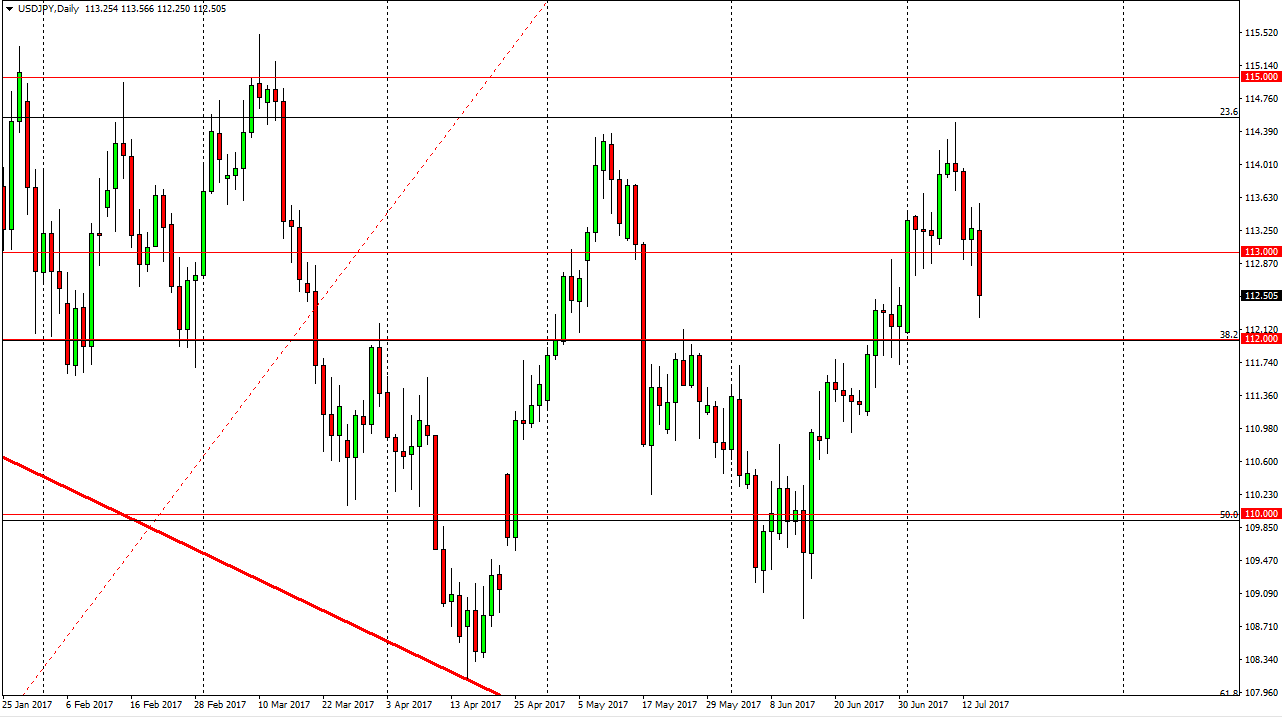

USD/JPY

The US dollar fell significantly during the day on Friday, as we continue to see concerns about whether the Federal Reserve can raise interest rates. Traders are starting to shift their attitude as far as this is concerned, and it looks very likely that the US dollar will continue to fall. The 112 level below is supportive, but I think there’s even more support near the 110 level. There is still a positive interest rate differential between the US dollar in the Japanese yen, so I think that we will eventually go higher, but we do not have a supportive enough candle to suggest that buying should be done. This is especially true considering that so many other currencies are breaking out against the US dollar.

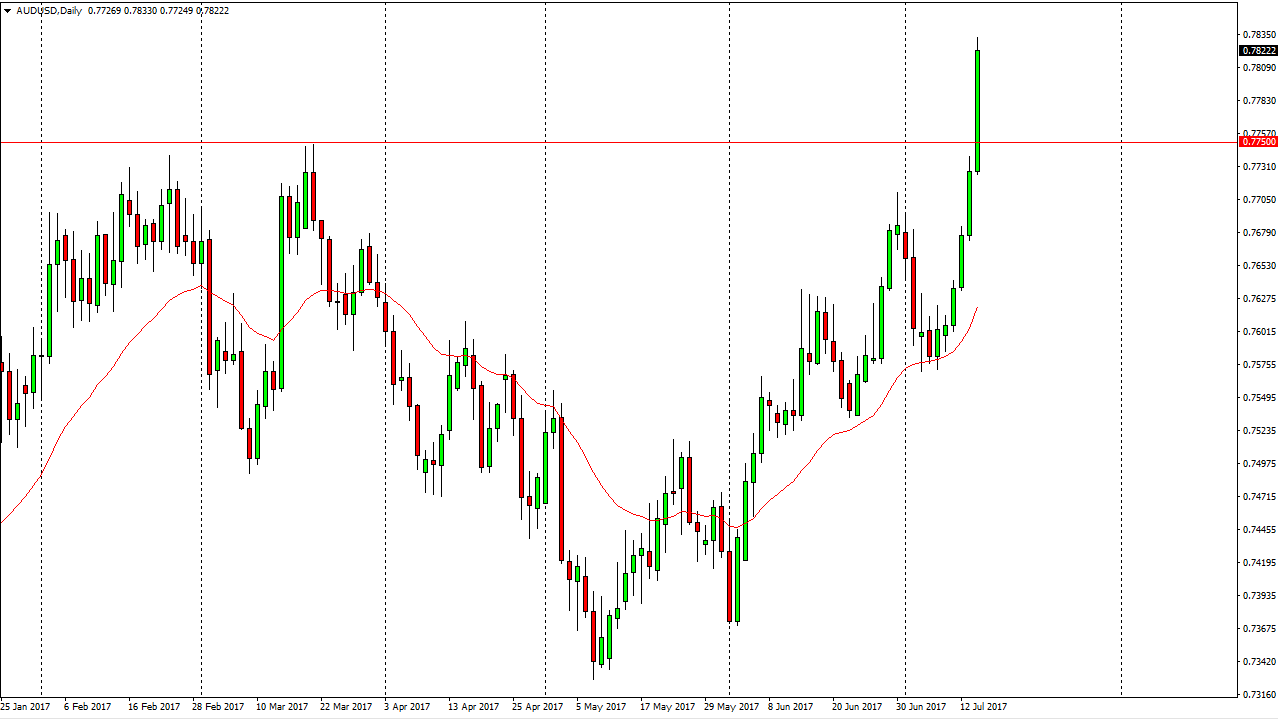

AUD/USD

The Australian dollar sliced through the 0.7750 level, an area that has been massively resistive. The fact that we broke above there and then close towards the very top of the candle, suggests that we are going to go much higher. I think that short-term pullbacks will be buying opportunities, and I believe that the 0.7750 level will probably end up being a bit of a “floor” in the market. Given enough time, I think that the market will go to the 0.80 level, which is massively important on the longer-term charts, and I think will continue to be an area that attracts a lot of attention. I don’t know if we can break above there, but in the short term I think that we are most certainly going to go looking towards that region. A pullback might be necessary to build up the momentum to go higher, but I have no interest in shorting as the Aussie and the gold markets both look extraordinarily bullish, and of course the US dollars getting beat up against most currencies.