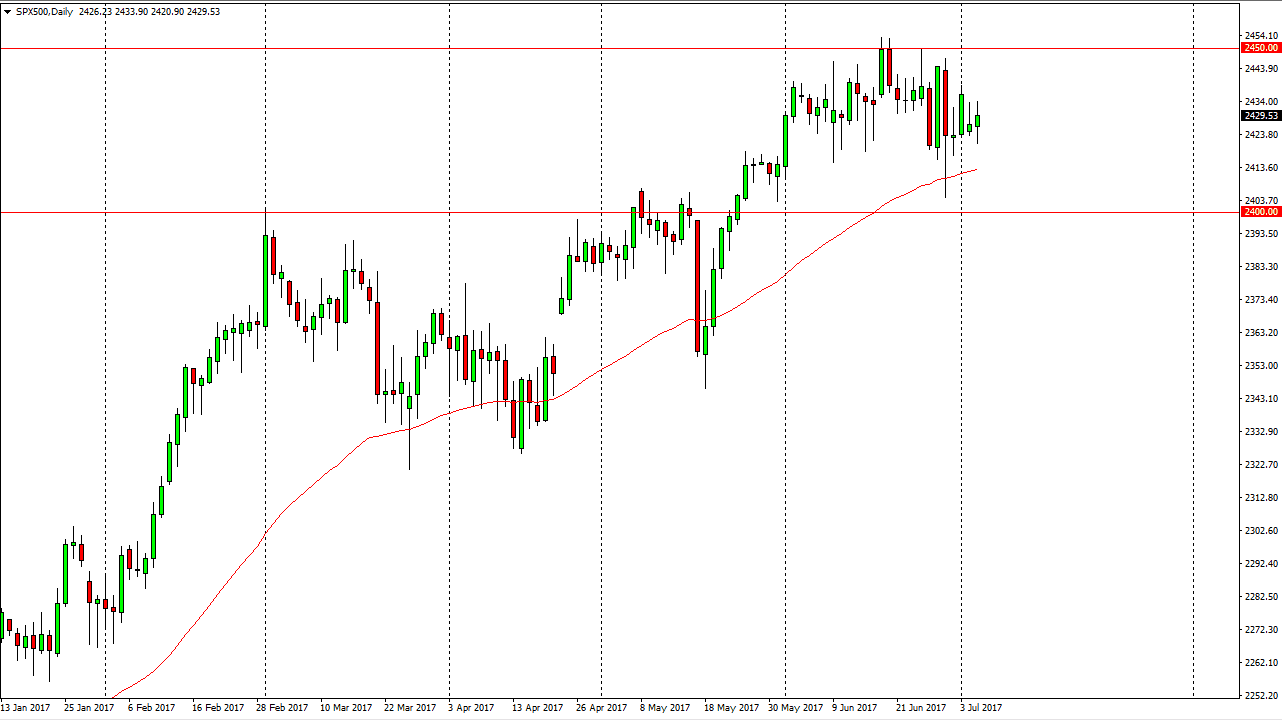

S&P 500

The S&P 500 was very volatile on Wednesday as the Federal Reserve release the Meeting Minutes, which essentially set everything that the market new. However, when I do pay attention to more than anything else is that the 2425 level underneath seems to be supportive, and that we are going to go looking towards the 2450 handle above. That was massive resistance, so if we can break above there it would springboard this market looking to the 2500 level next. The 24-level underneath that is massively supportive, but I believe that the buyers will continue to run this market to the upside, and I have no interest in shorting because of the massive uptrend that we have seen over the last several months.

NASDAQ 100

The NASDAQ 100 rallied rather significantly during the day on Wednesday, but I still see a significant amount of resistance above at the 5700 level. If we can break above the top of the uptrend line, I think the market then will go much higher. However, I am very cautious at this point as the markets have shown a significant amount of negativity, and that being the case it’s likely that the NASDAQ 100 will be volatile. If we break down from here, I believe it could be the beginning of something larger, as the NASDAQ 100 has been a leader among stock indices in the United States. Just as it pushed the rest of the stock market higher, it could bring the rest of it down. A breakdown below the 5500 level has me shorting this market, something that I didn’t think would be possible. In the meantime, I should assume that the buyers are to come back in, but I’m not comfortable until we break well above the 5700 level as it would show real wherewithal from the bullish.

nasdaq100_chris.png)