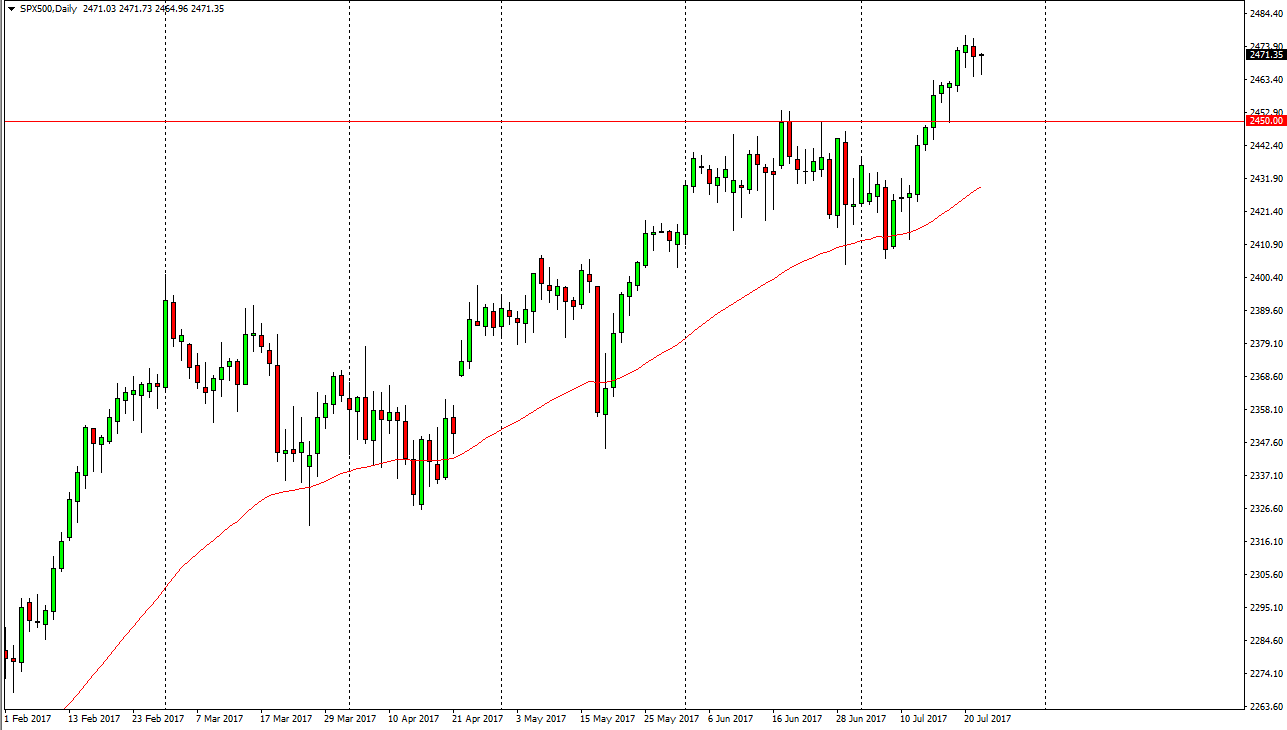

S&P 500

The S&P 500 initially fell during the session on Monday, but turned around to form a bullish candle. By forming a hammer, it suggests that we are going to continue to see bullish momentum in this market, and as we are in the middle of the largest week of earnings season, it’s likely that the S&P 500 will be volatile. However, it’s also obvious to me that we are an uptrend so I think that although we may grind sideways, and the longer-term we will start to see buyers reassert their control of this market. I believe that the 2500 level above continues to be a target, and eventually we may even break above there. I have no interest in shorting, as the 2450 handle underneath should continue to be the “floor” in the market, as it was previous resistance.

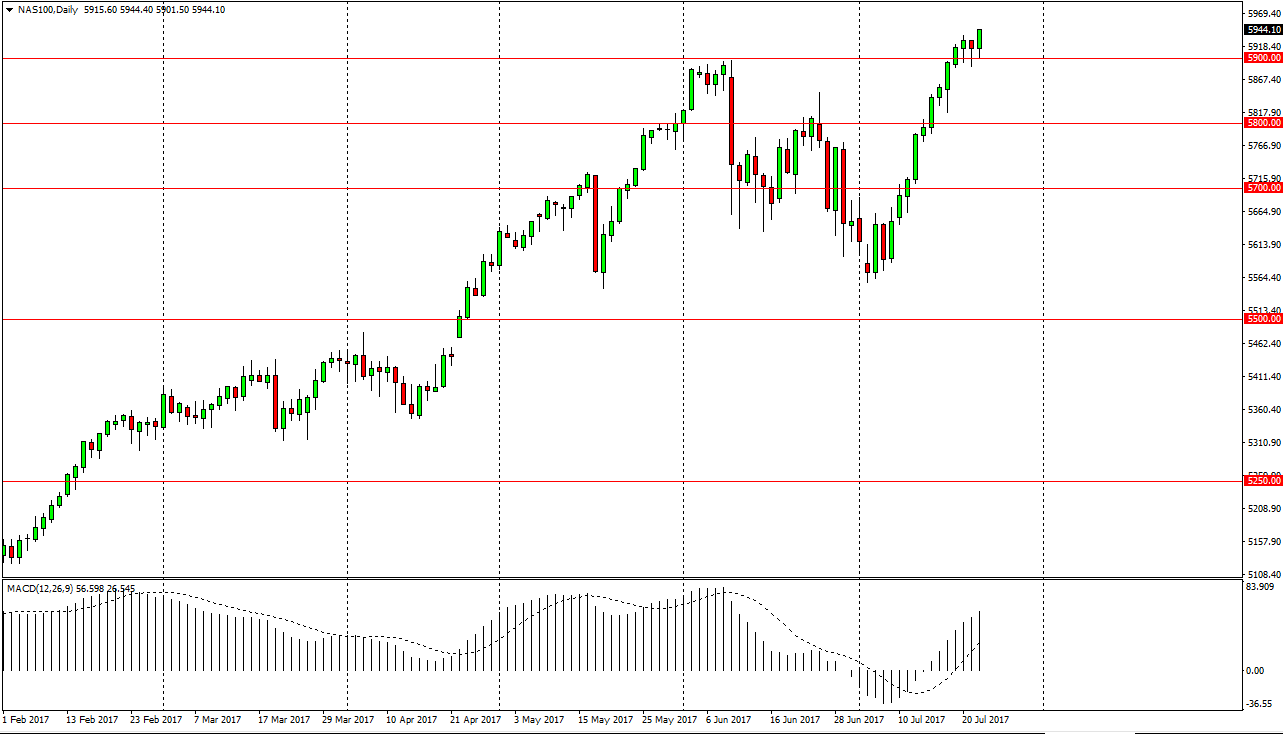

NASDAQ 100

The NASDAQ 100 fell slightly during the day on Monday, but found the 5900-level underneath to be supportive enough to turn things back around. By forming this very bullish candle, we broke above the top of the hammer, and that of course is a sign that we will more than likely continue to go to the upside. The 6000 level above is the target, and of course a certain amount of psychological resistance. I think that every time we pull back, there will be buyers underneath to continue to push this market, as the NASDAQ 100 has been a leader in the US stock indices over the longer term. I believe that is going to continue to be the case, so therefore I don’t have any interest in shorting. I have faith that this market will continue to be volatile yet positive. Selling isn’t a thought, and eventually I believe that will break above 6000 and continue much higher.