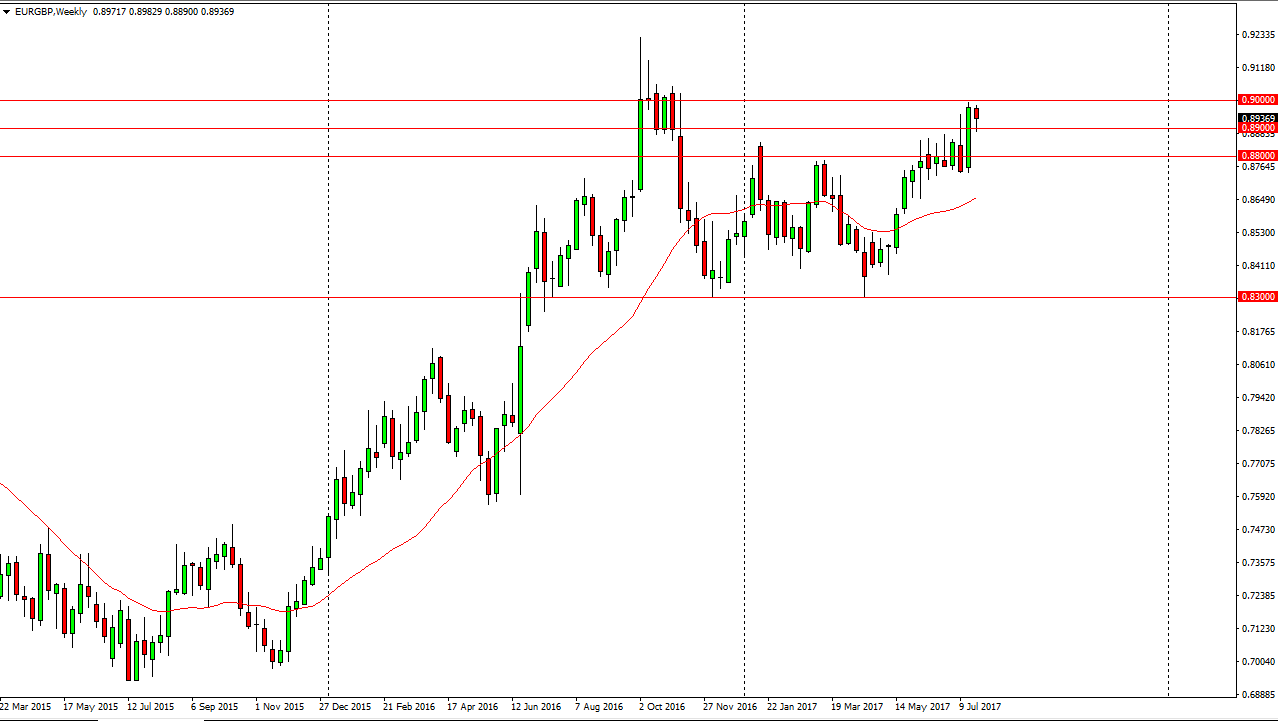

The EUR/USD pair has been rather quiet during most of the July session, but the market eventually rallied enough to reach towards the 0.90 level. I believe that the market break above that level should send this market much higher, perhaps reaching towards the 0.92 handle. I think that pullbacks will continue to offer buying opportunities, and it should be noted that the EUR/USD pair has broken above a 3-year consolidation area. That shows a significant strength in the Euro and that of course will translate the higher prices here. While the British pound has been bullish, it hasn't been anywhere near as bullish as the EUR in general, so I believe that the market should continue to go higher. After all, it makes a lot of sense as the EUR has shown relative strength.

Buying dips

I continue to buy dips in this market as I believe that the buyers will control the longer-term outlook. Given enough time, I think that the 0.92 gets tested, but then eventually we break above there and start going even higher. I think that with the Brexit negotiations going on, it’s likely that we could even go as high as parity over the longer term. However, and the short-term I think that “buying the dips” will continue to be the way, as this market has shown so much in the way of wherewithal and bullish pressure as we broke above the monthly range. I have no interest in shorting, least not until we break down below the 0.8750 level, which looks very unlikely given the current weekly charts. I think that the 0.92 level will be significantly resistive, but eventually that too will give way just as the 0.90 level is getting ready to do. Ultimately, headlines will continue to move this market as negotiations continue, but I look at pullbacks as opportunity.