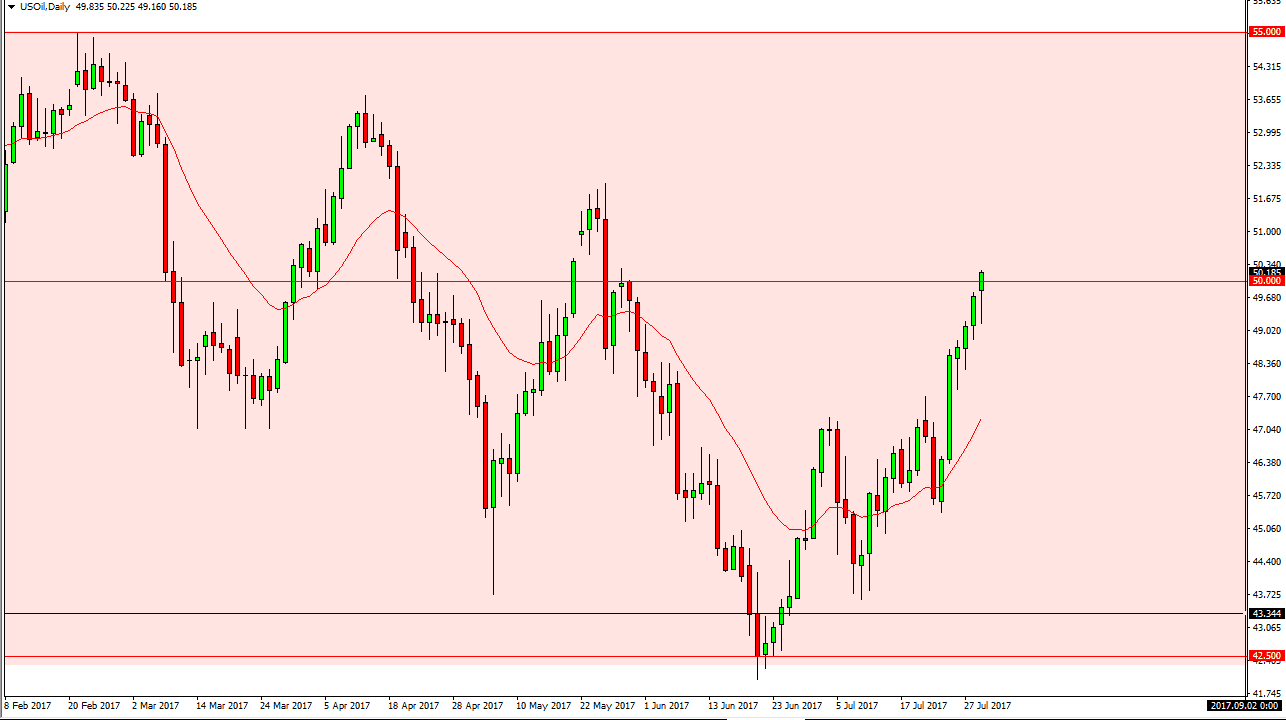

WTI Crude Oil

The WTI Crude Oil market gapped higher on Monday, but then fell towards the $49 level. We found enough buyers in that area to break above the $50 handle finally, and ended up forming a bit of a hammer for the day. This suggests that there is plenty of buying pressure underneath, although we are bit overextended. At this point, it appears that the oil markets are trying to break out to the upside and reach towards the $52.50 level. I believe that the $55 level above there is the top of the overall consolidation, so sooner, rather than later, I think that we will have sellers come back into this market. However, and the short-term it is obvious that this market is very bullish.

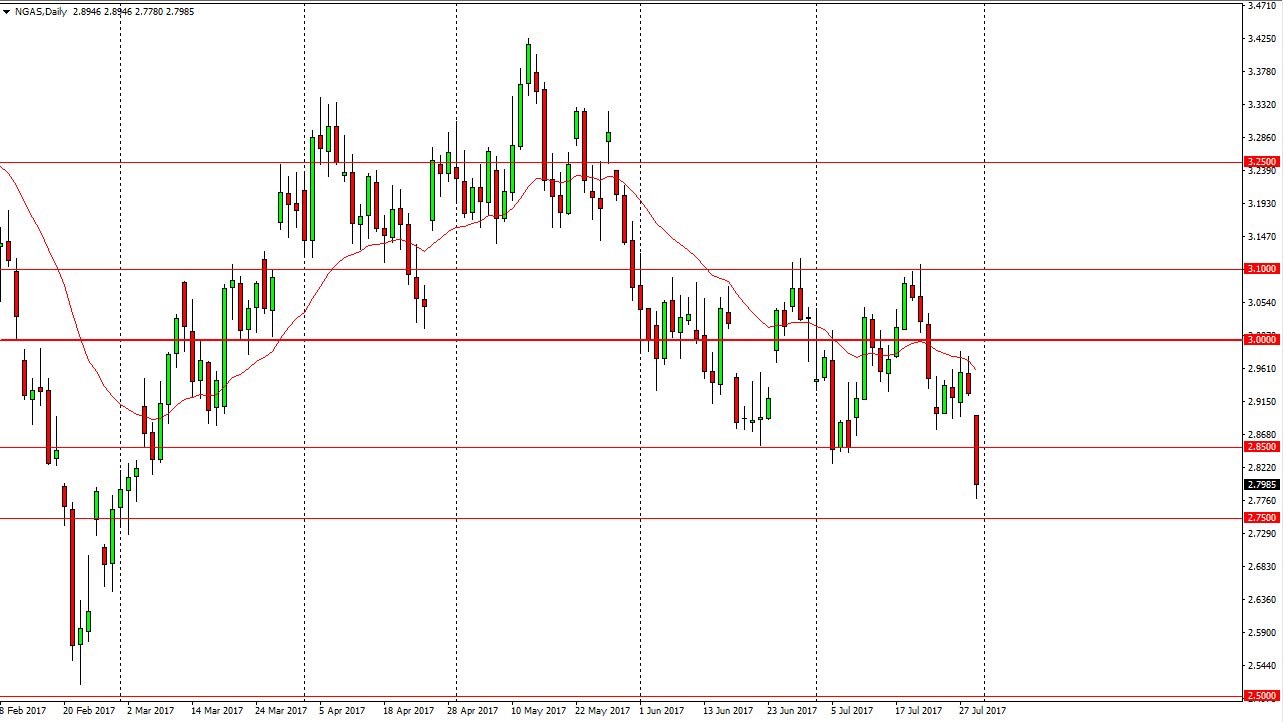

Natural Gas

Natural gas markets gapped lower at the open on Monday, and then sliced through the $2.85 level. In fact, we almost got down to the $2.75 level, which was my next target. I believe that any rally from here will run into a significant amount of resistance. Ultimately, if we can break down below the $2.75 level, the market should then go down to the $2.5 level after that. This is a market that is very negative, because we are so oversupplied. While it is possible that rising crude oil, prices could bring in a bit more demand for natural gas, the market is far from turning around at this point. Because of this, I continue to sell short-term rallies that show signs of exhaustion, as I believe that the bearish pressure will not only continue, but it’s very likely that I will increase from this point on. I believe that there is a massive ceiling in the market just above the $3 level, extending to the $3.10 level.