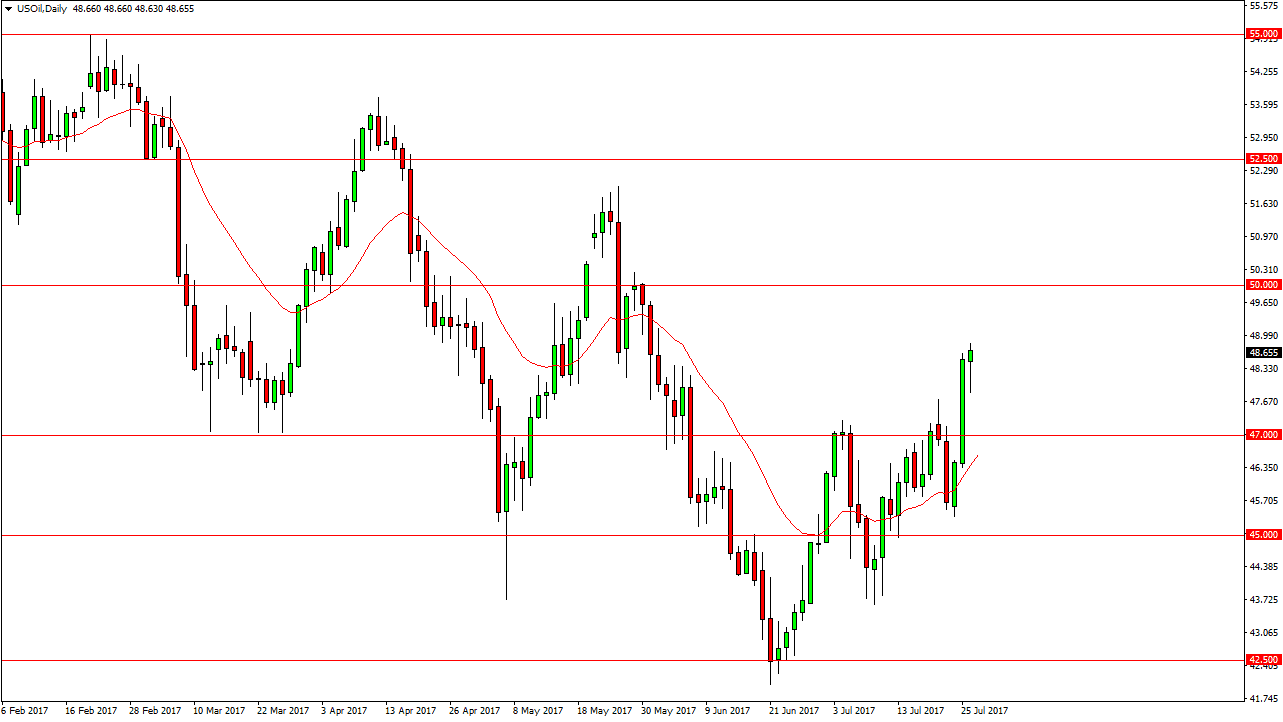

WTI Crude Oil

The WTI Crude Oil market initially fell during the session on Wednesday, but found plenty of support underneath as the US dollar cratered. This was due to the Federal Reserve sounding a bit more dovish than anticipated, and that of course works against the currency. By forming a hammer, I believe we are going to go looking towards the $50 level above. Short-term, we should continue to go higher, but I think somewhere near the $50 level, we are going to see the sellers return. On exhaustive candle in that area I more than willing to sell this market but I recognize that the next session or 2 might continue to see bullish pressure.

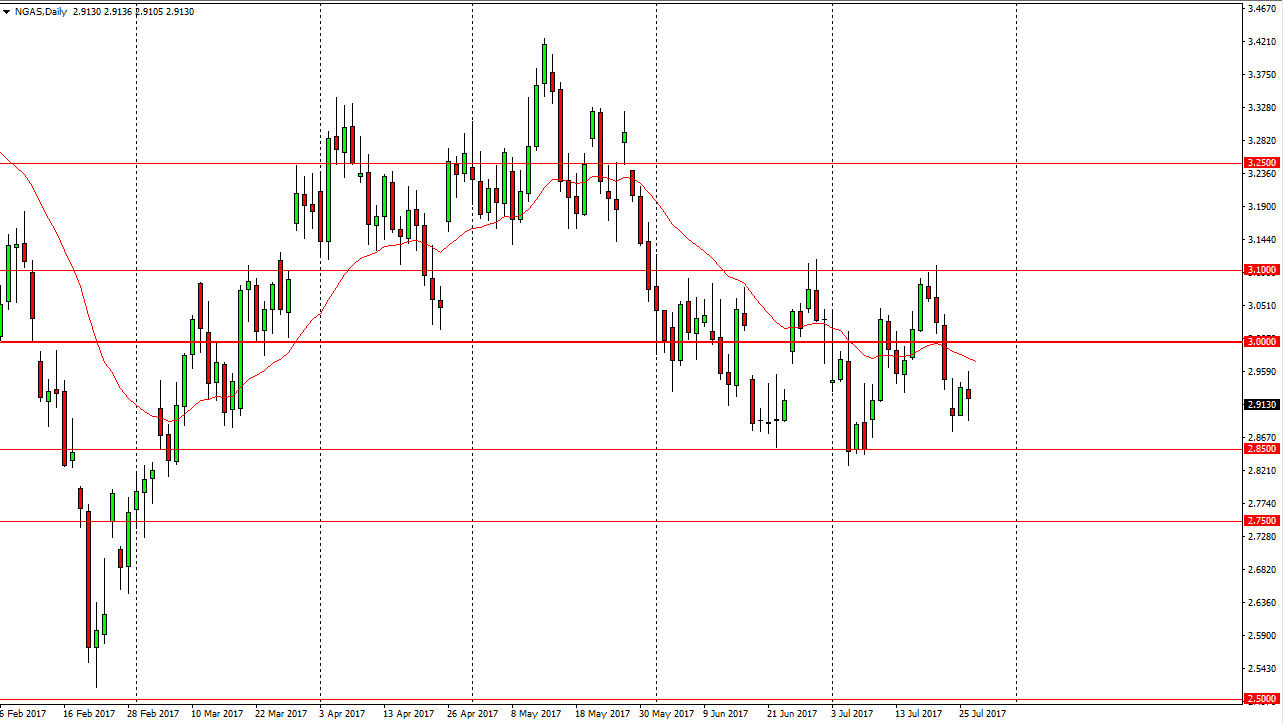

Natural Gas

Natural gas markets had a very choppy and volatile session, and I think that longer-term we are going to continue to see sellers. I would love to see this market bounced a bit so that I can sell from higher levels, especially near the $3 level. The $2.85 level below will be supportive and it initially will be my target. If we can break down below there, the market should then go down to the $2.75 level as well. Below there, then we go to the $2.50 level. I have no interest whatsoever in buying the market, as the oversupply in natural gas will continue to be a major issue in this market. In fact, I believe there is a massive amount of support above the $3 level that extends to the $3.10 level beyond that. This is continuing to be a “seller of rallies” type of situation, and therefore I look to signs of exhaustion and weakness as an opportunity to sell yet again. This is a trade that has worked for quite some time, and should continue to into the future.