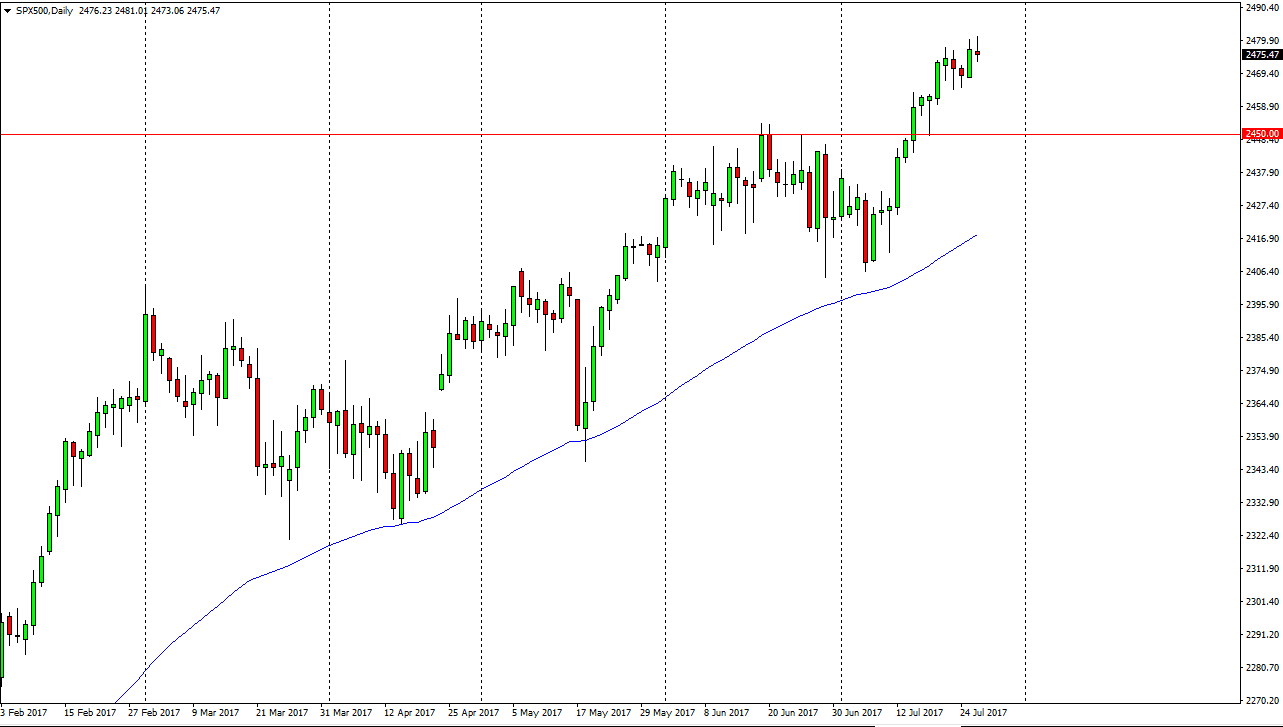

S&P 500

The S&P 500 initially was slightly negative during the day on Wednesday, but as the Federal Reserve FOMC statement was coming due, buyers started pushing the S&P 500 higher. Later in the day, we pulled back, as traders would have taken risk off ahead of the volatile announcement. However, when I look at this market we have ended up forming a shooting star for the daily candle which causes a bit of concern. I don’t think we’re going to turn around, but with the Federal Reserve talking about concerned with inflation, perhaps we are starting to see a market that needs to pull back. I think there is a significant amount of support below the 2450 handle, so I think we are going to drop any more than 25 handles. I think that a pullback is healthy, and should offer a buying opportunity underneath as we will need to build up momentum to finally break above the 2500 level.

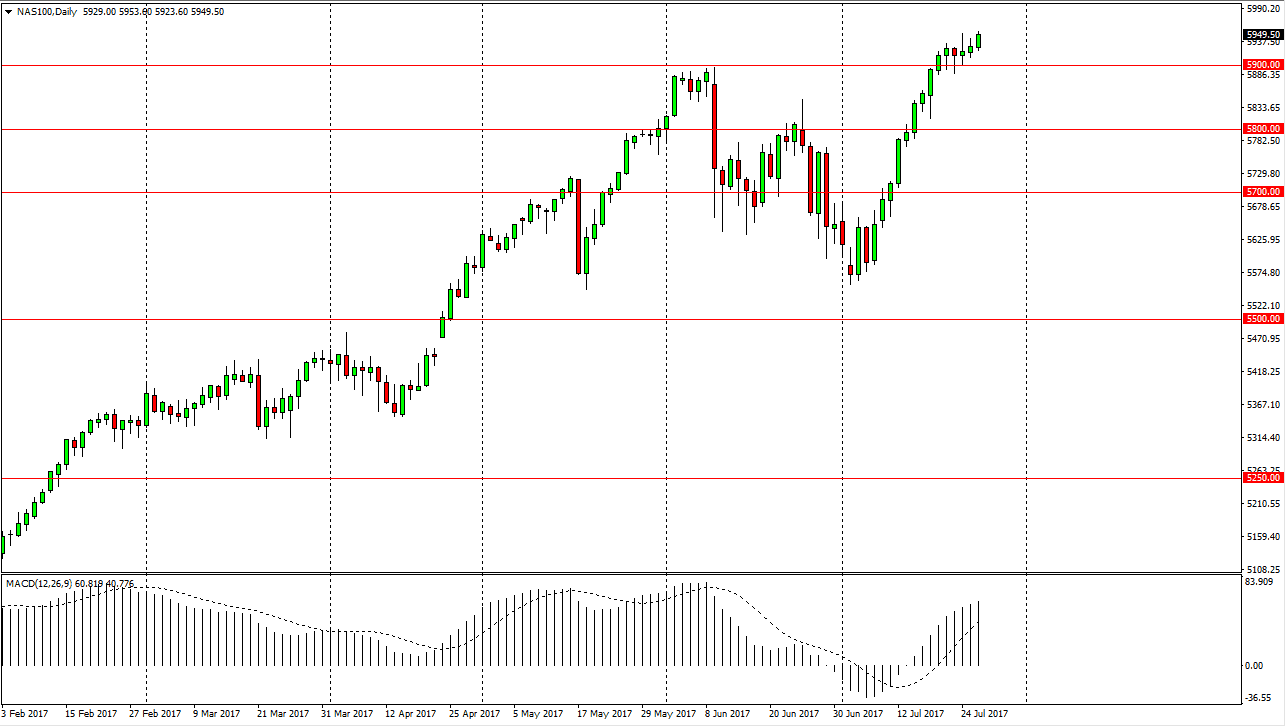

NASDAQ 100

The technology sector did very well during the day, as we broke towards the 5950 handle. It looks likely that the market will then go looking for the 6000 level and it’s probable that the NASDAQ 100 will lead the way for the rest of the European indices. I also believe that there is a bit of a “floor” in this market, near the 5900 level. Because of this, I don’t look at pullbacks or negativity as a reason to sell, it makes me start looking for value below on signs of support. Eventually, we should break above the 6000 handle, but it will take a certain amount of momentum building to get there. We have rallied so much as of late, it does not surprise me that we are struggling to make that break out currently.