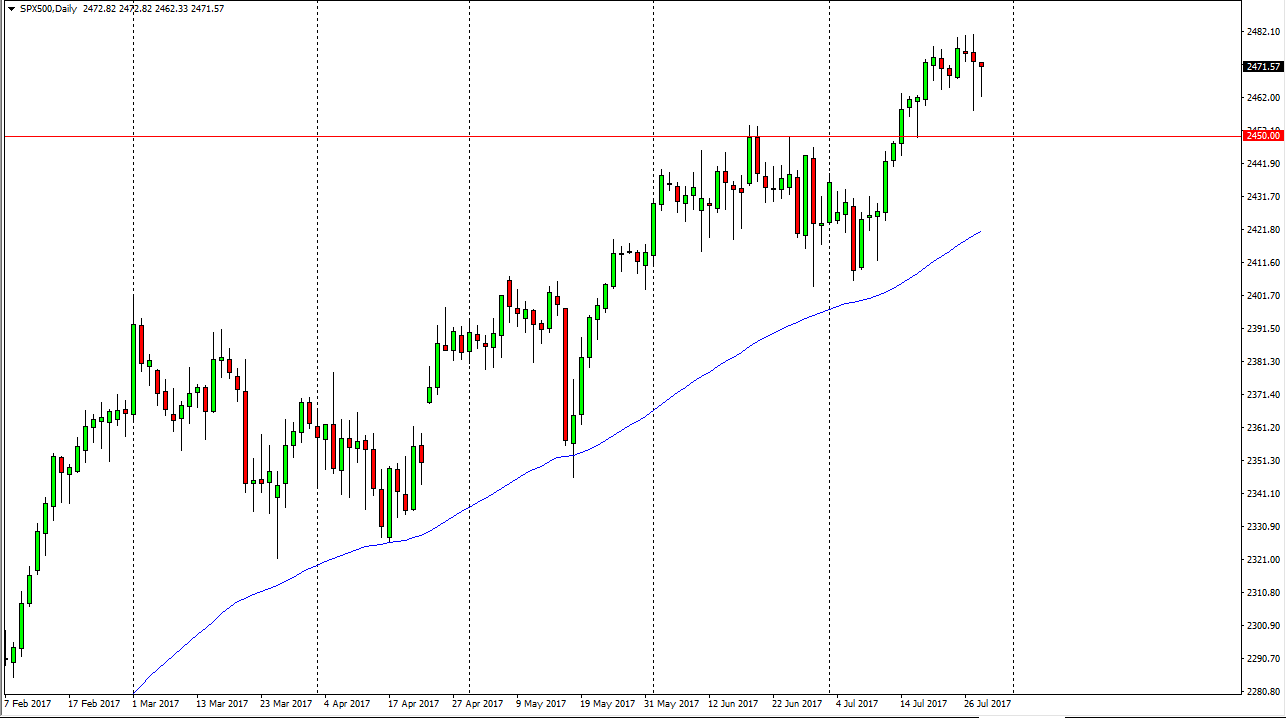

S&P 500

The S&P 500 fell during the course of the session on Friday but found support enough to turn around and form a hammer. The hammer is within the previous hammer, and it looks likely that we are going to continue to find buyers every time we dip. If we can break out to the upside, I think we will then test the 2500 level above. That is an area that’s going to be significant, of course as it is resistive. I think that the market should continue to go to the upside after that, but it will take a couple of different times to break out to the upside, which is typical at these large numbers. All things being equal, I expect to see the 2500 level broken over the next couple of weeks as the S&P 500 continues to find buyers. The 2450 level underneath should be supportive.

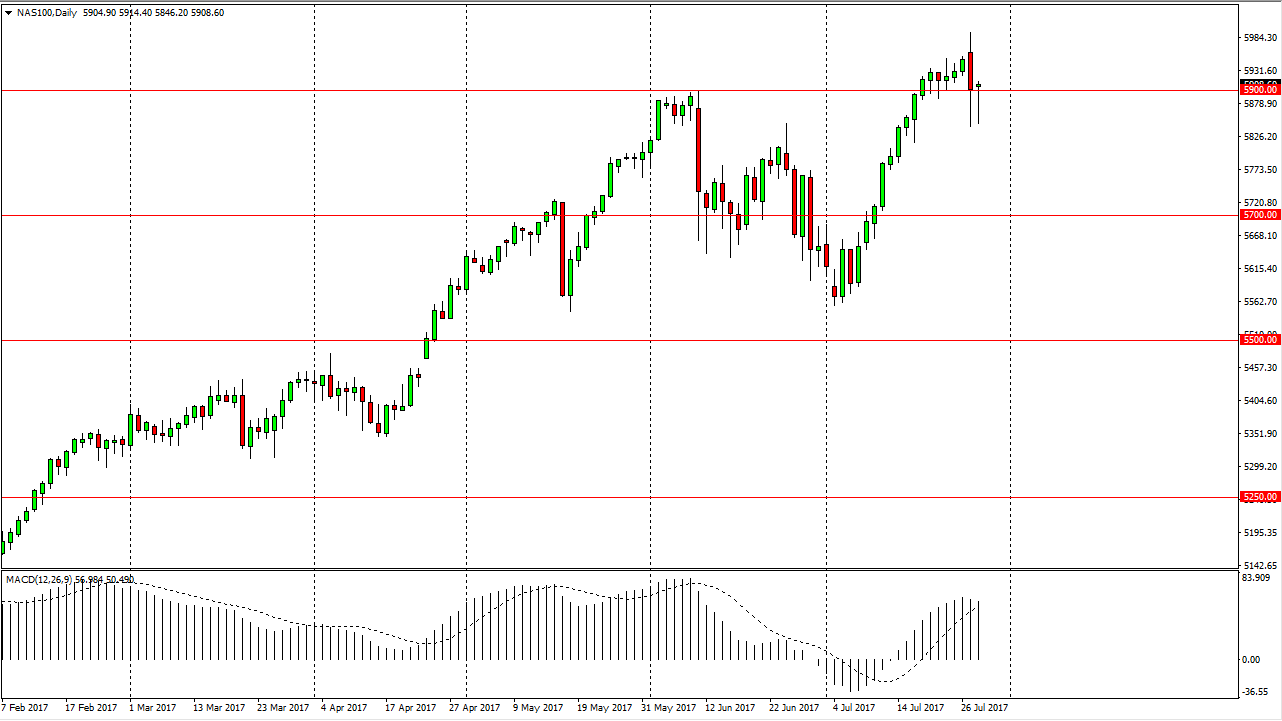

NASDAQ 100

The NASDAQ 100 fell initially during the day on Friday as well, but turned around to form a hammer. The hammer looks very bullish, and a break above the top of the hammer is a strong sign. This is the 2nd time that we try to break down below the 5900 level, but failed to show the negativity that we needed. A break above the top of the candle census market looking towards the 5990 level again, and then hopefully breaking above the 6000 level so we can continue the longer-term uptrend. I have no interest in shorting, I believe that the NASDAQ 100 continues to be a strong of market, and that the trend should continue to the upside. In fact, I believe that we are not only looking for the 6000 level, but we will probably go much higher than that over the next several months. With the Federal Reserve looking so soft, I believe that the stock market should continue to go to the upside.