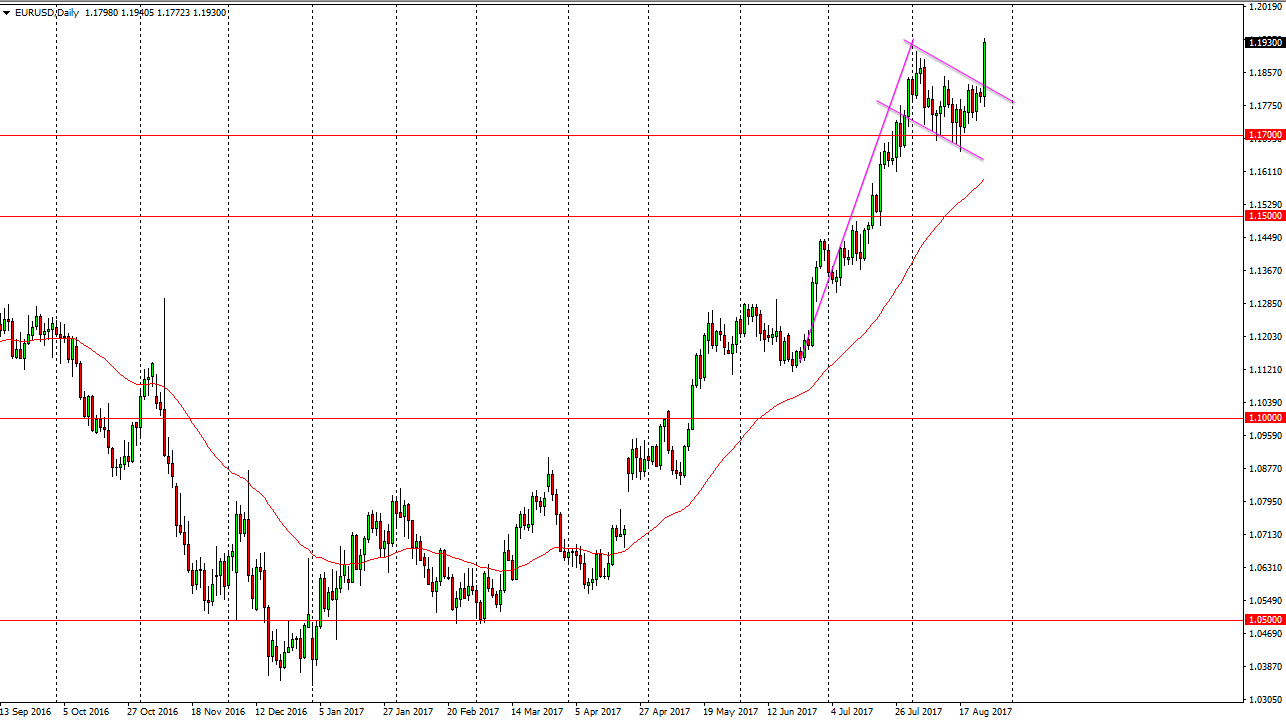

EUR/USD

The EUR/USD pair exploded to the upside on Friday, as Janet Yellen failed to mention anything about monetary policy during her speech. We had recently formed a bullish flag, and now we are most certainly broke out at this point. I think the 1.20 level will continue to be a nice target, and probably offer a bit of resistance. A pullback from here is very possible, but that should be a buying opportunity. I believe that the 1.17 level underneath should continue to be supportive. Ultimately, I do think that we get above the 1.20 level, and go looking towards the 1.25 level based upon the 3-year consolidation area that we have just broke out of during the month of July. I have no interest in shorting, I look at pullbacks as value.

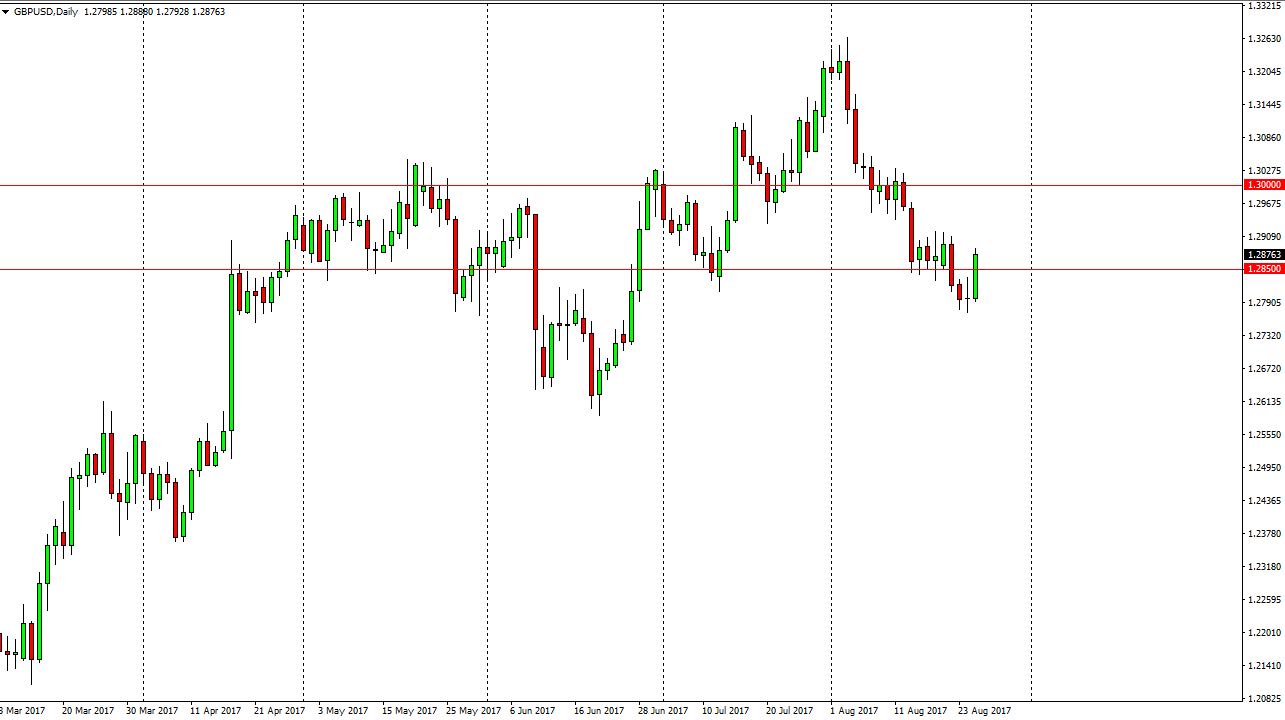

GBP/USD

The British pound broke higher during the session as well, slicing through the 1.2850 level. Now that we have broken above the 1.2850 level, I think we’re going to go test the 1.29 level. A move above that level is possible, but I believe that the market should into finding more resistance above at the 1.30 level. Because of this, even if the British pound does rally, I suspect that this is a market that will offer selling opportunities at the first signs of exhaustion. The British pound should underperform the euro overall, as seen in the EUR/GBP pair. With this being the case, I recognize that although this pair may go higher, it’s likely that it will underperform the EUR/USD pair. If we break down below the 1.2750 level, the market should send this market down to the 1.25 level over the longer term. Either way, expect a lot of volatility in this pair due to headlines.