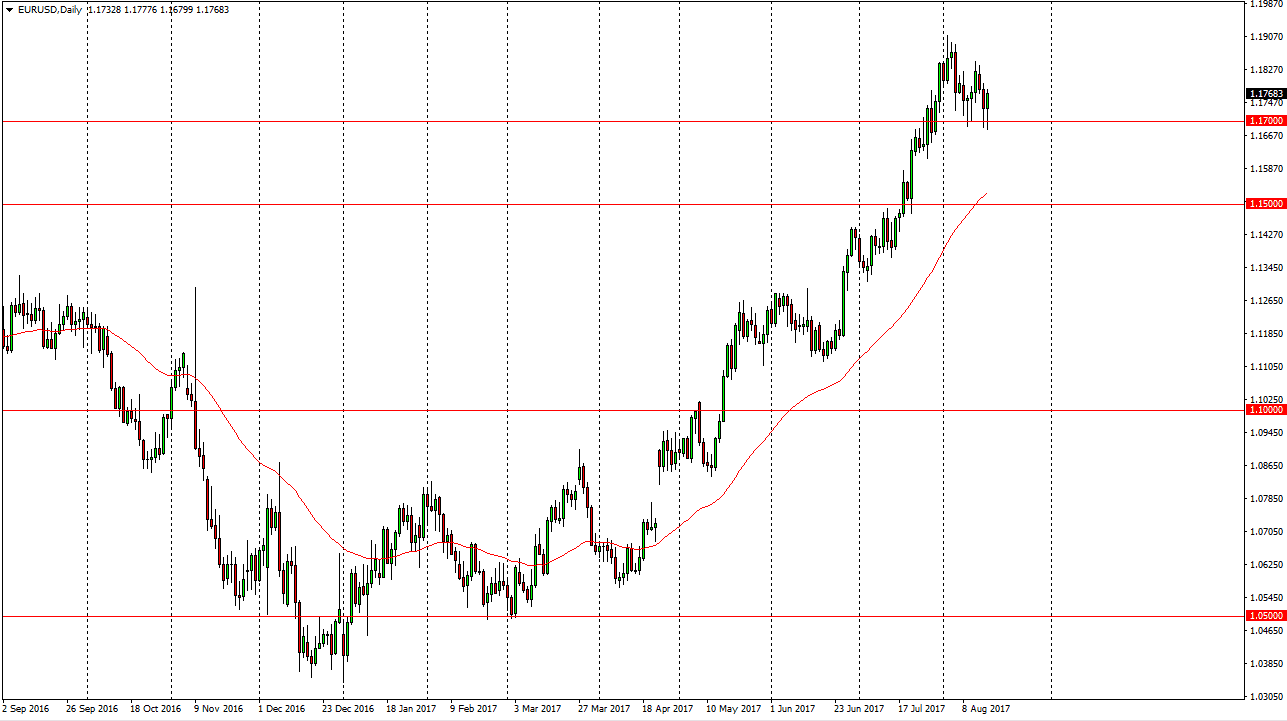

EUR/USD

The EUR/USD pair was initially bearish on Wednesday, but found enough support at the 1.17 level to turn around and form a hammer. This is a very bullish sign, and after the somewhat dovish FOMC Meeting Minutes, it appears that we will continue to go higher. The European Central Bank has not talked down the value of the currency yet, and if they fail to do so it Jackson hole, it’s likely that we will continue to see the uptrend. Currently, it looks as if were going to go looking for the 1.19 level above, and then possibly the 1.20 level after that. If we did breakdown below the 1.17 handle, I think that the market will find more than enough support at the 1.15 level under that to continue the longer-term uptrend.

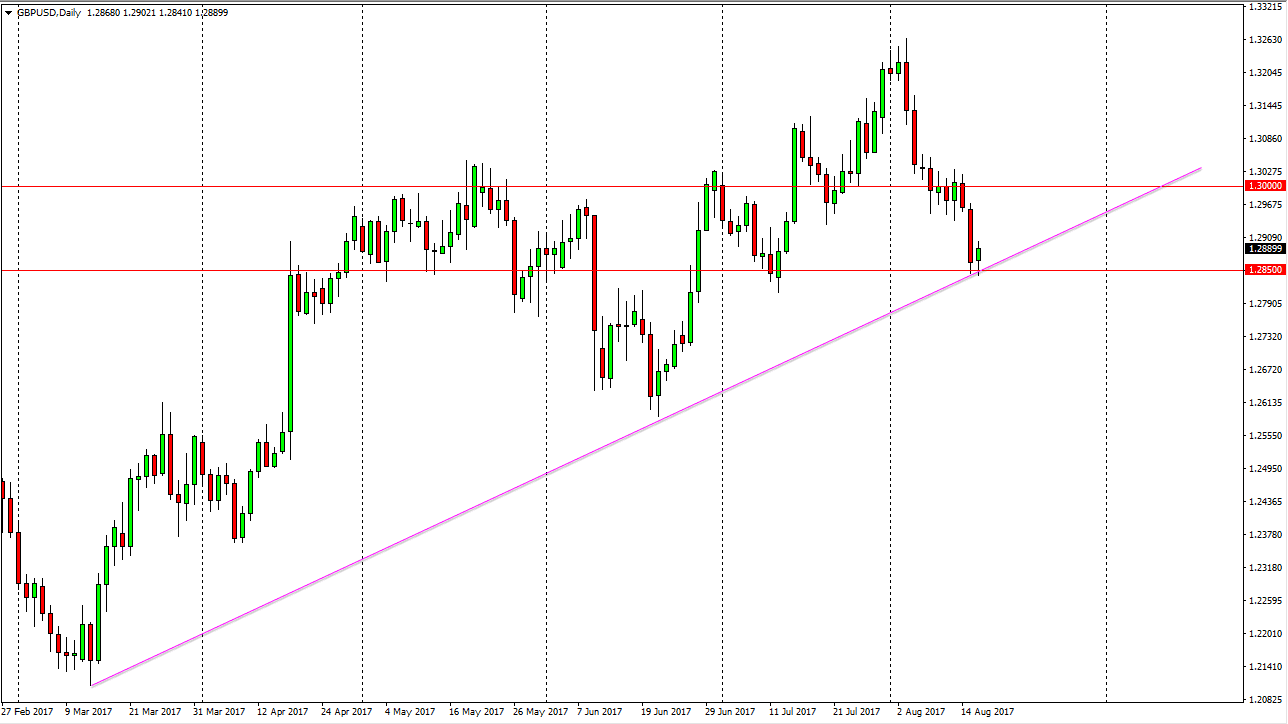

GBP/USD

The British pound went back and forth during the day on Wednesday, testing the 1.2850 level. We did get a little bit of support there, and with the dovish FOMC Meeting Minutes coming out during the day, that gave a little bit of support to the British pound. However, I think that longer-term we still have other structural issues when it comes to the GBP, so I think that even if this market rallies, it will lack some of the other ones. The 1.30 level above should continue to be resistance, but if we break above there I think at that point buyers would start to flood into the market again. Alternately, a breakdown below the 1.2850 level on a daily close sends this market down to the 1.26 level over the next several sessions. I’m not looking for some type of melt down, just a general grind in general as the market continues to chop around and low liquidity environments.