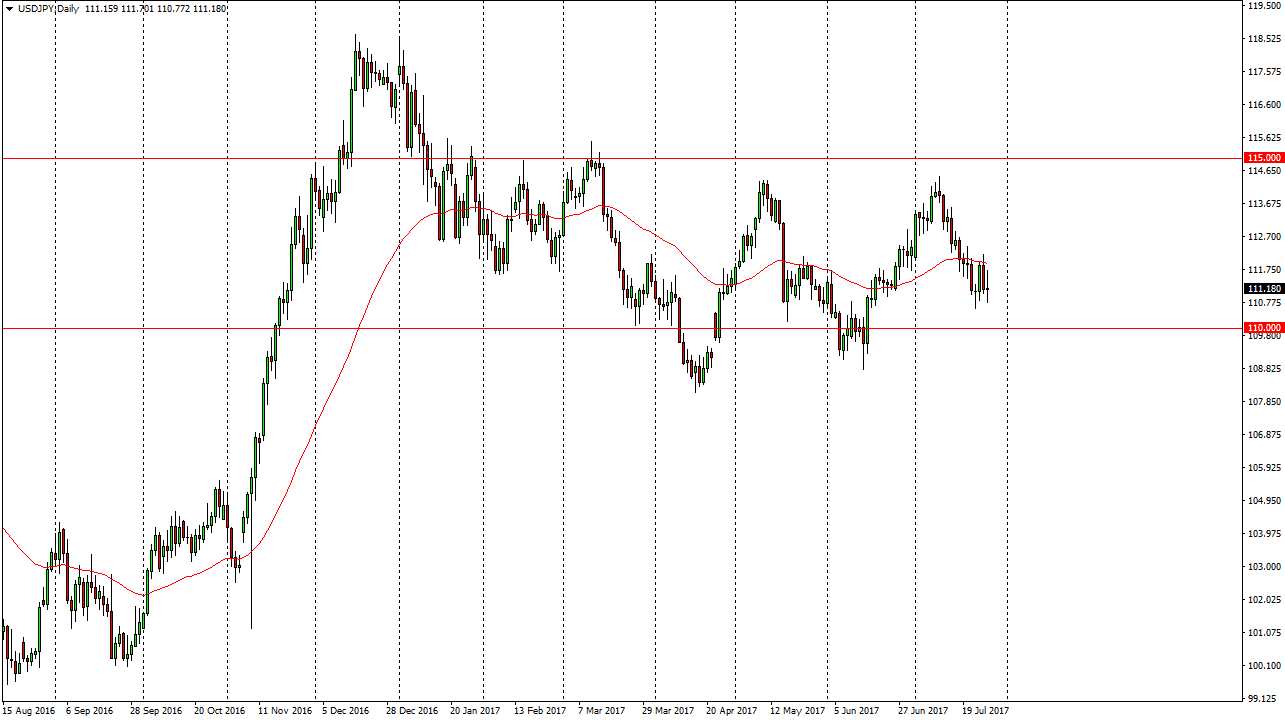

USD/JPY

The USD/JPY pair initially tried to rally on Thursday but ran into a bit of trouble just below the 115 handle. This is the top of the recent consolidation range, so I don’t see this as overly surprising. In fact, I think that a lot of people knew this and more than likely decided to take profits. We rolled over during the day as Wall Street got rather wild, and of course this send this pair tumbling as it is somewhat risk sensitive. However, by the end of the day the futures markets in the stock markets in America turned around completely, wiping out almost all the losses in the Dow Jones 30. This shows that there is still an underlying appetite for risk, so we should see this pair pick up a little bit from here. I don’t expect miracles, rather I expect a continuation of the overall sideways action that we have seen.

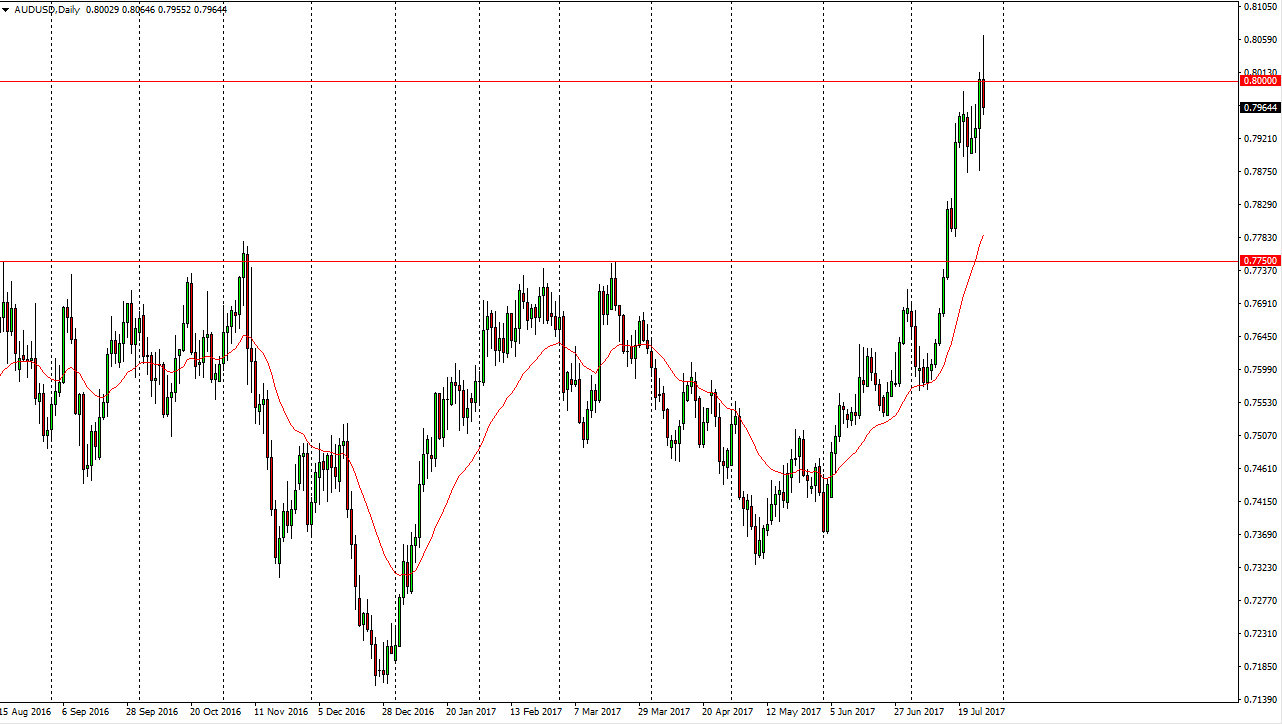

AUD/USD

The Australian dollar tried to rally during the session on Thursday, but found the area above the 0.0 level a bit too resistive. That is somewhat disconcerting, as we ended up forming a shooting star. Is a very negative sign, but I also recognize that there is a lot of noise just below, and extending down to the 0.7875 handle. Because of this, I’m not as concerned as I normally would be based upon a shooting star at such a large, round, psychologically significant number. In fact, I am expecting a bit of a bounce to pay attention to gold as it will more than likely lead the way going forward. If we do breakdown below the 0.7875 handle, all bets are off and then I would become an aggressive seller. In the meantime, I think that the buyers are going to come back in little bits and pieces and try to drive this pair higher today.