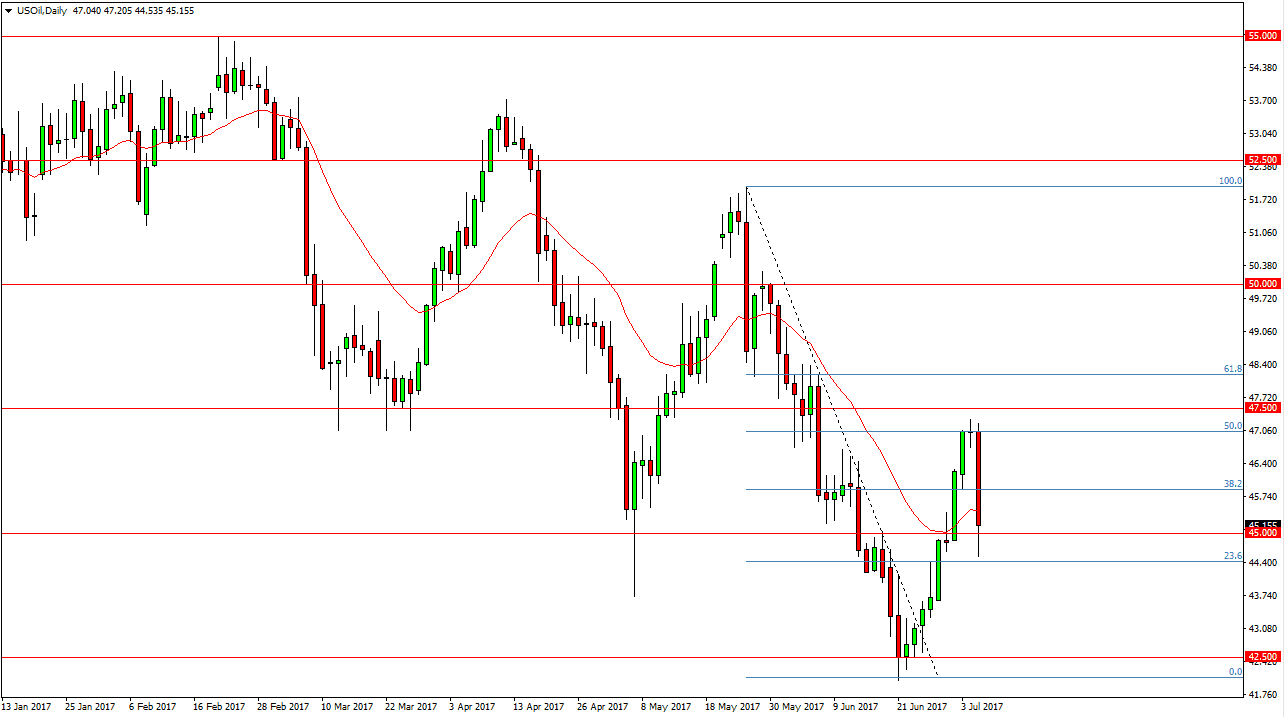

WTI Crude Oil

The WTI Crude Oil market fell apart during the session on Wednesday as the Russians say they are not willing to cut production. As soon as I across the newswires, oil fell drastically. In fact, we sliced through the $45 level at one point during the day, and at this point I feel that the market will sell off every time we rally, and I’m looking for short-term exhaustive candles to start going short again. This market looks likely to reach down to the $42.50 level, and I think that with this massive bearish candle it’s likely that the sellers will get aggressive. The $47.50 level above continues to be the massive resistance that keeps the market lower, and I believe that we will continue to see aggressive selling as the oversupply issue will certainly be a problem longer term.

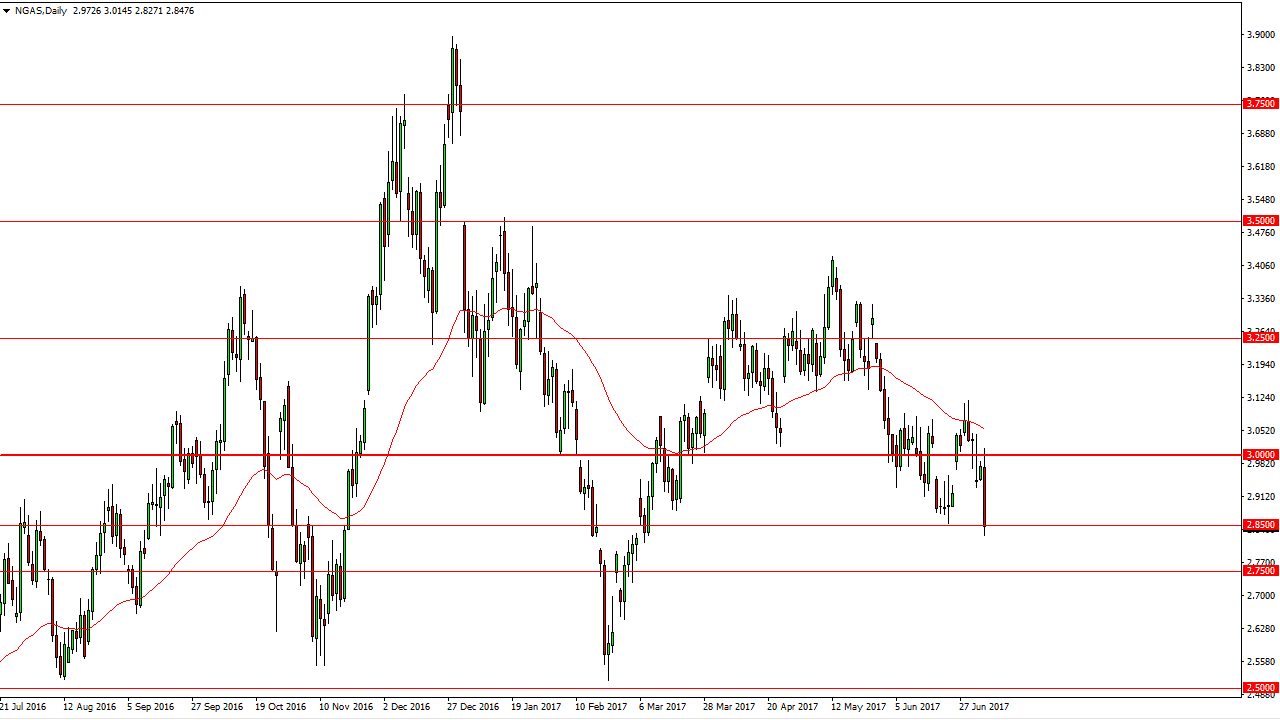

Natural Gas

The natural gas market initially tried to rally, testing the $3.00 level. That area causes a significant amount of resistance due to the psychological importance of that number, and we then broke down below to the $2.85 level. That’s an area that should be supportive based upon previous action, although we are closing near that level. A breakdown below the bottom of the range for the day should send this market down to the $2.75 level, and then eventually below there which could send the market down to the $2.50 level. Short-term rallies continue to be selling opportunities going forward, and that being the case I think that the sellers are going to continue to be very aggressive when it comes into the market, as we have seen the natural gas markets selling off every time they tried to gain. This being the case, the market looks likely to continue to the downside.