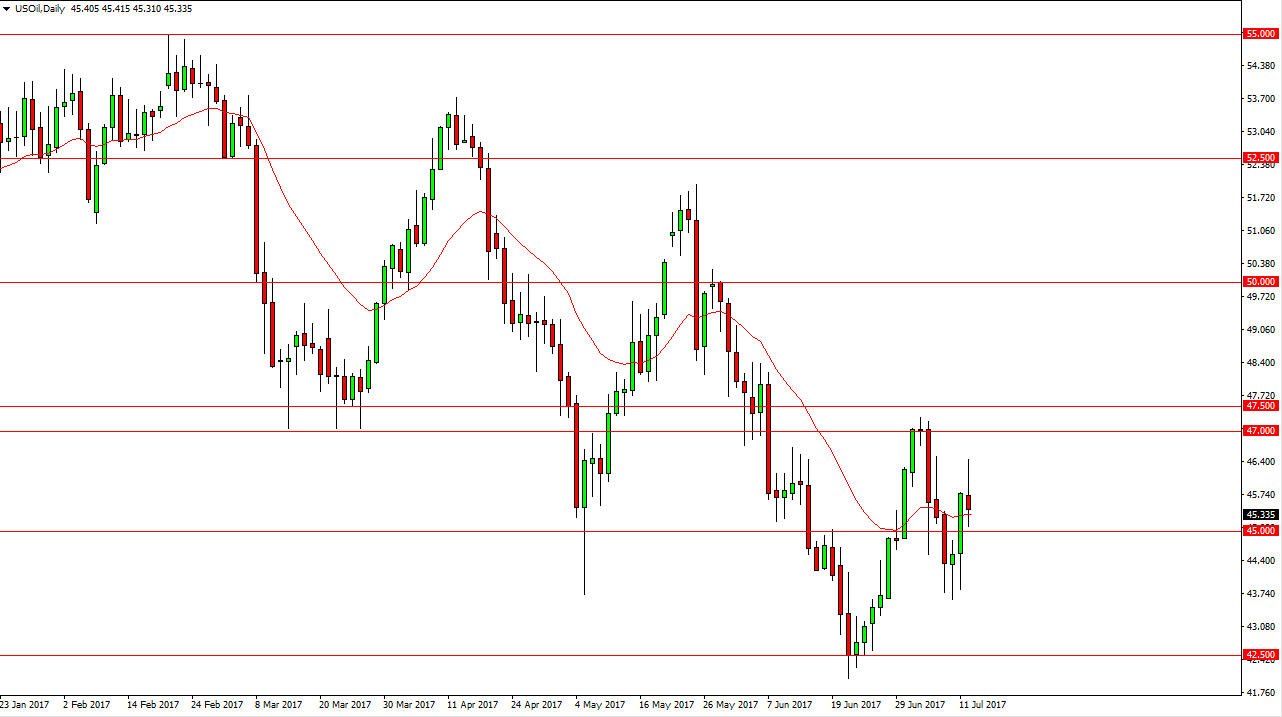

WTI Crude Oil

The WTI Crude Oil market had a very volatile session during Wednesday, as currency markets were moved drastically by Janet Yellen’s comments for the Congressional members. However, more importantly we saw a very bearish inventory number, so I think that we are going to continue to see selling on the rallies, and that is the thesis going forward. By forming the shooting star, it suggests that the buyers are probably doing nothing more than short covering, and that of course is no way to build a rally. I believe oil continues go lower longer-term, and because of that I have no interest in buying. I look at rallies as opportunities to short this market yet again.

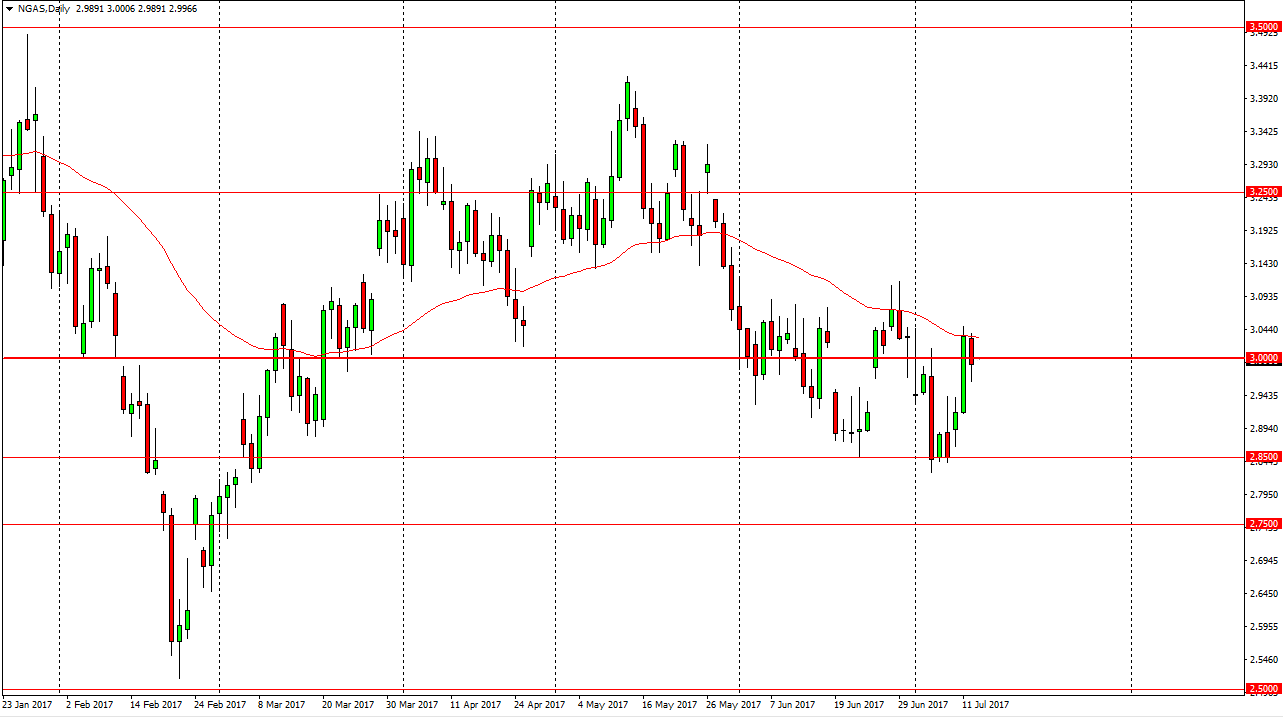

Natural Gas

Natural gas markets fell during the session on Wednesday, slicing through the $3.00 level again. I think that the market is going to continue to find sellers, as the 50-day exponential moving average has continued to be important in this market, as natural gas is very technically driven, beyond that, we also have major issues when it comes to oversupply, and with the Natural Gas Inventories announcement coming out today, we could get a catalyst to break this market down again. If we do fall from here, I suspect that the market is going to go looking towards the $2.85 level, and then the $2.75 level. I have no interest in buying natural gas, as I believe that the $3.12 level is massively resistive, and is essentially the “ceiling” in this market. I think that every time we rally, there will be sellers looking to take advantage of those overbought conditions as longer-term, I just don’t see how natural gas will find longer-term buying pressure in the current environment, and therefore I believe that this is a one-way trade given enough time.