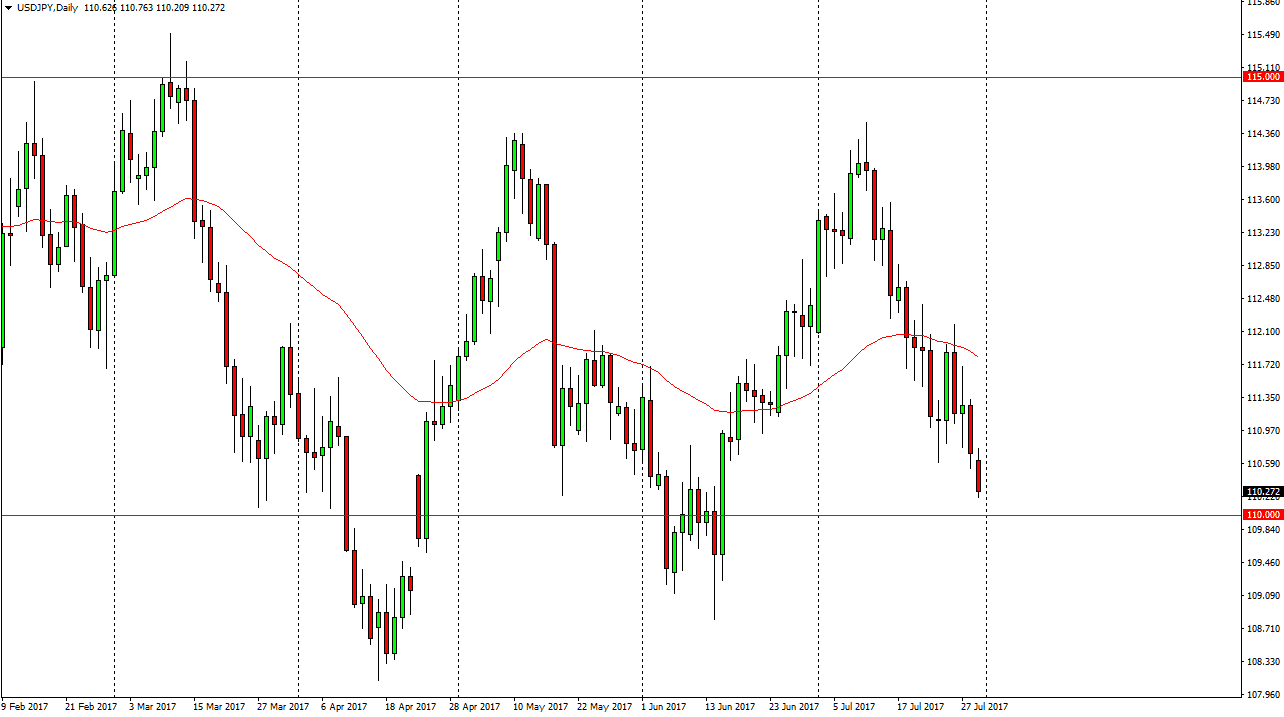

USD/JPY

The US dollar initially tried to rally against the Japanese yen on Monday, but then turned around to fall towards the 110 level as the US dollar continues to get pummeled against almost every other currency in the world. The 110-level underneath should continue to offer support, but if we break down below there I think that the market will then go looking for the 109 level under that. We do not have any type of supportive candle to suggest that the US dollar is going to find a lot of support, so I think that we are going to break down below the 110 level during the session. The daily close of course will be very important, but I believe that this point it is very likely that the sellers will continue to push against this market, perhaps trying to find support closer to the 109.50 level or below.

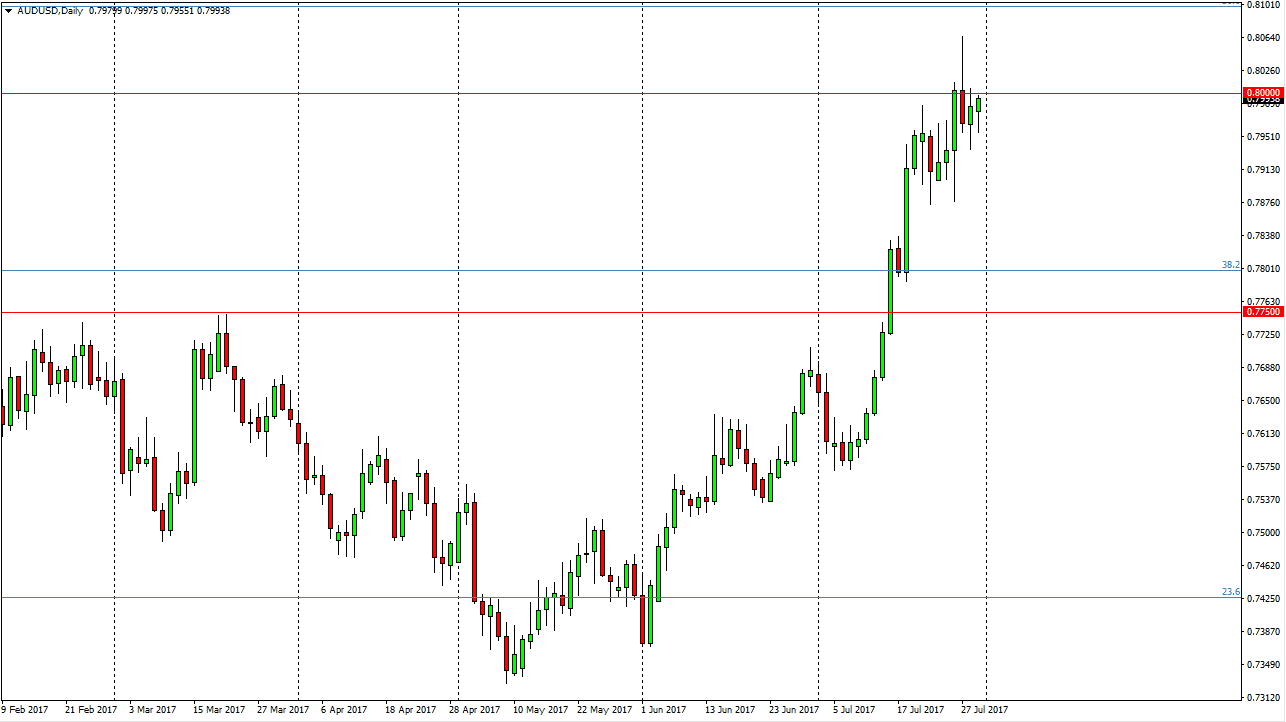

AUD/USD

The Australian dollar initially fell on Monday but continues to find buying pressure as we bang up against the 0.80 level. There is a massive shooting star from Thursday of last week, and a clearance of that would be a very bullish sign, sending this market much higher and perhaps for good. In the meantime, I would anticipate that we will get pullbacks from time to time, but quite frankly those should be buying opportunities going forward. The market looks very likely to look at pullbacks as value, as the US dollar continues to find quite a bit of massive selling pressure around the world. The Australian dollar has rallied a bit too quick for continuation, but given enough time we should continue to go much higher. Ultimately, I think that there is plenty of volatility, and more importantly: bullish pressure. Given enough time, we should break out.