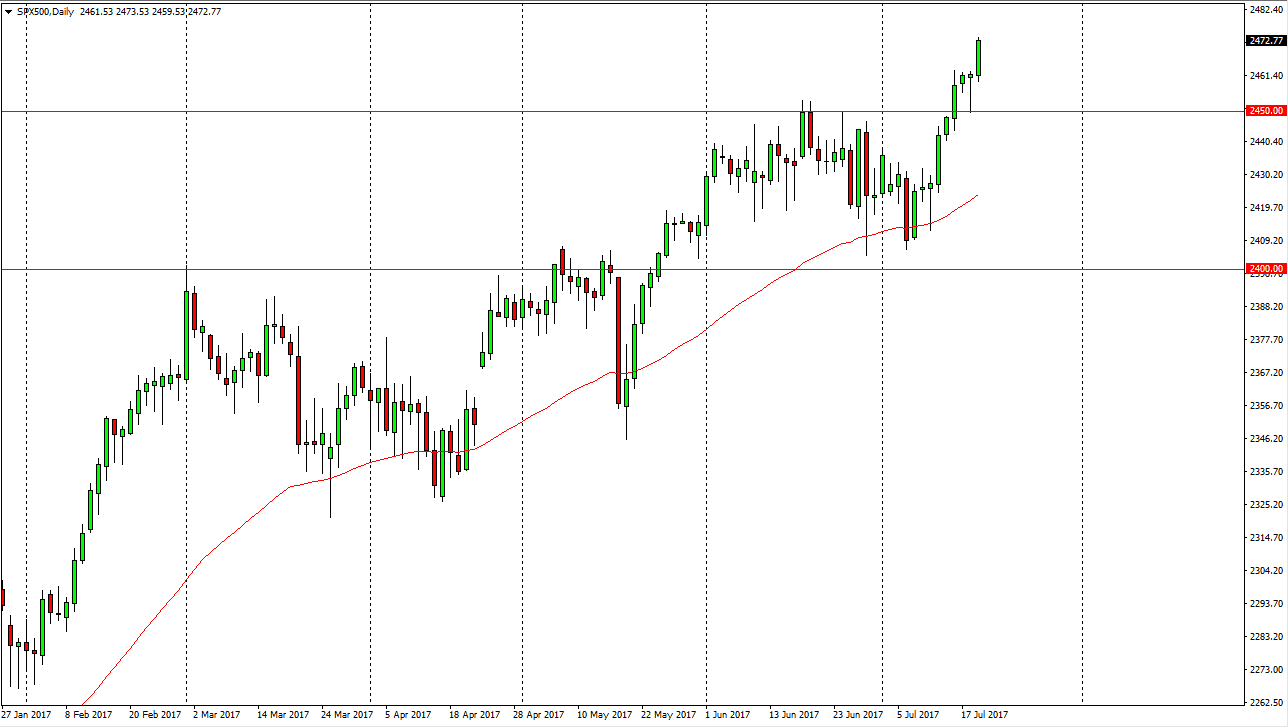

S&P 500

The S&P 500 broke to the upside during the day on Wednesday, clearing the top of the hammer that formed on Tuesday. It now looks obvious that we are going to go looking towards the 2500 level, which is a psychologically significant level. It’s been my longer-term target for quite some time, but we can also make an argument that we are getting close to the top of an uptrend in channel, so it is possible we get a pullback. Those pullbacks should be value, as this is obviously a very bullish market. I’ve no interest in shorting, and I believe that the 2450 level now offers a significant floor in the market that should continue to lift things going forward.

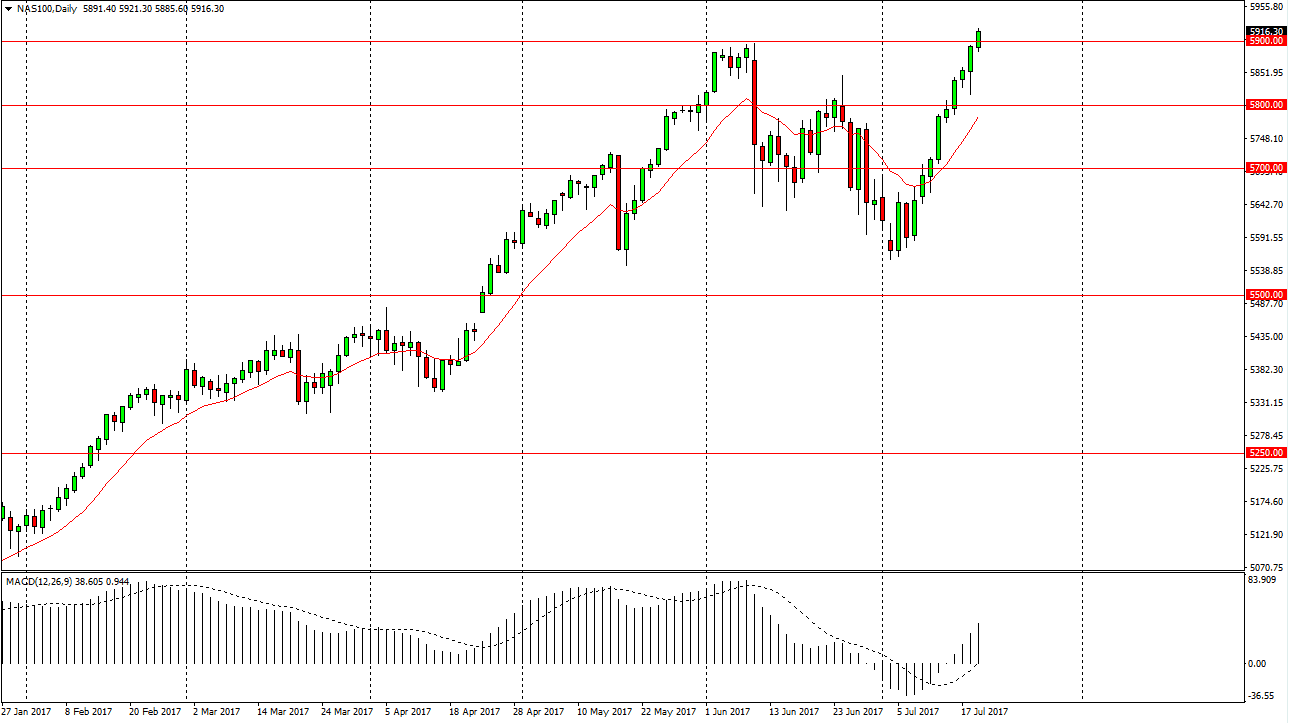

NASDAQ 100

The NASDAQ 100 broke to the upside during the day, slicing through the 5900 level. That’s an area being broken above that signals we are probably going higher, and my target has been 6000 for some time. Now that we’ve done this, I believe that short-term pullbacks continue to be buying opportunities, especially if we can stay above the 5900 level. Ultimately, I believe that the market is a bit overbought, but I also believe that we should continue to see value hunters coming back into the marketplace and taking advantage of cheaper prices. I believe that the market will go looking for 6000, but at that point I would expect a very significant amount of resistance due to the large, round, psychologically significant nature of the number, and of course the fact that we will have been very overdone to the upside. Given enough time, I expect that we may even break above there though.