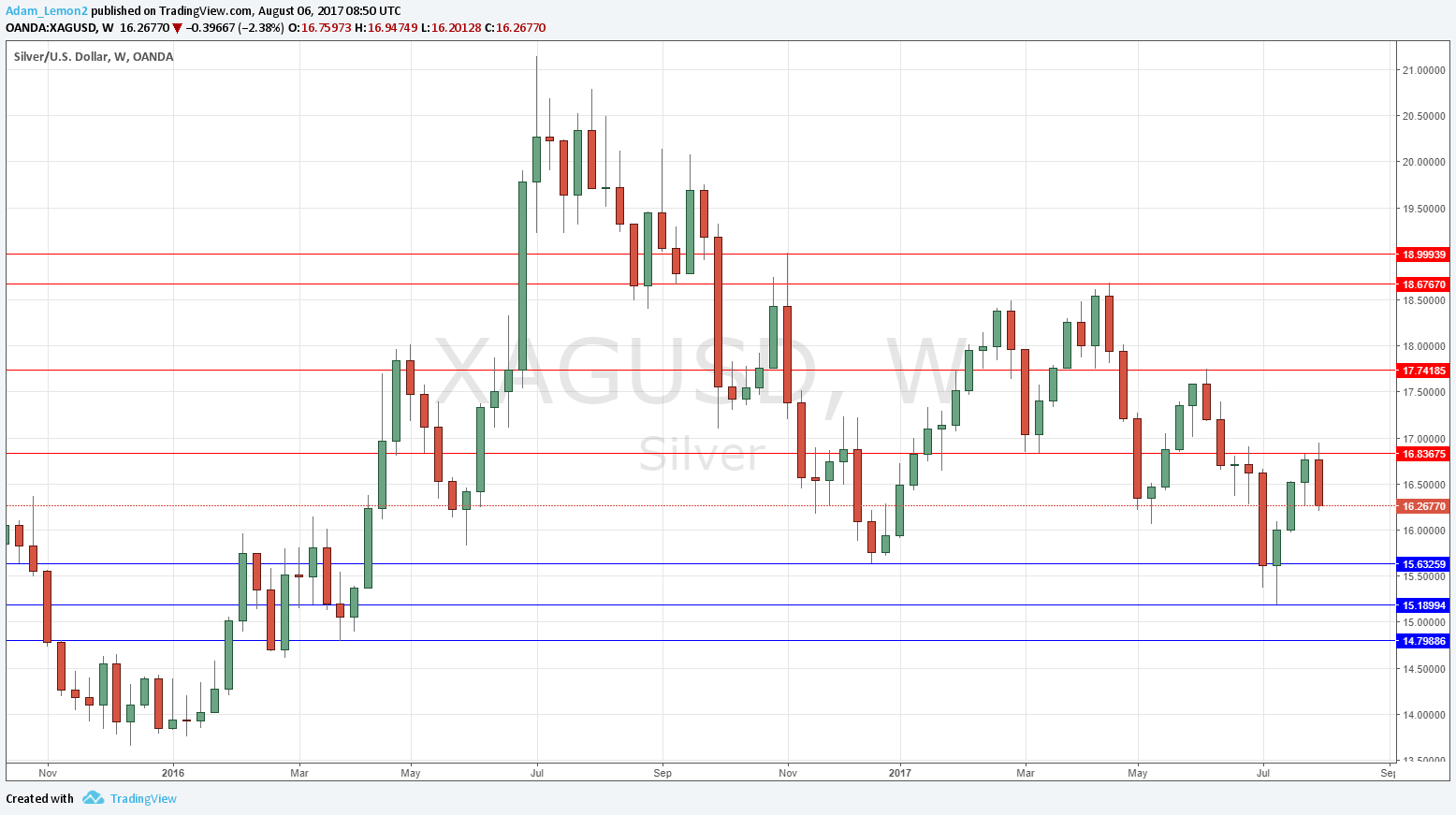

Silver

More or less the only asset in a long-term bearish trend against the U.S. Dollar is spot Silver. The chart below shows that although the trend is not strong, the week closed strongly down after rejecting a key resistance level at $16.83. It is not a trade I am very optimistic about, but it is a trend trade possibility in the current strong USD short-term environment.

Conclusion

Bullish on the Dow Jones 30 Index.