Gold ended the week up by 1.1% at $1268.90, the highest level since June 14, as the dollar came under fresh pressure on speculation that the Federal Reserve will likely wait at least until December to lift interest rates again. The FOMC’s policy statement last week suggested that central bank will be very careful about raising interest rates too quickly. Increased worries over political risks and slower-than-expected U.S. economic growth should also helped gold prices. The latest data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 90831 contracts, from 60138 a week earlier.

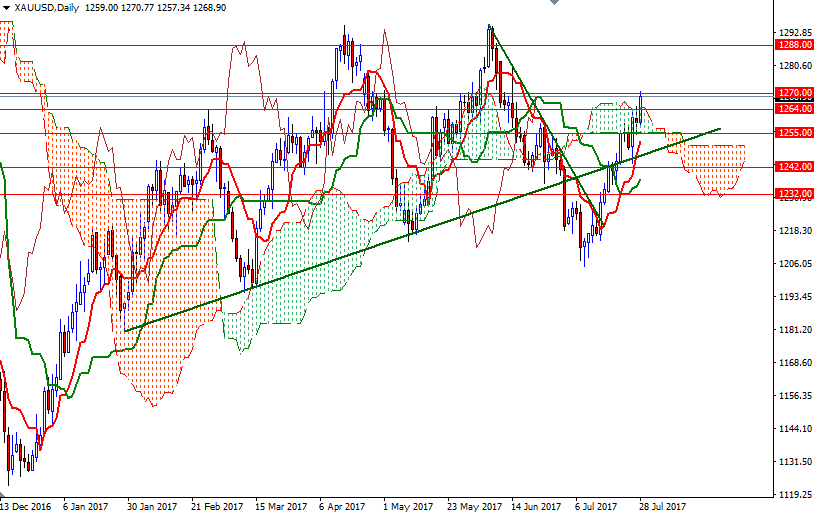

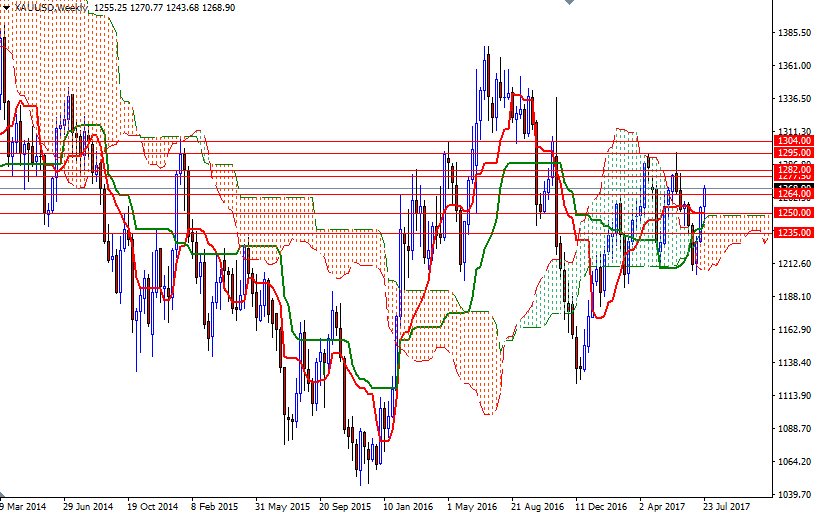

The Ichimoku cloud on the daily chart initially acted as resistance, but eventually XAU/USD was able break the resistance at 1264. Prices are above the clouds on almost all time frames, indicating that the bulls have the medium-term technical advantage. If the market can break and hold above 1270, prices could continue to move towards the 1296/5 zone. On its way up, expect to see resistance in 1282-1277.50 and at 1288.

However, if this move runs out of steam and XAU/USD breaks back below 1264, we might return to the 1258/5 area occupied by the hourly cloud. The bears will need to capture this camp so that they can challenge the bulls waiting in the 1250/48 zone, where the top of the weekly cloud and the weekly Tenkan-Sen (nine-period moving average, red line) converge. Not too far from there, the 1243/2 zone stands out as a key support. Closing below 1242 on a daily basis would open up the risk of a drop to 1232.