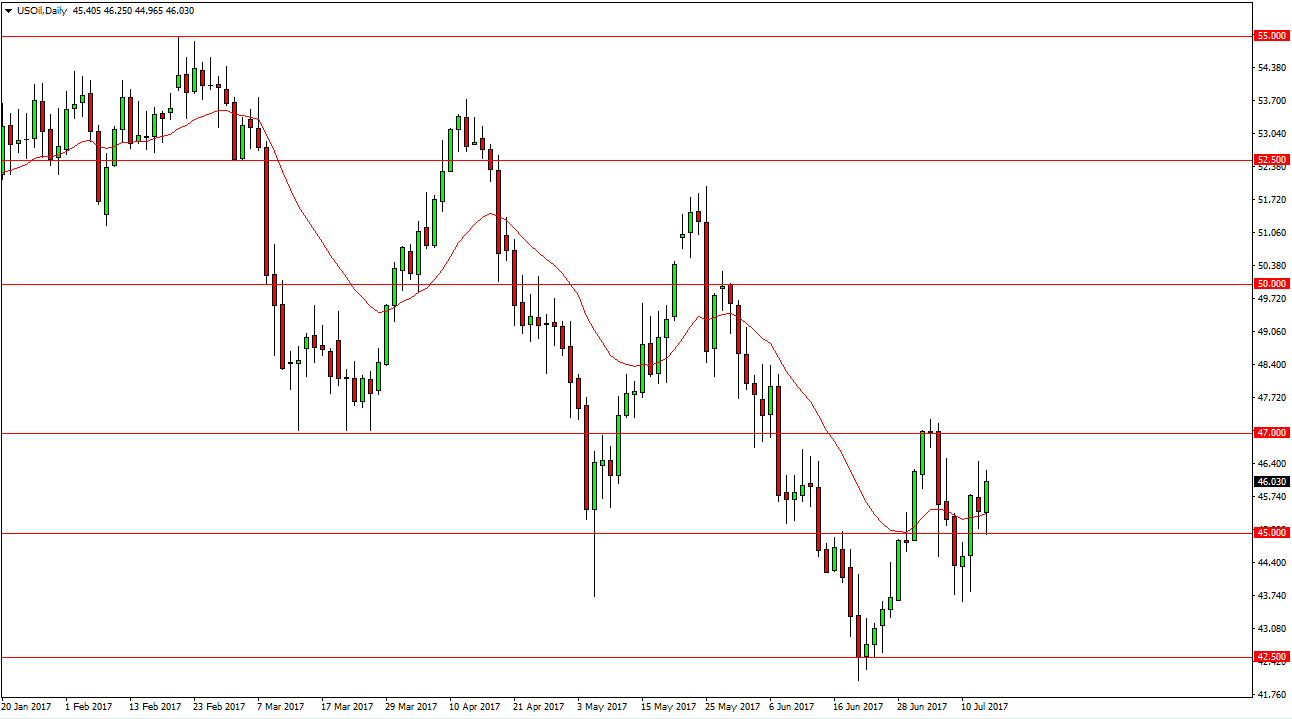

WTI Crude Oil

The WTI Crude Oil market rallied on Thursday, after initially dipping down towards the $45 level. We bounced enough to reach above the $46 level, and I think that any rally at this point is going to start running into a significant resistance. The $47 level above should be a bit of a ceiling, so I’m looking for and exhaustive candle to start selling. If we break down below the $45 level, I think the market will drop to the $43.50 level then. I believe that there is still a significant amount of bearish pressure longer-term on this market, but we are starting to see a bit short covering so we could continue to be very volatile. Until we break above the $47 level, I don’t have any interest in buying this market.

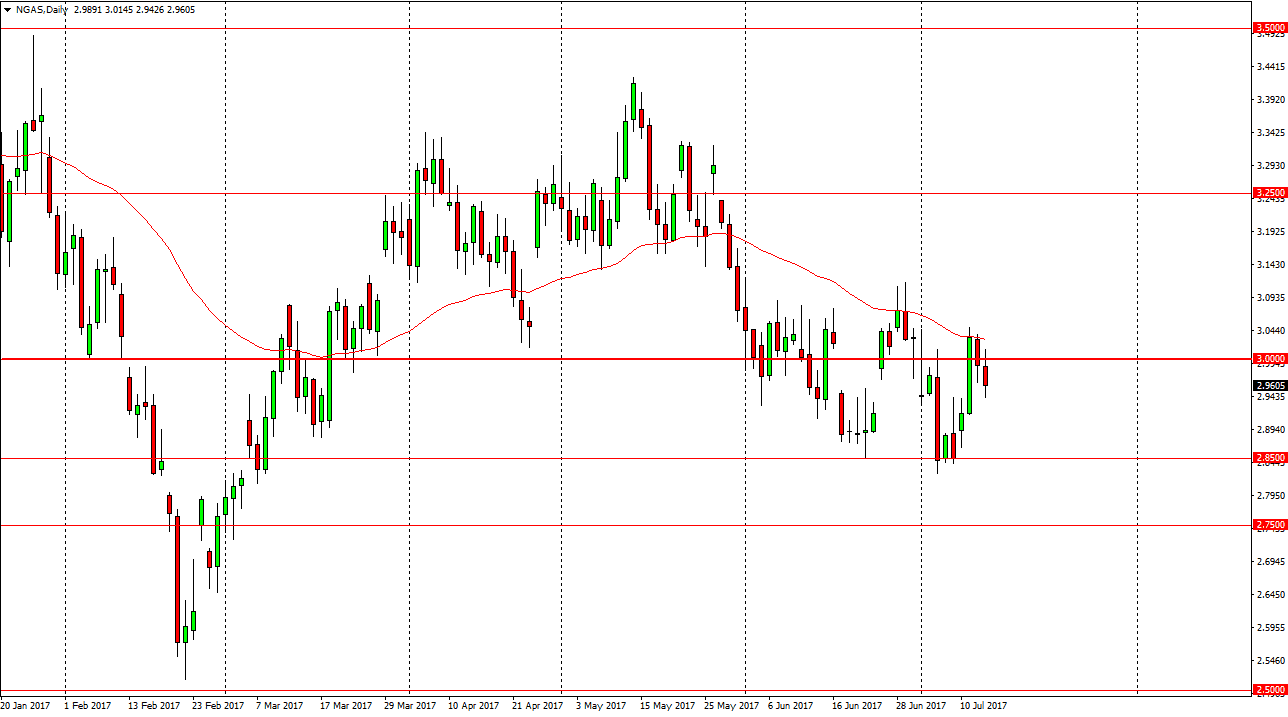

Natural Gas

Natural gas markets initially tried to rally, but found the area above the $3.00 level to be far too resistive. Since we turned around and fell through the $3 level again, it looks likely that the market will continue to drop from here. I think that the next target is going to be the $2.85 level underneath, which has been support at least a couple of times in the recent past. If we break down below the $2.85 level, the market should then go to the $2.75 level after that. Eventually, I think we broke down below that level, we could probably go down to the $2.50 level. I am a seller short-term rallies, I have no interest in buying this market because I think there is so much in the way of resistance and of course the 50-day exponential moving average continues to offer resistance. In fact, I believe that we are sellers in general until we can break above the $3.12 level.