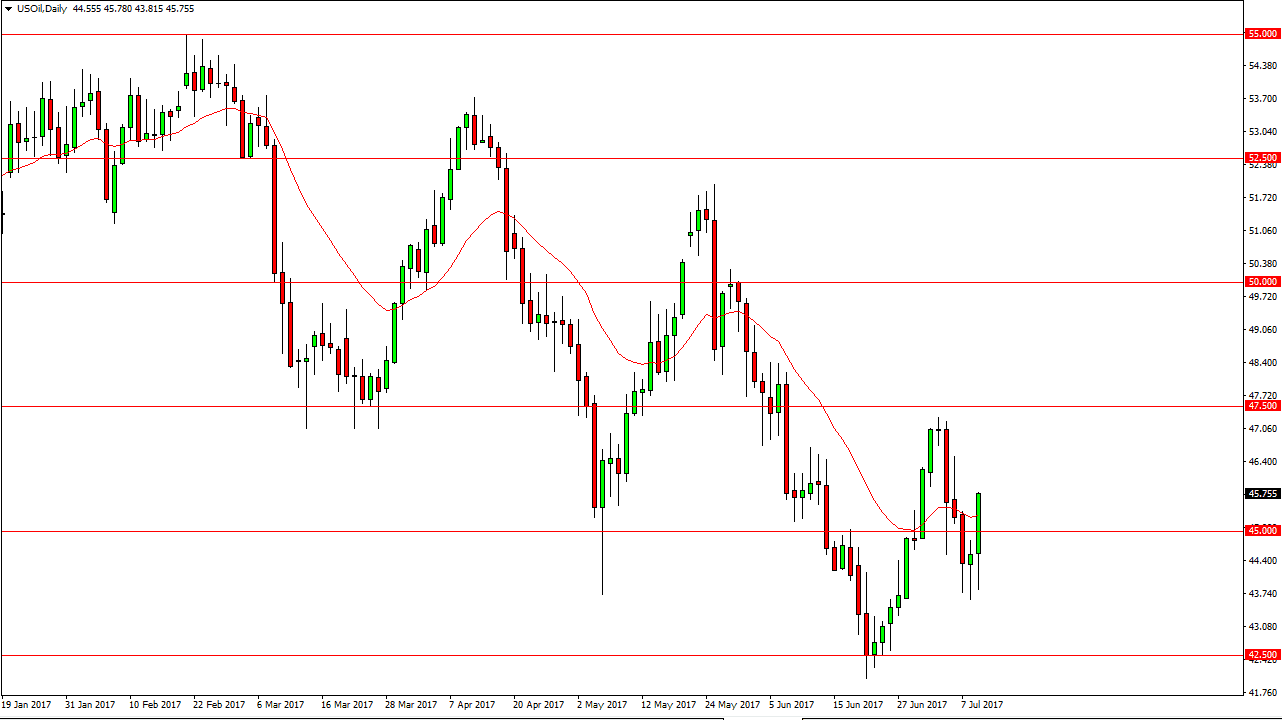

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Tuesday, but turned around to form a very bullish sign. The market broke above the $45 level, and it looks likely that we will continue to reach a little bit higher, but quite frankly with the Crude Oil Inventories announcement coming out today, we could get a massive turn around. Also, if Janet Yellen does anything to send the value of the US dollar higher, that could work against oil as well. Quite frankly, this is a market that I think is a bit range bound with a downward bias, and that is why we’ve seen a downtrend in general. I’m simply waiting for some type of exhaustive candle to start selling, even though I don’t have it yet, that is what I anticipate will be the case going long term.

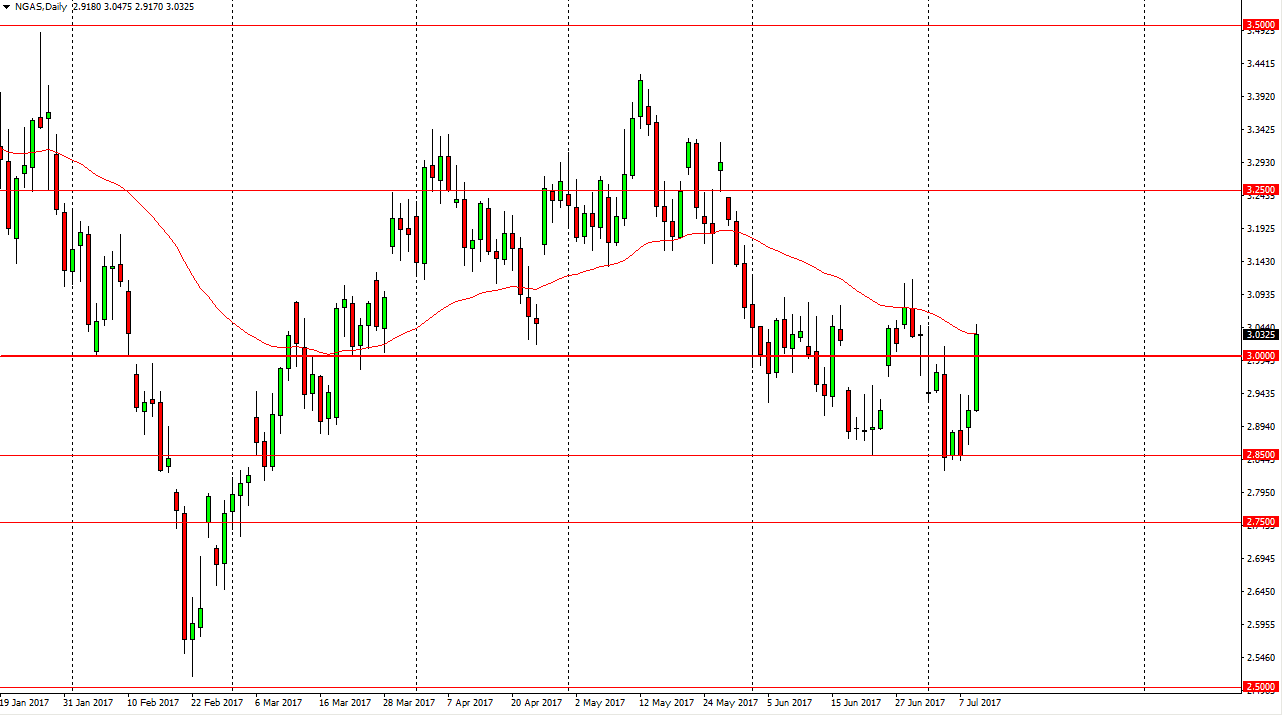

Natural Gas

Natural gas markets rallied during the day, breaking above the $3.00 level. I think that given enough time the market should find sellers the jump in and start punishing the lack of demand and more importantly: the massive oversupply. I believe that the oversupply continues to work against the value of natural gas overall, so I think that it’s only a matter of time before we reach back towards the $2.85 level. I do not have the signal to start selling yet but I also recognize that the 50-day exponential moving average is roughly where we closed during the day, so I would expect sellers to get involved. If we finally break down below the $2.85 level, the market should then go to the $2.75 level after that. If we broke above the $3.12 level, at that point I think we would have to regroup and look for a selling opportunity at higher levels.