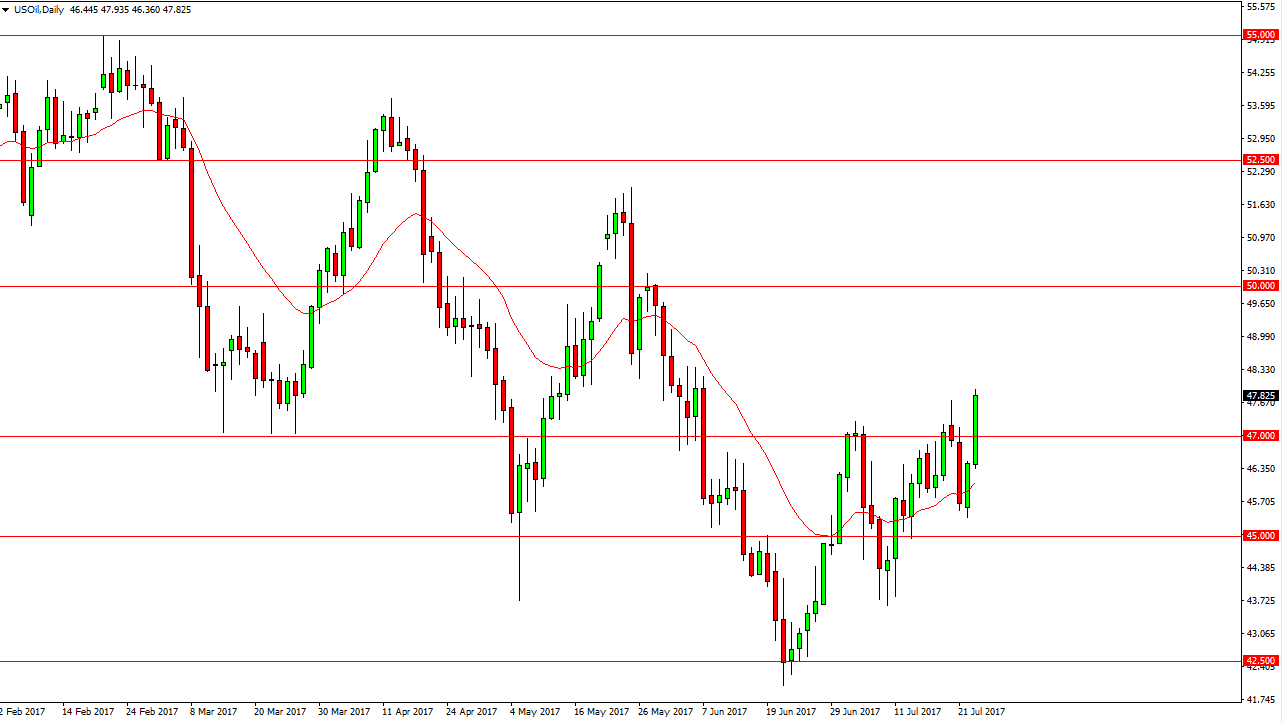

WTI Crude Oil

The WTI Crude Oil market rallied during the day on Tuesday, slicing through the $47 level. By doing so, and breaking above the top of the shooting star from last week, the market looks as if it is ready to go higher. However, today is not only the Crude Oil Inventories announcement, but it is also the FOMC Interest Rate announcement. Because of this, the market is likely to see buying pressure to the upside due to the fact that we broke out, but if we were to turn around and broke below the $47 level, the market could rollover significantly. Longer-term, I still believe in the bearish picture, but obviously we are starting to see bullish pressure in the short term.

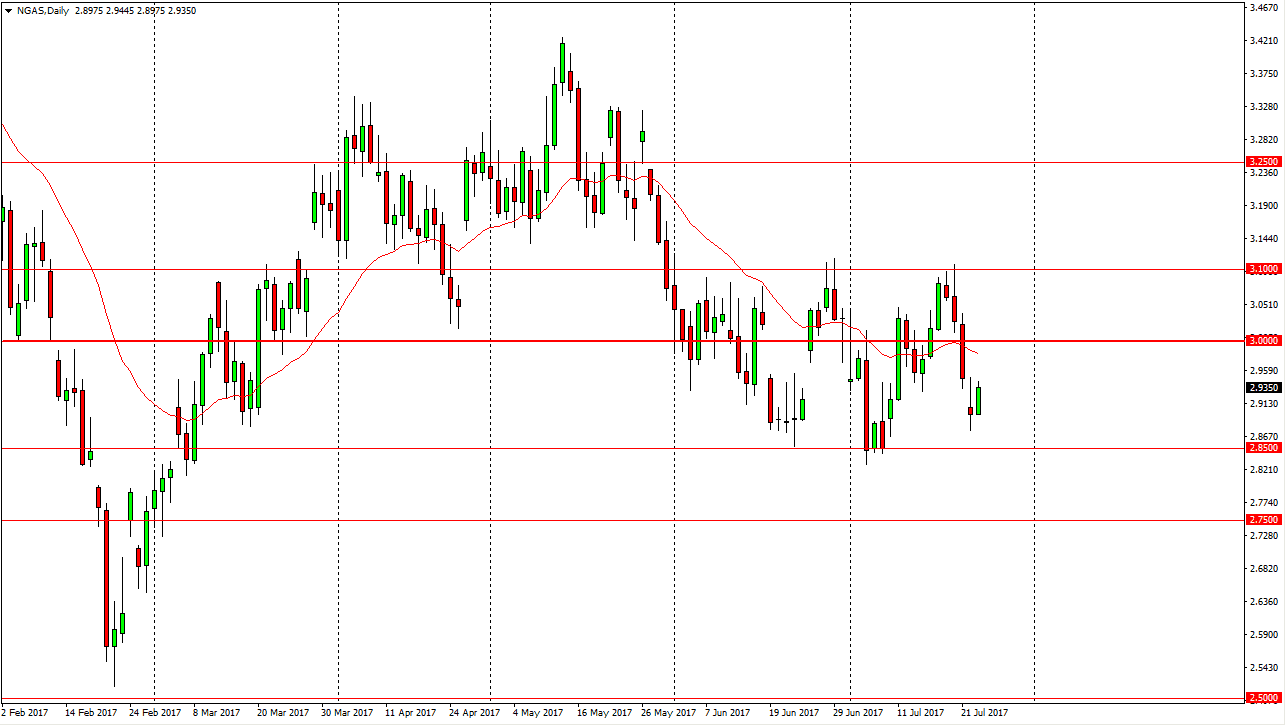

Natural Gas

Natural gas markets rallied during the day as well, as we continue to see back and 4 types of moves. I think that the $3 level above should be resistive, and I think that the resistance runs to the $3.10 level above, so with this being the case I have no interest in going long, and I look at rallies as selling opportunities. If we break down below the $2.85 level, I think that it is a signal that we should go down to the $2.75 level underneath. Ultimately, this is a market that should continue to show volatility, but longer-term I still believe that the oversupply of natural gas will continue to be an issue for participants. Longer-term, I still believe that the $2.50 level will be the target. I have no interest in buying this market until we clear that the $3.10 level above, which seems to be very unlikely to happen. Because of this, I expect a lot of volatility but certainly more negative pressure than anything else.