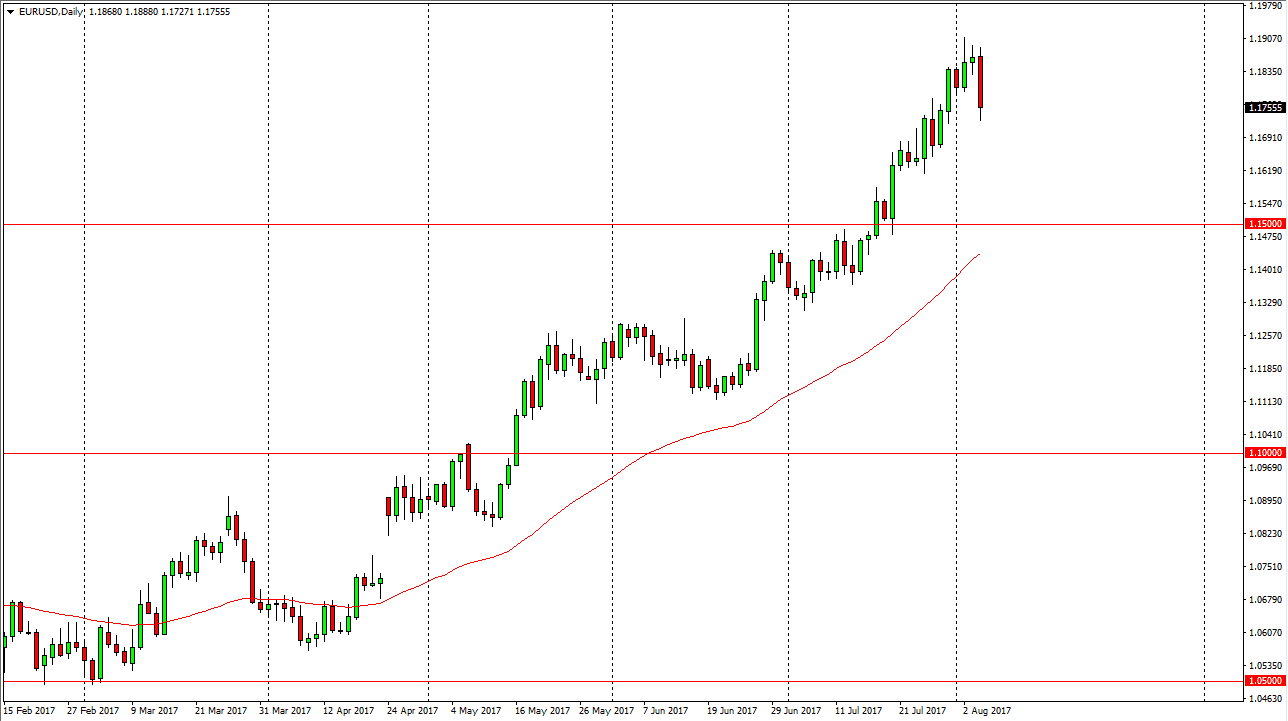

EUR/USD

The EUR/USD pair fell significantly during the session on Friday, after the jobs number came out of America much stronger than anticipated. Because of this, the market broke down below to the 1.1750 level. The bearish candle wiped out several days, and quite frankly I think we need to fall even farther than this. This is a parabolic market, and that almost always means that eventually you get a significant selloff. I would not be surprised at all if the market breaks down to the 1.16 handle, and then perhaps even the 1.15 handle after that. However, I would expect that the market should come back to the upside given enough time, as eventually the overall uptrend should continue. I expect weakness offering value over the next several sessions.

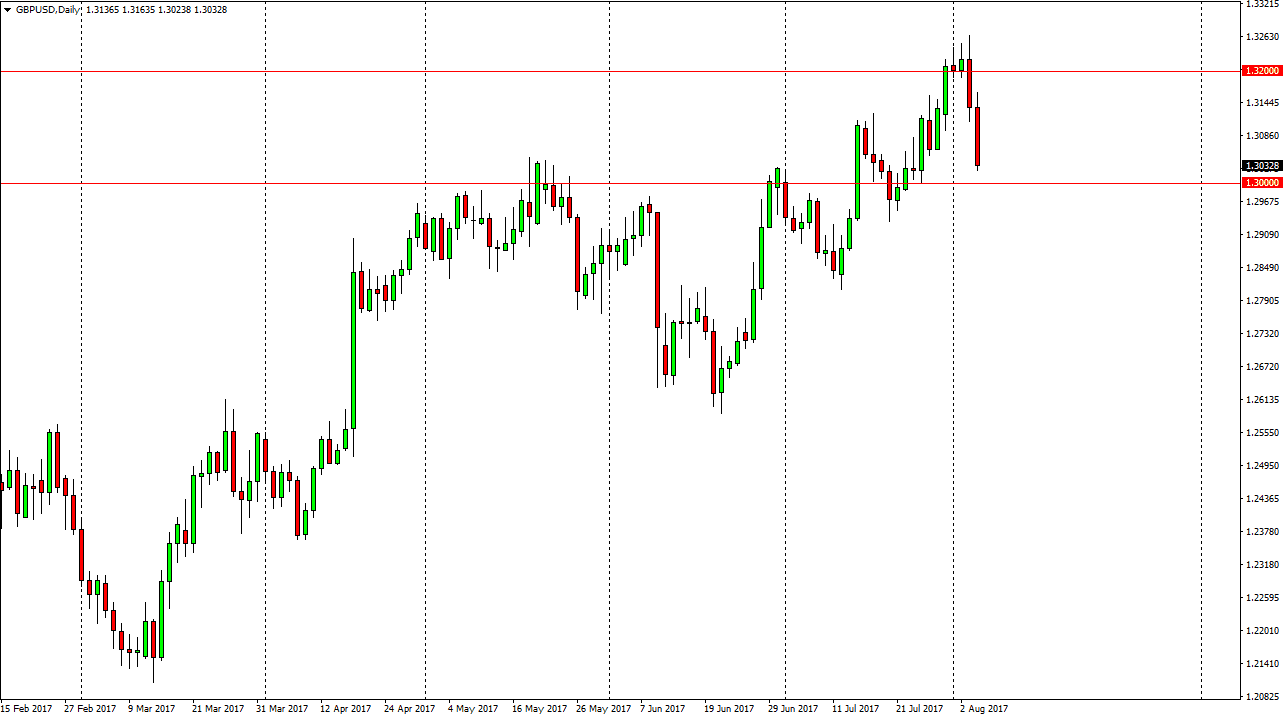

GBP/USD

The British pound fell significantly after the job announcement as well, and is reaching towards the significant 1.30 level. A breakdown below there should send this market much lower, perhaps down to the 1.2850 level. A bounce from here could send the market back to the 1.32 handle, but quite frankly I think that with the Bank of England suggesting that interest rate hikes won’t come until 2018, and the strengthening US dollar overall, we should probably continue to go lower. If we were to break down below the 1.2850 level, that would be significantly bearish enough to make me start selling aggressively. I think we’re going to see a lot of volatility over the next couple of sessions, but I also believe that we will eventually get some type of impulsive move that gives us a bit more clarity. In the meantime, small position sizes might be the best way to trade this market as the danger is relatively high. I prefer the downside in the meantime.